- The US Federal Reserve (FED) has launched an investigation into whether the Bank of Silicon Valley (SVB) has gone bankrupt and has caused concerns in the banking system, whether it has fulfilled its oversight and operational responsibilities. Fed Chairman Powell said a comprehensive, transparent and rapid review of the SVB is needed.

- After the meeting, it was stated that Fed Vice President Michael Barr would lead the review task. In his statement, Barr stated that he will carefully and comprehensively review how the SVB is supervised, regulated and what needs to be learned from this situation.

- Following the bankruptcy of the Silicon Valley Bank, Goldman Sachs, Barclays and Pimco updated their expectations that the Fed would not raise interest rates in March.

- In the US, the Consumer Price Index increased by 0.4% month on month and 6.0% year on year, meeting expectations. Core inflation, on the other hand, rose 0.5% month on month, just above the 0.4% expectation, and rose 5.5% year-on-year. Although the inflation data come as expected, the upward effect in the monthly data continues. After the data, while the EURUSD parity is rising to 1.0735, all attention will be on the FED’s statements and the interest rate decision.

- The US 10-year bond yield rose slightly today and reached 3.65%. The 2-year bond yield is rising faster and is around 4.35%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

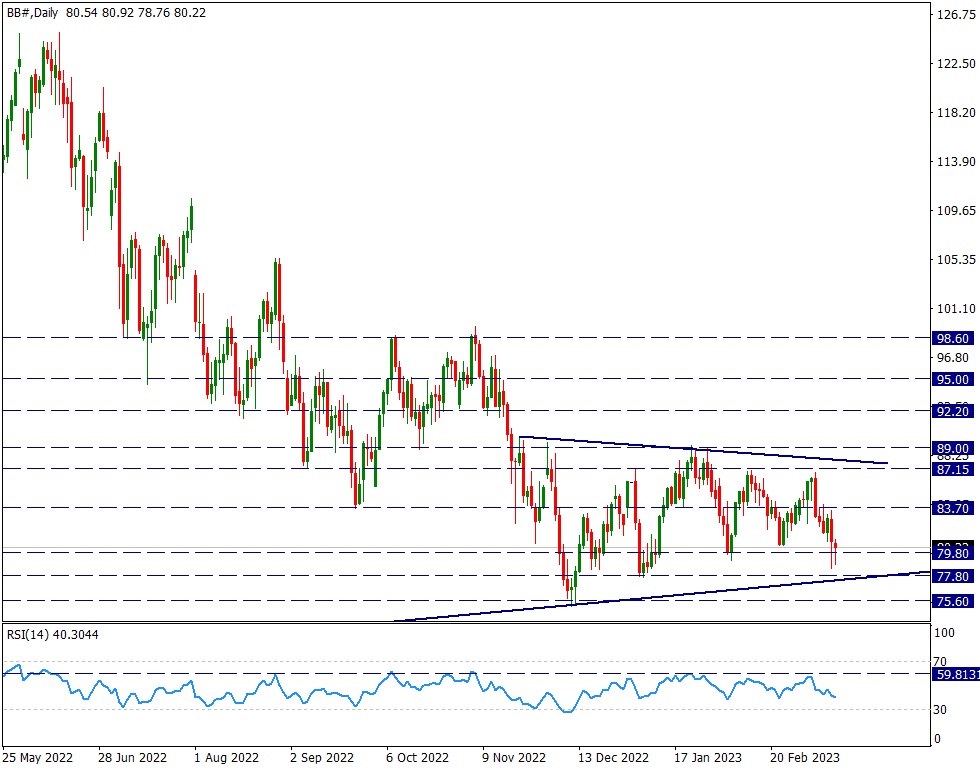

BRENT

BRENT – Price Actions Continue to Tighten…

On the Brent side, price movements continue to tighten. We are watching the 79.80 support carefully in intraday movements. Although it sagged under the region yesterday and today, there is an immediate reaction. When we look at the lower band of the pinched triangle, we see 77.80 as the main support.

Above, the upper band of the contracting triangle, the region between 89/87.15 is the main resistance. Since the end of November 2022, we have been following the ongoing movements within this horizontal but squeezed triangle, paying attention to the levels below and above. This compacted horizontal zone is important for a possible trend change.

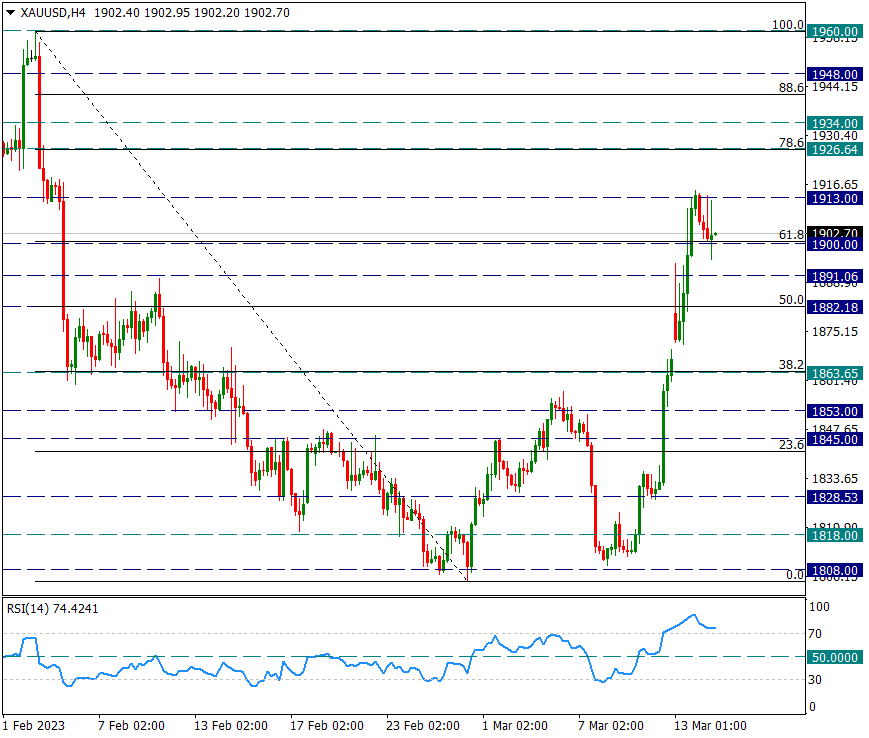

XAU/USD

XAU/USD – We Will Watch 1891 in Profit Sales.

Ounce Gold has regressed to 1900 with light profit sales from 1913 resistance after the sharp rise it has experienced for the last 3 days. Generally we will check for sags up to 1891 level. If there is no movement below 1891, the uptrend may resume as a result of a flag formation and the 1960 peak seen in February may come up again. We will follow this during the day with 1913 resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

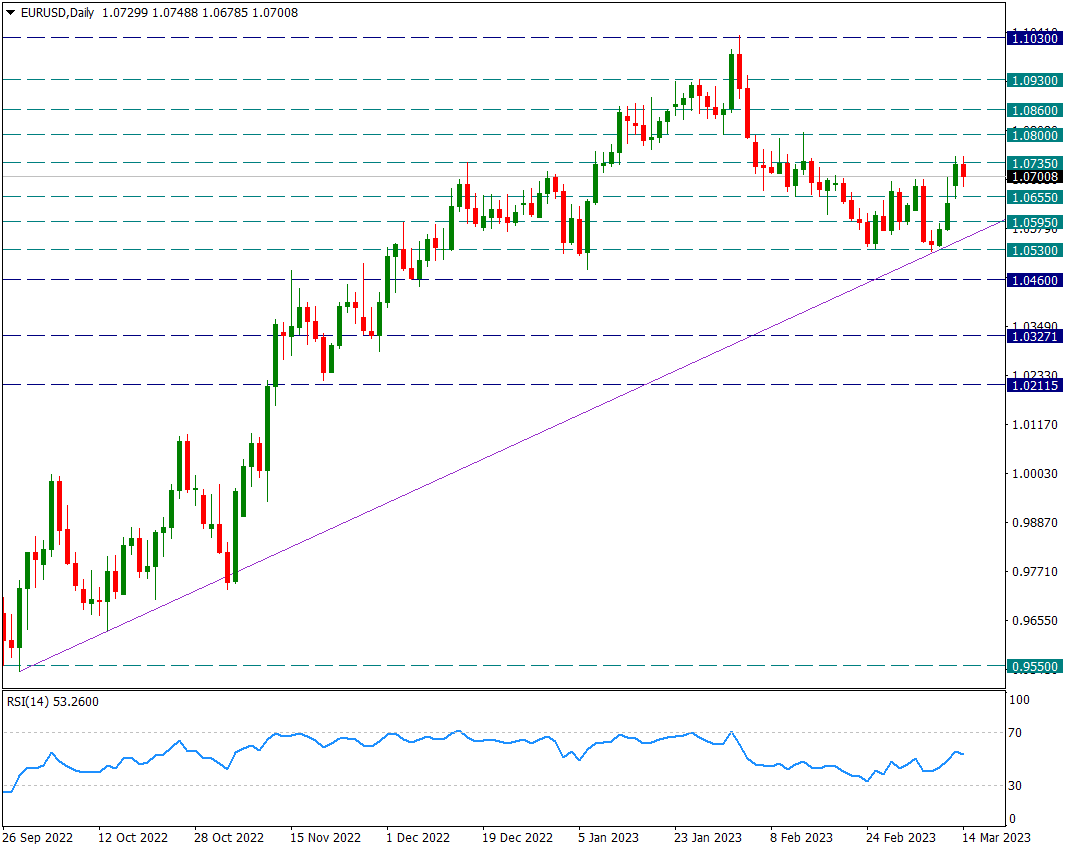

EUR/USD

EUR/USD – The pair started to decline from the resistance of 1.0735…

The US Dollar, which has lost value with the bankruptcies in the USA recently, is in a tendency to recover its losses slightly today. Especially with the US inflation data at 15.30 today, this trend made itself felt a little more. Although US inflation is declining on both the headline and quarterly side, on an annual basis, core inflation remains high on a monthly basis.

The pair started to retreat from 1.0735 resistance. Reactions up to this region may seem normal due to the reaction from the trendline from 0.9550. However, if the 1.0735 resistance is crossed upwards with daily candles, the reaction may extend up to the 1.09 region.

In the continuation of the profit selling that started today, we will be watching the trend from 0.9550 and this is the main support line.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.