*The UK’s fourth-quarter GDP, announced today, exceeded expectations and grew by 0.1% quarterly and 0.6% year-on-year. The data was expected to come in at 0.0% and 0.4%, respectively. The Housing Price Index, another data we follow in the UK, came in at -0.8% monthly and -3.1% annually, lower than expected.

*The Consumer Price Index (CPI) in the Euro Zone for February increased by 0.9% monthly and 6.9% year on year. The previous data was 0.8% and 8.5%, respectively. Core CPI, which was followed more closely by the European Central Bank (ECB) in the interest rate hike process, increased by 1.2% monthly and 5.7% annually. The previous data had increased by 0.8% and 5.6%.

*The PCE Price Index, which is the data closely followed by the FED in the interest rate hike process, was announced. The PCE Price Index rose 0.3% month on month and 5.0% year on year in February. Core PCE Price Index rose 0.3% and 4.6%. Despite the increase in the data, there was a decrease in the rate of increase on an annual basis compared to the previous data. The previous PCE and Core PCE came in at 5.4% and 4.7% respectively. With the decrease in the rate of increase in the data, there were depreciation in the Dollar Index.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

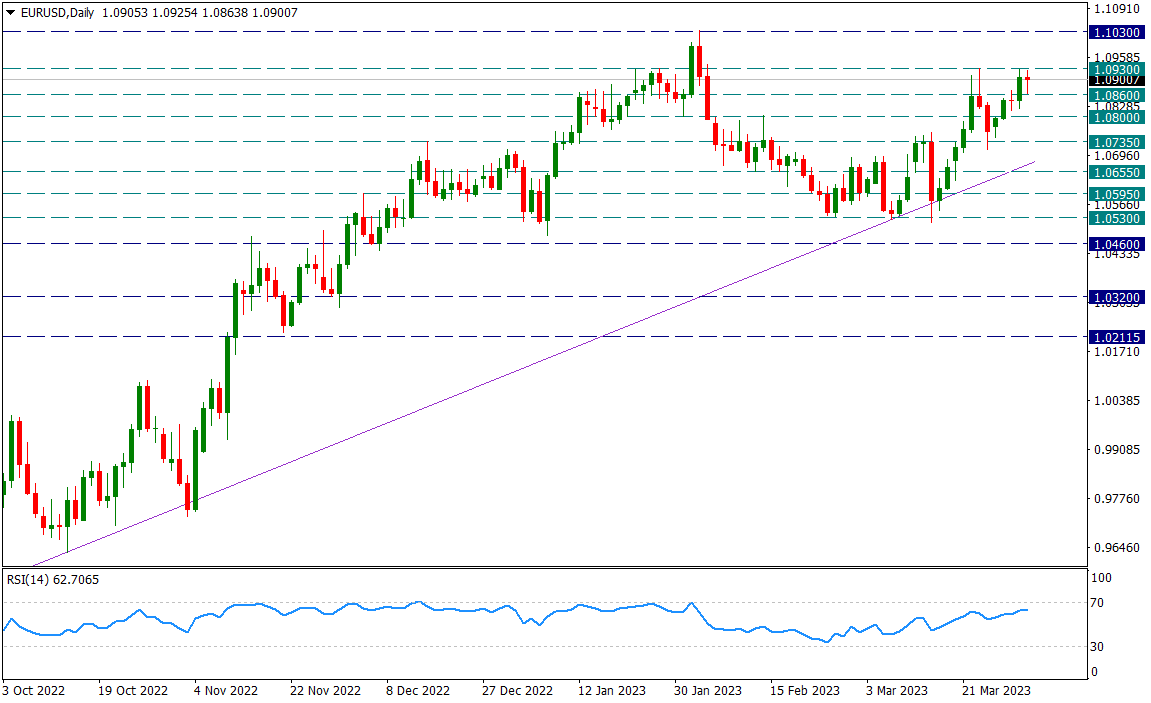

EUR/USD

EURUSD – 1.0930 Remains Resistance

Having tested the 1.0930 resistance yesterday, the pair remains below this level and the moves are a little more sideways today. Generally, we watch the day between 1.0930 and 1.0860. Possible dips here could be the application of a double top pattern and 1.0735 will be our main intraday support line to this situation.

In intraday movements in favor of the Euro, the 1.0930 level will continue to be a resistance as it was yesterday.

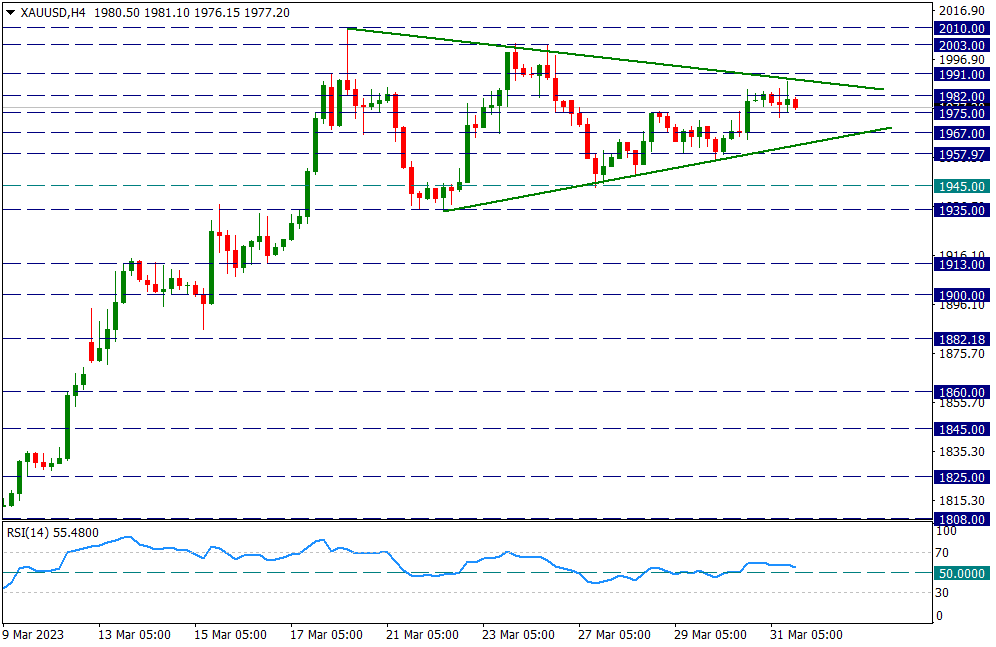

XAU/USD

XAUUSD – 10-Day Narrowing Triangle Structure Has Begun to Draw Attention…

While the yellow metal continues to price in the 1982/1975 range for two days, there is a narrowing triangle in the wider time frame starting from 2010. This triangle is getting narrower day by day. Therefore, we will watch the pricing in the narrowing triangle structure more carefully in the coming days.

In intraday movements, we will follow the horizontal movement within the 1982 resistance and 1975 support range and the possible breakdown of this horizontality.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

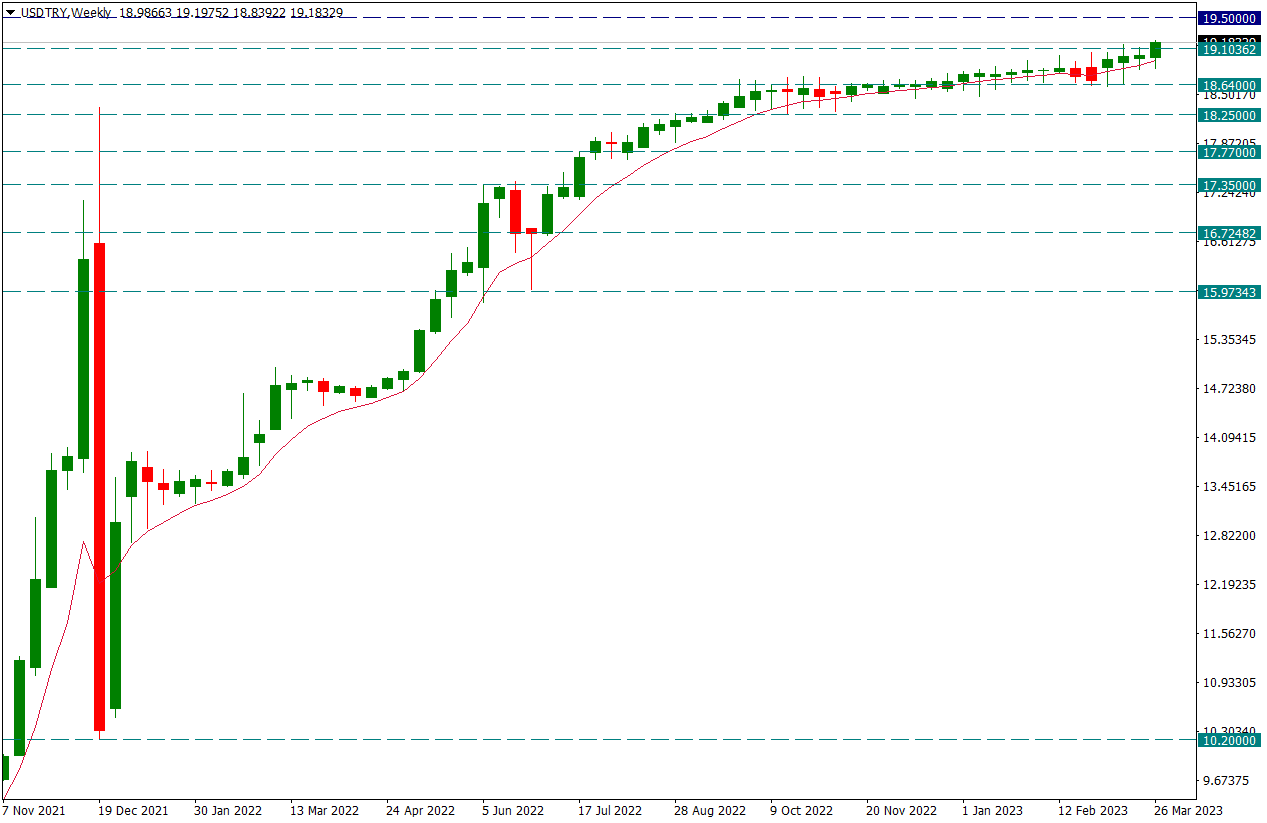

USD/TRY

USDTRY – Current Trend Continues with 8-Week Average…

We continue to monitor the dollar rate on a weekly chart. This week, the increases were slightly higher than the previous weeks. We follow the current trend with an 8-week average. As long as there is no significant weekly candle close below this average, we can technically expect the continuation of the current trend.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.