*In the Euro Area, the Consumer Price Index announced for April increased by 0.6% on a monthly basis and by 7.0% on an annual basis. Data was expected to increase 0.6% monthly and 7.0% annually. Core CPI, on the other hand, came in as expected, increasing 1.0% monthly and 5.6% year-on-year.

*Bank of England (BOE) Governor Bailey said in a speech today that further tightening may be needed if they see signs of more persistent inflation, inflation is too high and they have to bring it to the 2% target permanently, and he has good reason to expect inflation to drop rapidly in the coming months.

*In his speech on the debt ceiling, Speaker of the US House of Representatives McCarthy stated that the Republican party advocates a higher spending limit, the problem is in the level of spending, there are opportunities to find common ground, but they only have a few days to reach an agreement.

Agenda of the day;

17:30 US Crude Oil Stocks

18:15 Speech by ECB Member de Guindos

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

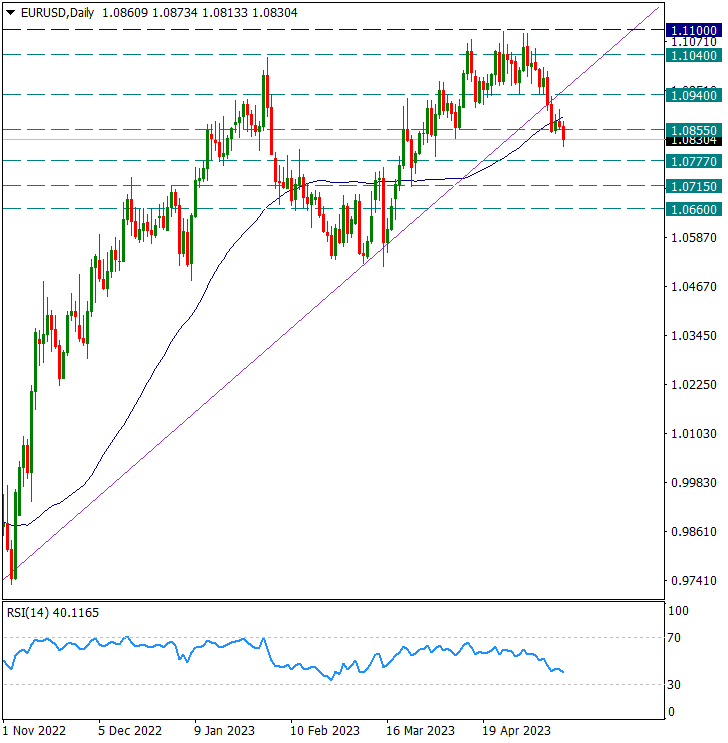

EURUSD

EURUSD – The Last Days Cycle in Favor of the Dollar Deepens…

After breaking the uptrend from 0.9550, it had a slight backlash, but it didn’t last long. It set a 50-day average response.

The parity, which could not hold on to the support of 1.0855, moved strongly in favor of the dollar with the technical power of breaking the trend. As of today, the pair declined to 1.0820 levels. In the short term, a parity that cannot go above 1.0855 or the 50-day average can make us watch the movements in favor of the dollar. We’ll be tracking it throughout the day.

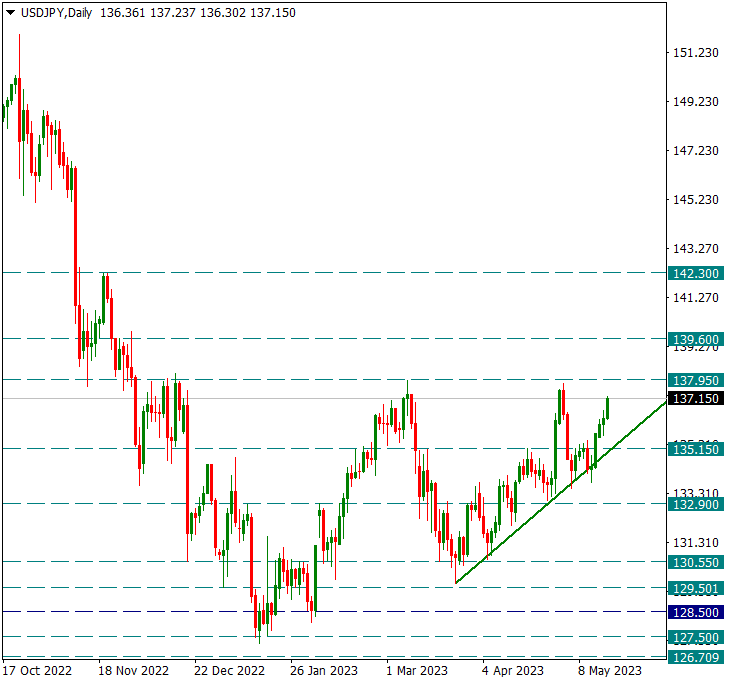

USDJPY

USDJPY – 137.95 Resistance On Our Agenda…

The pair continues to trend towards the 137.95 resistance with the continued move in favor of the dollar. As we mentioned in our previous daily reports, the level of 137.95 has not been tested three times before in the medium term. For this reason, if this resistance is broken in the ongoing possible attacks, the 142.30 level will be the first region we will pay attention to.

In possible declines, the main weekly support is 135.15, and breaking this level can end the movement in favor of the dollar in the parity.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

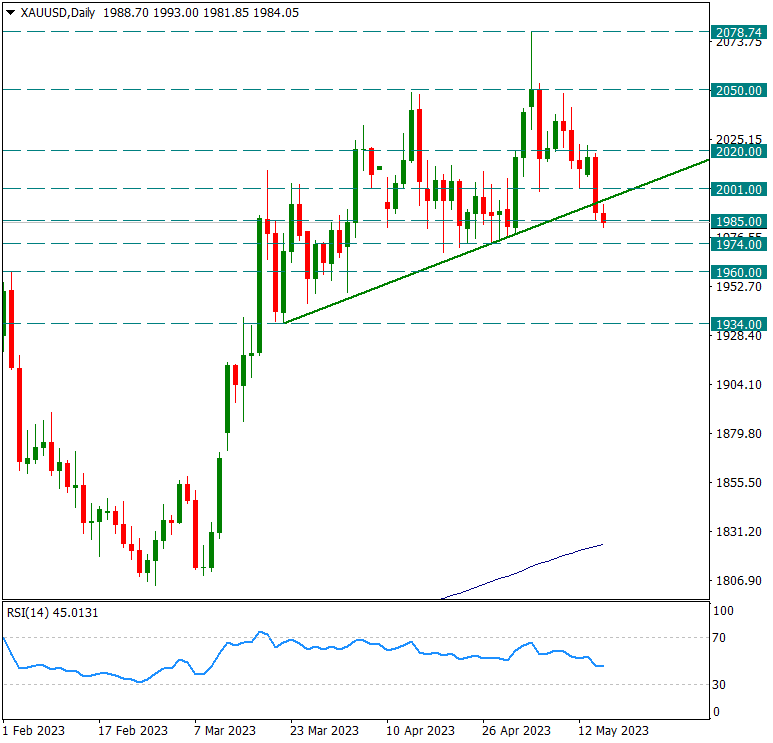

XAUUSD

Ounce Gold – Continuing to Press…

With the consecutive strengthening of the dollar index, the pressure was felt in the yellow metal as well. As seen on the daily chart, the short-term trend has broken down and the yellow metal is being suppressed. In the continuation of possible decreases, we will be watching the 1934 level.

We will follow 2001 and then 2020 levels for possible attacks.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.