- We are coming to the end of 2022. As we approached the end of the year, the slight decline in US inflation data and China’s abandonment of its zero covid policy allowed the markets to breathe a little. This weekend was quiet due to the year-end holiday mood and the lack of economic data.

- We wish the next year to bring firstly health and then a stable income to all our investors.

- Most of the global market will be closed on the first trading day of next week. We will follow the Manufacturing PMI data from Turkey during the day.

- US markets opened as of 17.30 and the US 10-year bond yield is trending towards 3.90%. US futures stock indices, on the other hand, are slightly declining. EURUSD parity is close to 1.07, Ounce Gold, which tested 1825 during the day, is currently at 1820 level.

- Crude oil is traded at 79.30 and Brent Oil at 84.65.

- The Chinese Yuan is poised to close the year 2022 with a loss of almost 8% against the US Dollar. Although the USDCNY parity, which went up to 7.30 at the beginning of November, prepared a shoulder-to-shoulder formation and regressed with profit sales, the loss in the Chinese Yuan shows the worst performance against the US Dollar since 1994.

- The question marks in the cycle of FED tightening next year and China’s move away from the zero Covid policy will be an important issue for the general market, especially the USDCNY parity.

- According to the preliminary inflation data for December, annual inflation in Spain was 5.8%. In the previous month, this data was 6.8%.

- The five months since annual inflation in Spain peaked at 10.8% in July. The decline is largely due to falling energy prices and the absence of harsh winter in Europe for now.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

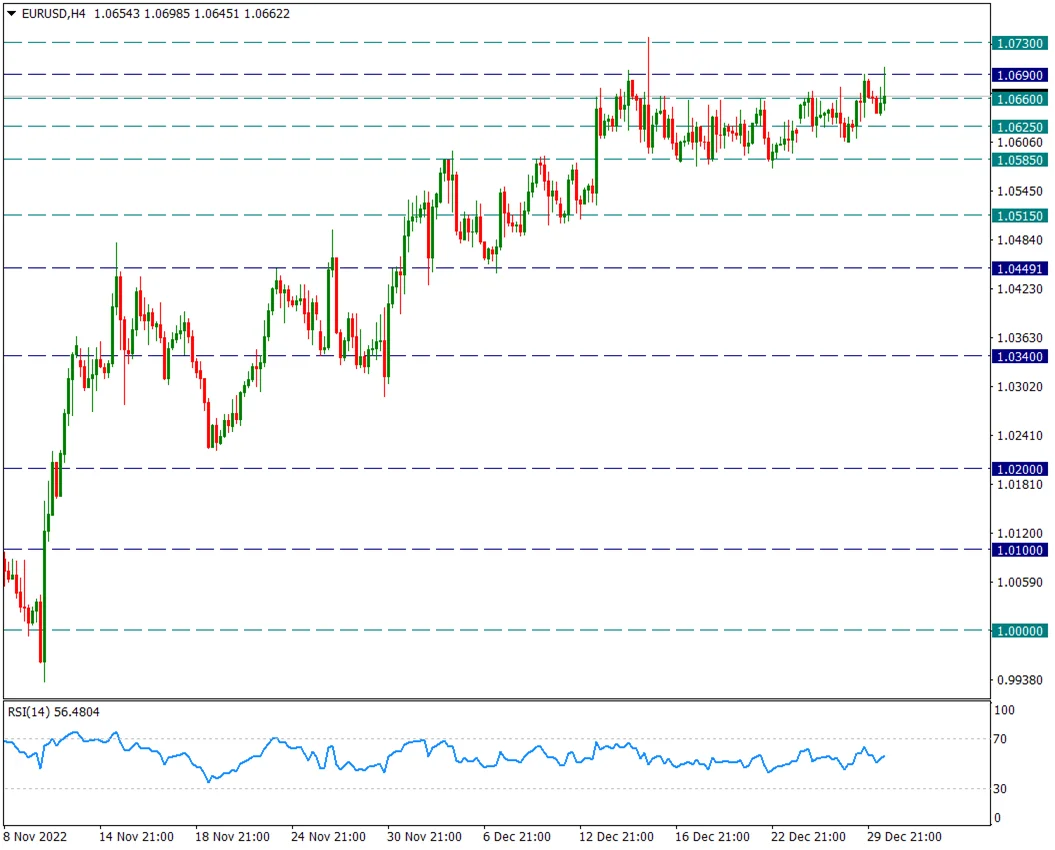

EUR/USD

EURUSD – Calmly Priced at 1.0660 on the Last Trading Day of the Year…

- The pair is priced slightly sideways and zigzags in the 1.0660 region. On the last day of the year, it can be prepared to end the day with non-aggressive price movements. However, it may be useful to be prepared for a possible surprise on the last trading days of the year.

- We are looking at the support resistance zones step by step in the horizontal pricing range of 1.0690/1.0585. It is priced in the 1.0660 region towards the evening in Turkey but close to the opening of the markets in the USA.

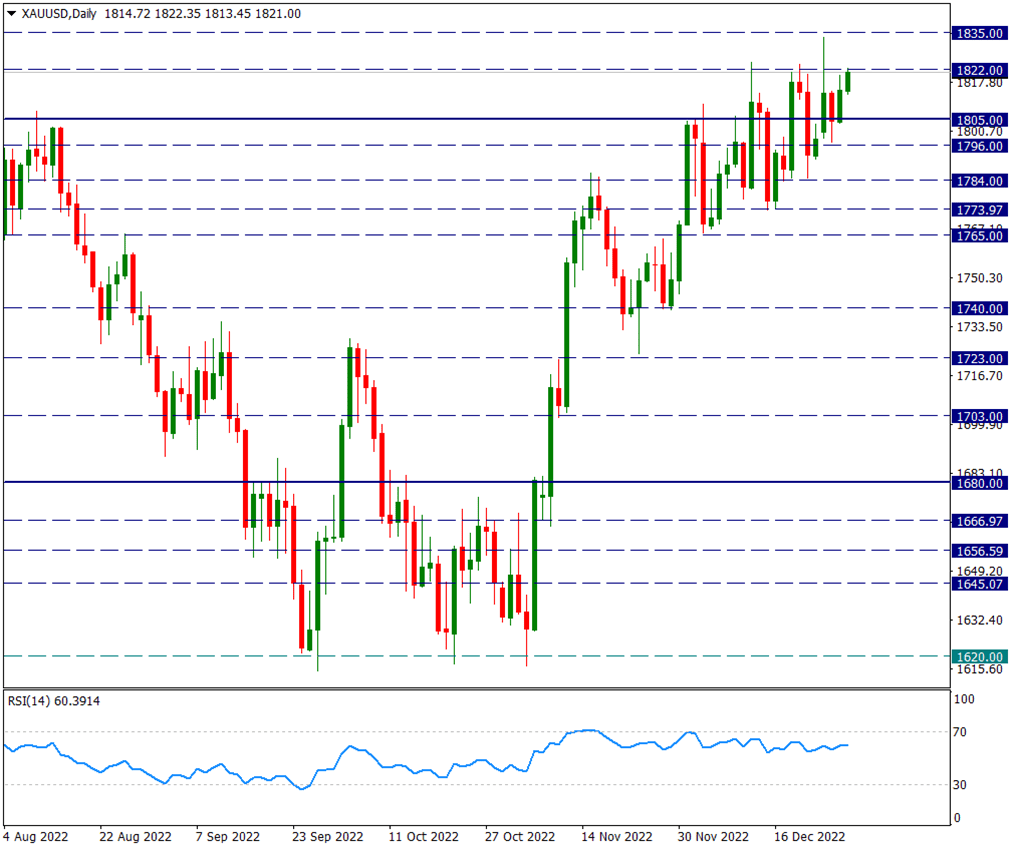

XAU/USD

XAUUSD – Preparing to Close the Year by Testing 1822 Resistance…

- The yellow metal, which has been rising with a slow acceleration since December, has been correcting step by step, and is testing the 1822 resistance again as of the last trading day of the year. Since the beginning of December, this area has been tested 5 times. We even saw the reaction up to 1835 levels. However, daily candle closes never closed above the 1822 resistance. We will be following this tonight and in the continuation of possible upswings in the future.

- If this region is not passed, our first important support region in possible profit sales will be the 1805 level.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

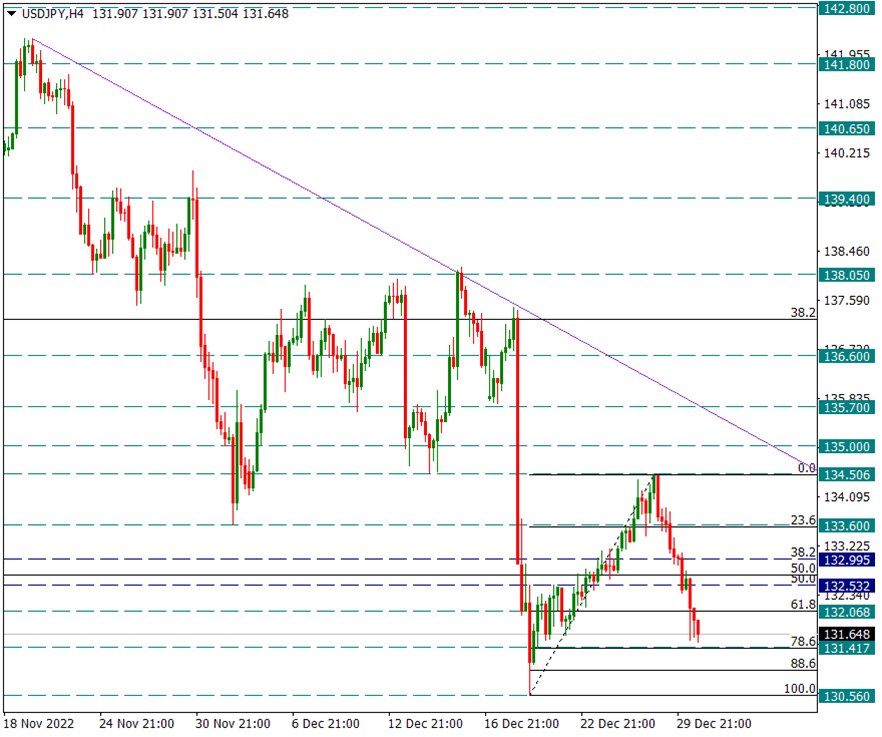

USD/JPY

USDJPY – Turns Year Off By Giving Back More Than Half Of Its Annual Rise…

- 2022 was a very active year for the Japanese Yen. Rapid interest rate hikes by the US Federal Reserve during the year, the US 10-year yield rising to 4.3% during the year, as well as the aggressive expansionary policy of the Bank of Japan, on the contrary, made the Japanese Yen depreciate very quickly against the US Dollar. had caused him to lose. During this period, the USDJPY parity rose to the level of 151.93. As the BOJ intervened harshly in these aggressive and speculative movements, the rises in the parity were quickly reversed. In the middle of this month, BOJ’s 10-year Japanese Bond yield, which was previously kept at 0.25 in its extreme expansionary policy, increased to 0.5%, strengthening the movements in favor of the JPY and as of today, the parity is at 131.60 levels.

- Looking at the year, more than 50% of the losses during the year were recovered as a result of BOJ’s intervention in the uncontrolled and aggressive depreciation JPY:

- Technically speaking, it had reacted to 134.50 from the 130.56 level it saw in December. Nearly Fibo 78.6 of this reaction has rebounded. If it pulls back below 131.40, the pair may continue to decline, move in favor of JPY and see a move below 130.

- We will follow the 134.50 level as resistance in possible reactions.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.