- Zew Economic Confidence for October in Germany and the Euro Zone came in above expectations in the Index announced today. The index came in at -59.2 in Germany and -59.7 in the Eurozone. The data was estimated to come in at -65.7 and -61.2, respectively. In the statement, it was stated that the economic situation in general worsened again and economic growth is likely to decline in the next 6 months.

- European Central Bank (ECB) Member Herodotou, in his assessment of the interest rate hike process, said that it is absolutely necessary to raise interest rates, as the persistence in inflation disrupts macroeconomic stability. Another ECB Member, Nagel, said the ECB should not continue to quickly reclaim monetary support and stop interest rate hikes too soon.

- In the assessment made by Fitch, the International Credit Rating Agency, it was stated that a very mild recession is expected in the USA, that this recession will resemble the recession that started in July 1990 and ended in March 1991, and the Unemployment Rate in the USA will rise from 3.5% to 5.2%.

- Industrial Production in the USA, which we tracked for September, increased by 0.4% on a monthly basis, exceeding the expectations of 0.1%. Data also increased by 5.30% year-on-year. Manufacturing Production also came in better than expected and grew 0.4%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

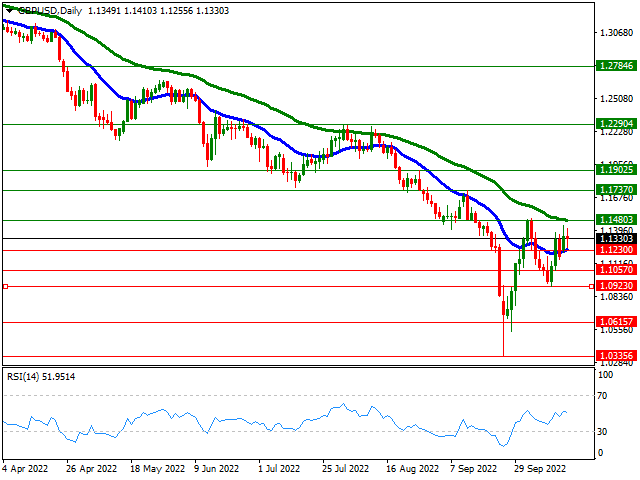

GBP/USD

GBP/USD – Having Difficulty Maintaining Its Uptrend…

The GBPUSD pair is struggling to sustain its gains on Monday on the second trading day of the week. Supported by the optimism about the UK government’s decisions to put the fiscal trajectory on a more sustainable path, following the recent extreme volatility, the pair appears to have been impressed by reports that the Bank of England is delaying its policy of shrinking its balance sheet until the long-term bond markets calm down and will manage inflation control with interest rates. From a technical point of view, the 1.1480 level, which is the 55-day exponential moving average above, will be the first resistance zone in the pair. Below, the 20-day exponential moving average remains as support. In case of possible regressions below this region, 1.1057 and 1.0923 band, which is the lowest level seen since the beginning of October, can be followed as the next support zones.

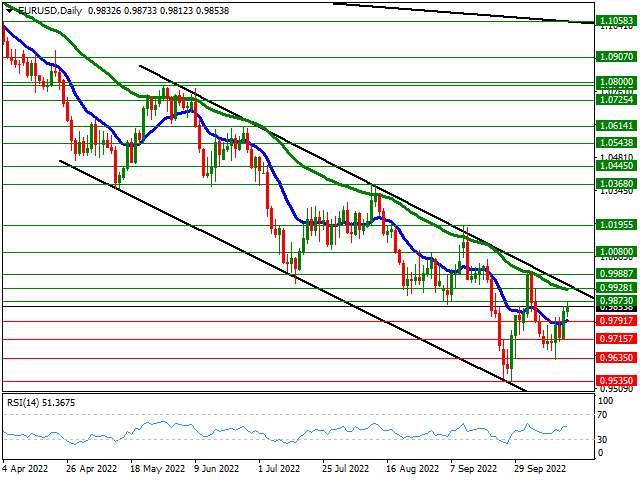

EUR/USD

EUR/USD – The 50-Day Average Will Be Followed As The Main Resistance Zone…

In the EURUSD parity, which recovered above the 15-day exponential moving average with an increase of more than 1.00% on Monday, the rise seen during the European session today was relatively limited compared to yesterday. Before the 50-day exponential moving average and the upper band of the descending channel, the 0.9873 region formed resistance during the day. If the parity accelerates its gains, possible trends and day closures above the descending channel will be important, but if the parity fails to break through this region, the selling pressure may prevail again in the parity. Below, the 15-day exponential moving average, which it broke yesterday, will be the first support zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAU/USD

XAU/USD – Upward Movements Suppressed from 10-Day Average…

The recovery in the US dollar in the first half of the European session limited the gains of Ounce Gold, which were observed so far. From a technical perspective, upside movements in Yellow Metal remain limited to the 10-day exponential moving average. The precious metal tested this average yesterday but failed to break it. In the possible directions above this region, 1684 and 55-day exponential moving averages come to the fore as the next resistance areas. Below, the 1640 level will continue to be followed as the first support band.

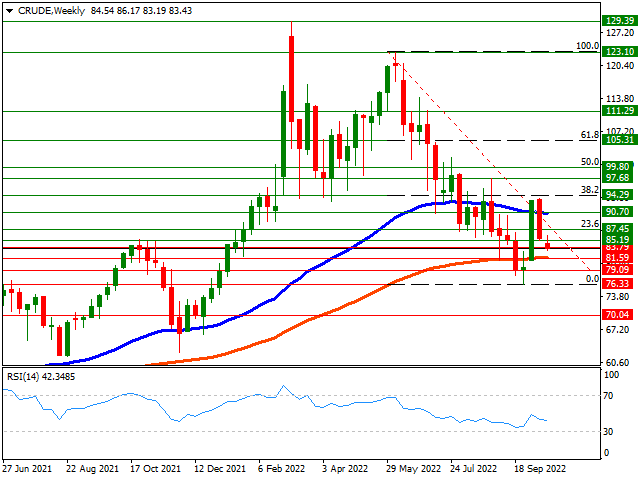

CRUDE

CRUDE – Approaching its 100-Week Average…

The downward trend came to the fore in the second trading day of the week, after the crude oil price failed to consolidate yesterday, after the steepest weekly decline in 2.5 months last week. The comments of the United Arab Emirates (UAE) Energy Minister that the OPEC+ production cut decision was the right decision and that the decision had no political side may have put pressure on prices. If the pair turns below the $83 support, the $81 level, which is the 100-week exponential moving average, will be our main support zone. On the other hand, $85 and $87 levels can be viewed as the first resistance zones on possible upward trends.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.