- In Germany, the GDP for the fourth quarter, announced today, fell short of expectations and shrank by 0.4% on a quarterly basis and grew by 0.3% on an annual basis. The economy was expected to contract by 0.2% quarter-on-quarter and grow 0.5% year-on-year. In his speech, German Central Bank President and European Central Bank (ECB) Member Nagel said that the latest data in the Euro Zone show that core inflation is high and that he does not ignore more serious interest rate hikes after March.

- In the statement made by the People’s Bank of China, it was stated that it will focus on supporting the expansion of domestic demand, avoid massive stimulus, keep the Chinese Yuan at a reasonable and balanced level, maintain a strong recovery in consumption, and keep liquidity at a plentiful and reasonable level.

- In the USA, the PCE Price Index for January, which we are watching today, exceeded the expectations, increasing by 0.6% monthly and 5.4% annually. Data were expected to increase by 0.5% and 5.0%, respectively. The Core PCE Price Index, which was followed more closely by the FED during the rate hike process, also exceeded the expectations, increasing by 0.6% monthly and 4.7% annually. Core PCE was 0.3% and 4.4%, respectively, in the previous data. While the Dollar Index gained value after the data, global indices fell.

- After the PCE price index was strong, the image in favor of the dollar in the markets started to increase strongly again. While the US 10-year bond interest approached 4%, the EURUSD parity decreased to 1.0540 and the Ounce Gold to 1810 level. There were expectations that the Fed’s interest rate hike adventure would be a little longer. There is a sharp decline in the US stock markets today.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

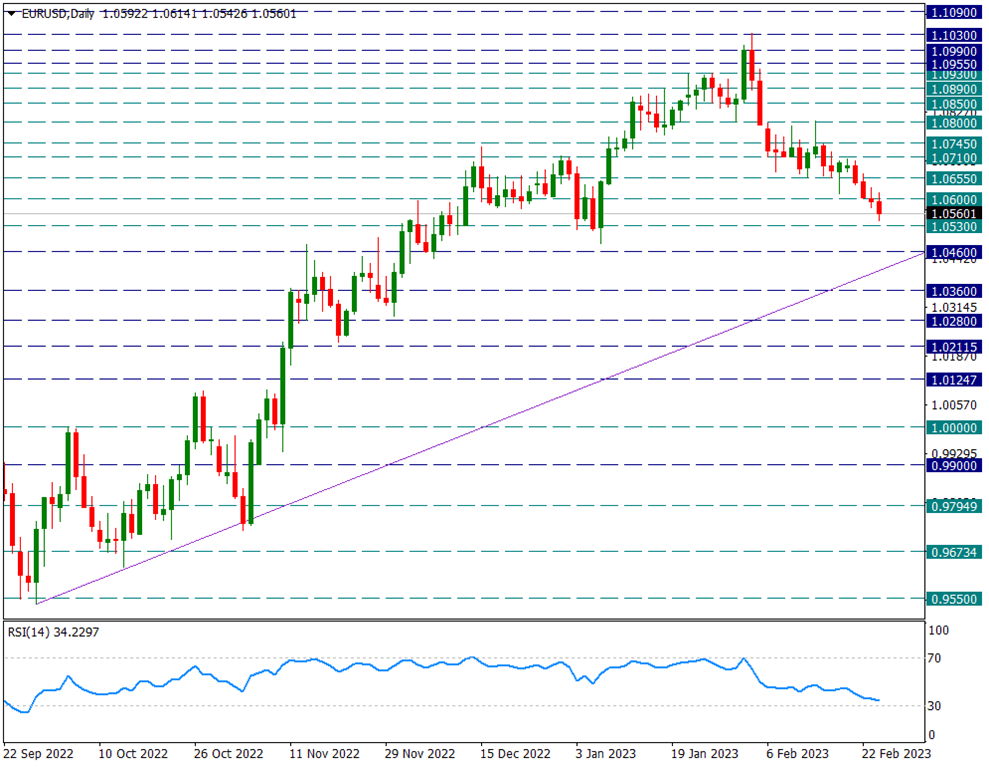

EUR/USD

EUR/USD – Incoming Data Supports Dollar Index…

Inflation pressures on the US side do not end. PCE price index data released today exceeded expectations on both the headline and core side, boosting the annual side as well. After the data, the already appreciated Dollar Index continued to protect its gains. Accordingly, we see the continuation of the decreases in the EURUSD parity. During the week, the 1.0655 level that it tested last week was broken to the downside. After this breakdown, the decline continues step by step. As of today, it has reached 1.0530 support. The uptrend line from 0.9550 below will be our main support line. This is roughly equivalent to 1.0460. We will follow this line as the main support.

As long as it does not rise above 1.0655 again in the short term, it can be predicted that the movements in favor of the dollar will maintain its strength.

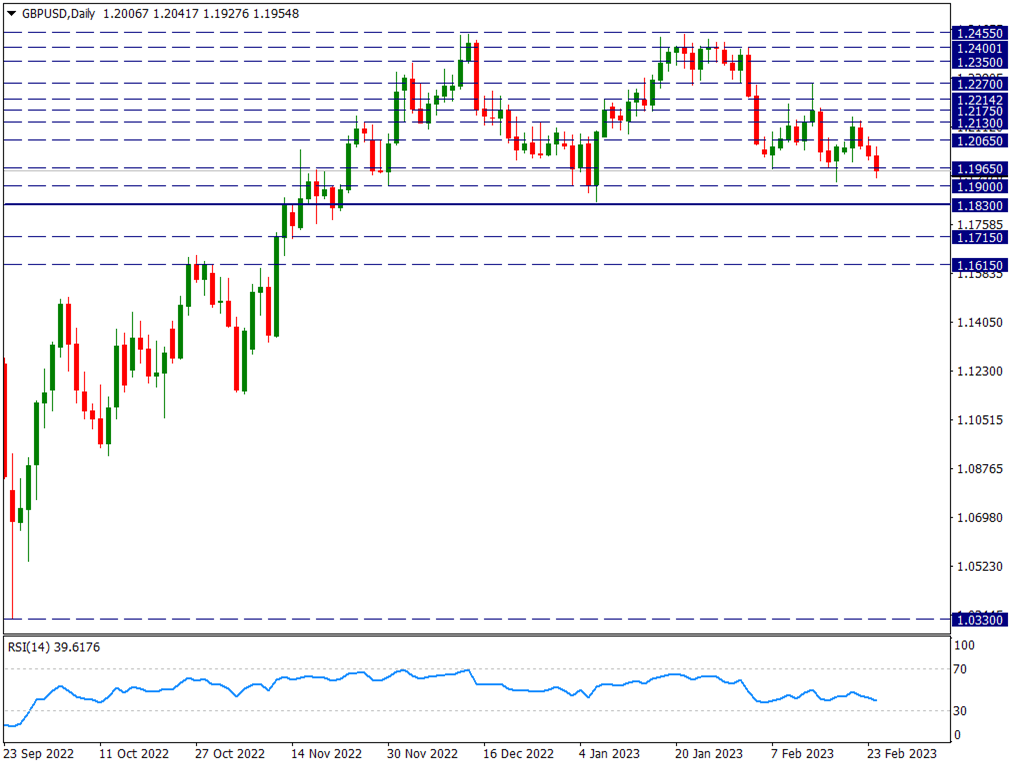

GBP/USD

GBP/USD – If Daily Close Below 1.1965…

On the Sterling side, there is a net depreciation against the Dollar Index. Although it has reacted slightly with the good data coming in the past days, there is pricing against the Sterling after the US 10-year bond yield, which is dominated by the Dollar, approaches 4% in the pair.

As of today, it sags below the previously tested 1.1965 support. The candle close that will take place today is important. If there is a close below, the downward trend in the parity may continue strongly. In this case, the main support will be 1.1830, which is the neck region of the double top formation, which we previously indicated with 1.2455.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

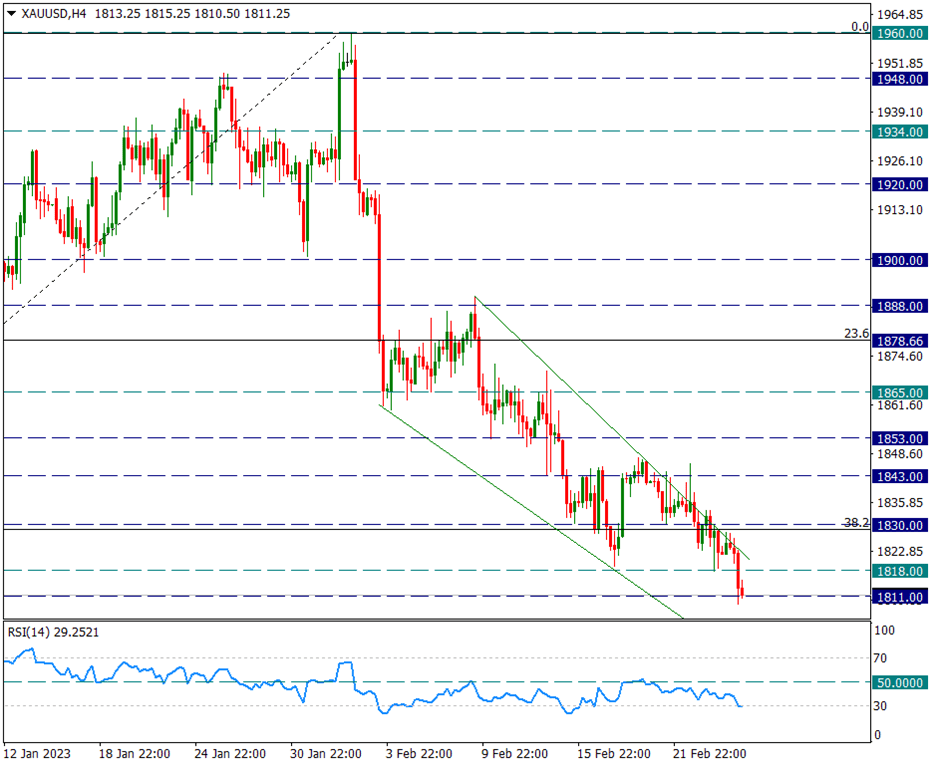

XAU/USD

XAU/USD – Drowning Below 1818, This Support Is Important…

The US PCE price index data, which came in today at 16.30, was extremely strong. With this data, the expectations that the FED will continue to increase interest rates without slowing down have strengthened again. The US 10-year Treasury yield rose to 3.97%. This puts pressure on the yellow metal.

Technically speaking, the yellow metal, which had forced the upper band of the descending wedge structure on the four-hour chart, started to retreat strongly when it failed to break through this region. The yellow metal, which is hanging below the 1818 support, which was recently tested on February 17, as of today, reached the 1810.50 level during the day. If four-hour candles close below the 1818 level on the four-hour chart, the declines may be permanent in the short term and a price below 1800 may be possible.

The possible repercussions are significant, but it may be premature to expect it to be permanent unless it rises above 1830.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.