- The calmness of the intraday data density and explanations was also reflected in the prices. In instruments traded in a narrow price range in general, EURUSD parity is above 1.05, Ounce Gold is at 1775 levels, USDJPY parity is stable in 136 region. While the US 10-year bond yield decreased slightly to 3.55%, the difference between the 10-year and 2-year bond yields is at its highest in recent times and has risen to 83 basis points.

- Policy maker from the European Central Bank, Herodoto, stated in his statement that there will be more interest rate hikes and they are close to the neutral rate. In addition, he said that he has not seen a “hard landing” for the Eurozone economy, while stating that there has been no change in inflation expectations yet.

- Factory Orders in Germany increased by 0.8% monthly in October, while September data was revised to -2.9% from -4 percent.

- Oil prices continued to decline in the European session and the Crude Oil price for January 2023 contracted to 75.59. On the other hand, Brent oil price for February 2023 has reached the lowest level of 81.29.

- We followed the policy decision of the Reserve Bank of Australia in the Asian session. The bank increased the policy rate by 25 basis points to 3.1%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

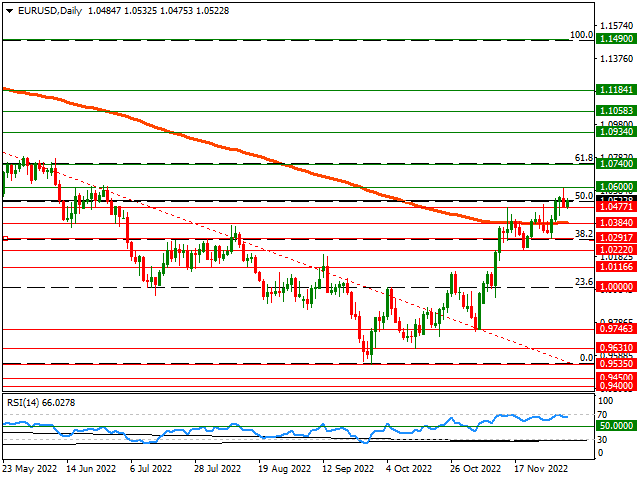

EUR/USD

EUR/USD – Found Support From 1.0475 Region…

After testing the highest levels of the last 5 months on Monday, the EURUSD parity, which was pulled back to below the 1.0500 band with the sales, found support from the 1.0475 region on today’s trading day when the economic data flow was calm, and gave its direction back up and erased some of yesterday’s losses. The 1.0600 level above can be viewed as the first resistance zone in the pair. Below the 1.0475 band, the 200-day exponential moving average of 1.0384 can be followed as the next support zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

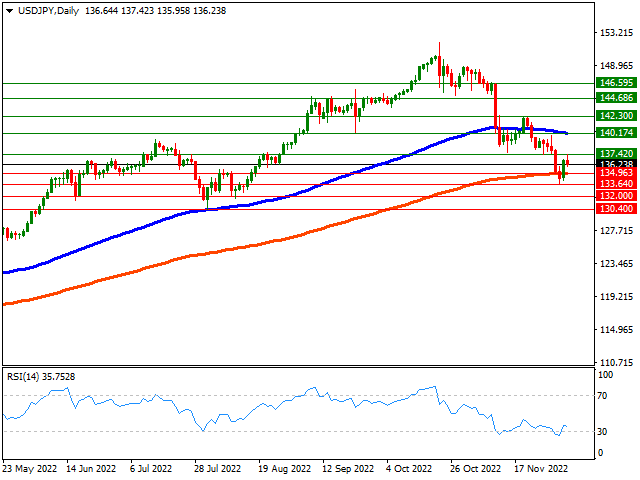

USD/JPY

USD/JPY – Intraday Rise Suppressed from 137.42 Band…

Despite the efforts to maintain this trend in the Asian session on Tuesday, which started to rise with the purchases developing in the 200-day exponential moving average region on Monday, the European trading session retreated to the 136 region with the developing sales at the beginning of the trading session. The 134.95 region, which is the 200-day exponential moving average below in the pair, will continue to be followed as the first support band. Above, the 137.42 level, which is the area where it is suppressed today, can be followed as the first resistance area.

GBP/USD

GBP/USD – 200-Day Average Received Support From Relatives…

GBP/USD picked up some bullish momentum and gained bullish momentum during European trading hours on Tuesday, heading towards 1.22. If the uptrend continues, the 1.2344 band, the highest level seen on Monday, can be viewed as the first resistance zone. Below, the 200-day exponential moving average will continue to follow us as the first important support zone.

XAU/USD

XAU/USD- Turns Up From Its 100-Week Average…

On Tuesday, Ounce Gold, which tested below its 100-week exponential average with the sales that developed from the 1810 region on Monday, is followed by an effort to erase its losses with the reaction buying from this region. If the recovery effort continues, the 1796 and 1810 levels above in Yellow Metal could be followed as initial resistance zones. Below, the 1770 band, which is the 100-week exponential moving average, will be followed as the first support zone.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.