- As expected, the European Central Bank (ECB) increased interest rates by 75 basis points, raising the policy rate to 2%. The ECB caught up with the Fed in this regard by increasing interest rates by 75 basis points last month. In its statement, the ECB stated that it would continue to increase interest rates in order to return the 2% inflation target, while stating that inflation is still high. The first general statement came in line with the expectations, and this was also in line with the expectations if the continuation of interest rate hikes was not picked up with tweezers.

- Lagarde stated at the press conference that with the high inflation rate, consumer and business confidence fell rapidly. She stated that they expect a weakening in the economy at the end of the year and next year due to the policy implemented and the weakening demand. She stated that the labor market is going down, but as the economy weakens, a bad performance may come on this side as well.

- At the end of the speech, she stated that future decisions will continue to depend on data and they are ready to use all instruments.

- In the question and answer part:

- She said they deliberately avoided making forward-looking directions.

- After the ECB, Germany’s 10-year yield decreased by about 14 basis points and tested the level of 2%, while the US 10-year bond yield again forced below 4%.

- Another important data that came in during the day was the first statement of the US third quarter economic growth. This data was announced as 2.6%. As it will be remembered, the final growth in the second quarter was -0.6%. With this data, the USA showed an effort to get out of the technical recession. This was no surprise. Previously, a growth close to this result was predicted in the Atlanta GBPNow projection.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

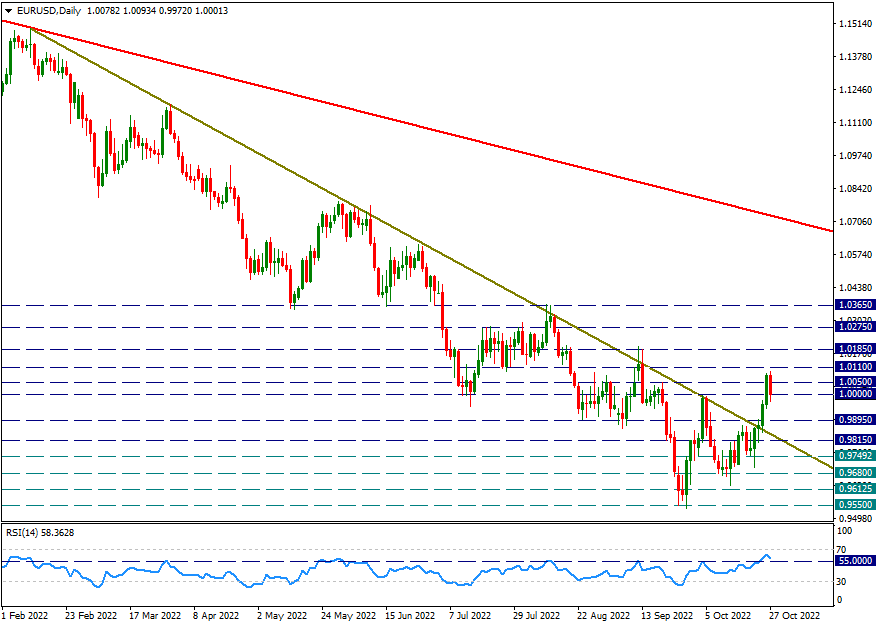

EUR/USD

EUR/USD – Continuing the Post-ECB Fall and Touching 1.00…

After rising to 1.01 levels during the day, the pair retreated during the day and continued this decline at the ECB meeting and tested below 1.00. Below 1.00, we can talk about movements in favor of the dollar again. But for now, we will be monitoring this region.

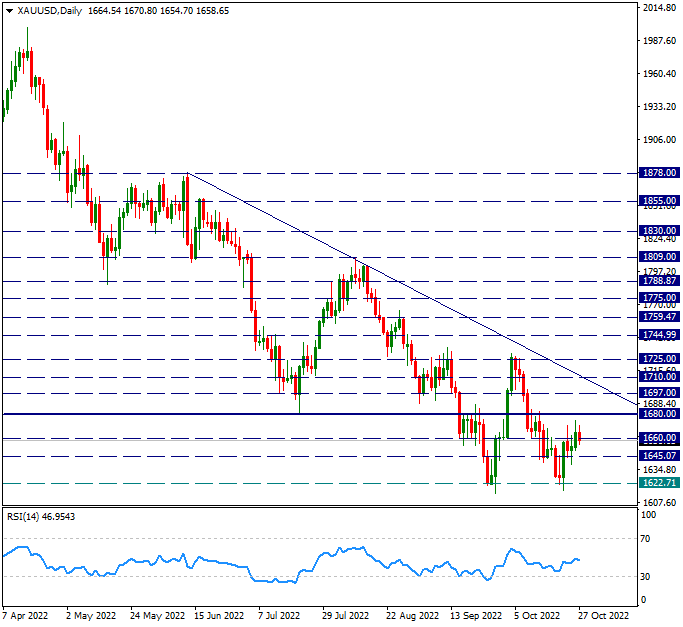

XAU/USD

XAU/USD – Getting Pressured As It Approaches 1680…

While the ounce of Gold continues to stay below 1680, it is priced in the 1660 region. As long as it stays below 1680, we can predict that the rises can open up space for selling. However, daily closes that may be above 1680 can trigger positive transactions. Therefore, we attach importance to 1680 as resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

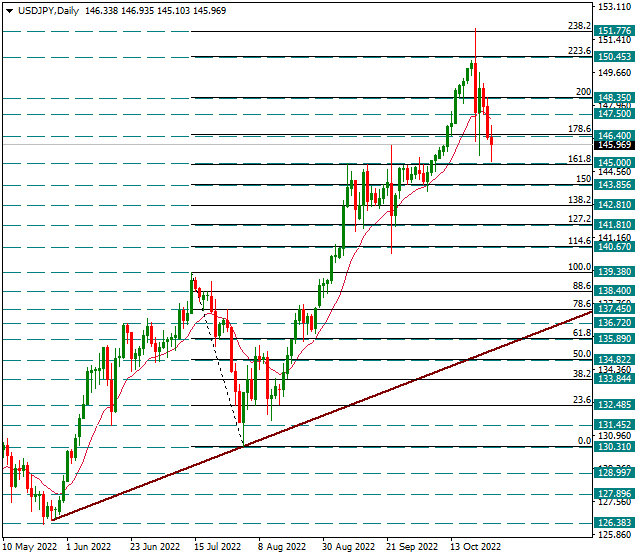

USD/JPY

USD/JPY – Breaks 14-Day Average and Hangs Up To Critical 145.00 Support…

On the Japanese Yen side, there was a rapid decline from the level of 151.77 with the intervention last week. As of yesterday, the 14-day average following the rise from 133 levels has been broken down and today we see that there are movements in favor of the Japanese Yen in USDJPY, despite the strengthening of the dollar index again. With today’s decline, it went up to 145.00 support, which we see as important, but there is a slight reaction from this support. If it sags below 145, the declines can be followed up to 140.65. We will watch 145.00 as an important support during the day.

In possible reactions, we will continue to monitor the 14-day average as a resistance line this time.

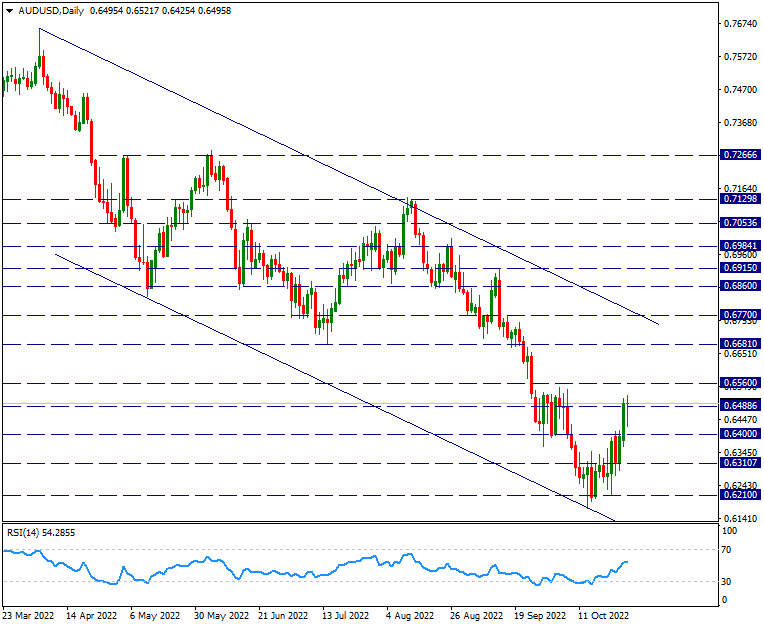

AUD/USD

AUD/USD – Approaching 0.6560 with Reaction from the Bottom of the Channel in the Last Two Weeks…

On the AUDUSD side, a decrease was observed to the level of 0.6210 with the sharp appreciation of the dollar index and the loss of performance on the AUD side in the past weeks. This decline actually received a technical reaction by touching the lower band of the technically descending price channel. In addition, we can say that the slight positive dissonance on the daily RSI(14) side helped this reaction. With this reaction, it approached 0.6560 resistance with a small rise and V movement. Movements above 0.6560 may gain some more strength, but for now, we will follow this area as the critical resistance area for the day.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.