- Industrial Production in Germany for September, which was announced today, increased by 0.6%, above the expectation of 0.2%. Industrial Production increased by 2.6% on an annual basis. Apart from this data, Construction PMI announced for October increased to 43.8 from 41.8. However, since the data remained below 50, it pointed to a shrinkage in the Construction Sector. The Construction Sector in the Euro Zone also shrank to 44.9.

- Sentix Investor Confidence, which was announced for November in the Euro Zone, rose to -30.9 from -38.3. Investor Confidence has increased in the Euro Area with the expectations that the recent increase in temperatures and falling energy prices in Europe will prevent the gas crisis in winter.

- In his speech today, European Central Bank (ECB) Member Villeroy said that inflation has not peaked yet, so interest rate hikes should continue, headline inflation may peak in the first half of 2023 and there may be a few more rate hikes next year.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

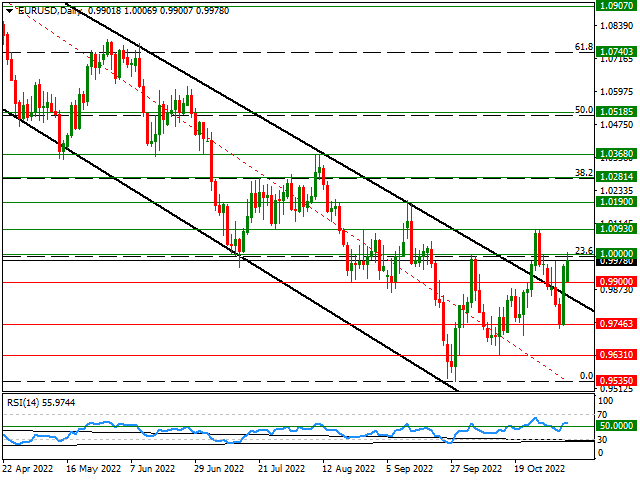

EUR/USD

Just Below 1.0000 Resistance Zone….

The EURUSD parity, which wiped out all its losses during the week and closed the week on a positive note after the US Non-Farm Employment report on Friday, managed to maintain its buyers trend in the European session on the first trading day of the new week. Although the pair is trending above the 1,000 resistance zone, it has not been successful in breaking this zone. If the 1.14-0.95 decline manages to hold above the 1.0000 resistance zone, which also coincides with the 23.6% Fibonacci band, the 1.0093 level, the highest level seen in October, stands out as the next resistance zone. On the other hand, 0.9900 and 0.9745 levels, which are the lowest levels tested today, can be viewed as the first support zones in possible retracements in the parity.

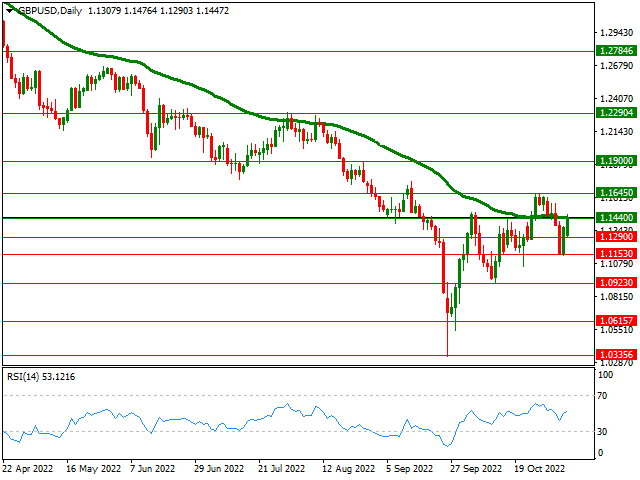

GBP/USD

GBP/USD – Tests 55-Day Average…

With the US Dollar losing ground against its rivals with the US Non-Farm Payrolls report on Friday, the GBPUSD parity also managed to erase some of its losses after the Fed and the Bank of England. On the first trading day of the new week, the pair, which has managed to maintain its recovery trend so far, is testing its 55-day exponential moving average. If this resistance zone, which also coincides with the 1.1440 band, is broken, 1.1645, the highest level seen in October, can be followed as the next resistance zone. On the other hand, if the pair is suppressed from its 55-day average, 1.1290 and 1.1153, the lowest levels it has seen today, can be followed as the first support zones.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

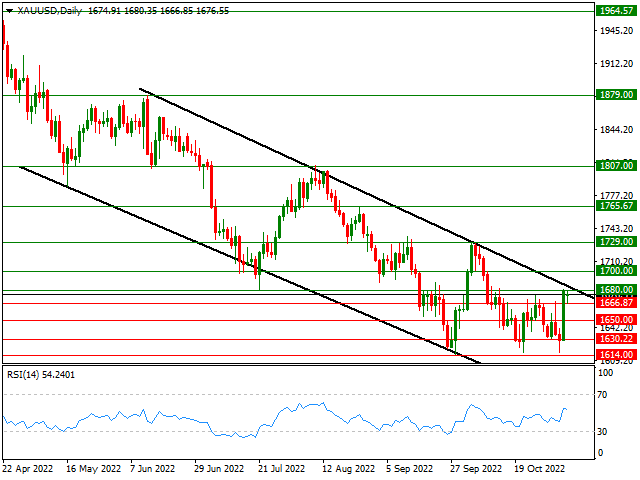

XAU/USD

XAU/USD – At the Upper Band Boundary of the Descending Channel…

The strong rise in Gold Ounces after the US Non-Farm Employment on Friday has left its place to a limited rise on the first trading day of the new week. From a technical point of view, if Ounce Gold, which tests the upper band of the descending channel and the 1680 resistance zone, breaks above this zone, the technical levels of 1700 and 1729 may come to the fore. Below, the 1666 band, which is the lowest level it has seen today, and the 1650 level can be viewed as the first support zones.

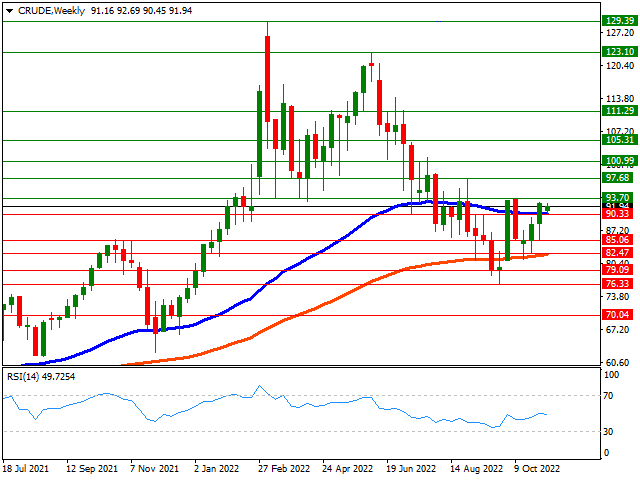

CRUDE

CRUDE – Maintains Earnings Above 50-Week Average…

Crude Oil, which rose above the $90 resistance zone, which is the 50-week exponential moving average on Friday last week, maintains its gains above this zone on the first trading day of the new week. Above $93 and $97 levels on Crude Oil can be viewed as the next resistance zones. Below, the 50-week average will now be followed as the first support zone.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.