*Nonfarm Employment Change for September, announced today in the USA, came in much higher than the expectation of 170 thousand and increased by 336 thousand. The previous data was also revised from 187 thousand to 227 thousand. Apart from these data, the Unemployment Rate at 3.8% remained unchanged, while Average Hourly Earnings remained below expectations, increasing by 0.2% monthly and 4.2% annually. After the data, the probability of the FED increasing the interest rate at its meeting on November 1 was 71.3%.

*European Central Bank (ECB) member Knot said in his speech that inflation is approaching its peak and they are satisfied with the current policy stance. Another ECB Member, Vujcic, said that they are on a good path and that they will achieve a soft landing if the predictions come true.

*The September Employment Change, which we follow in Canada, was well above the expectation of 20 thousand and increased by 63.8 thousand. The Unemployment Rate remained unchanged at 5.5%.

Agenda of the Day (GMT +3);

07:00 p.m. FED Member Waller’s speech

08:00 p.m. Number of US Oil Drilling Rigs

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

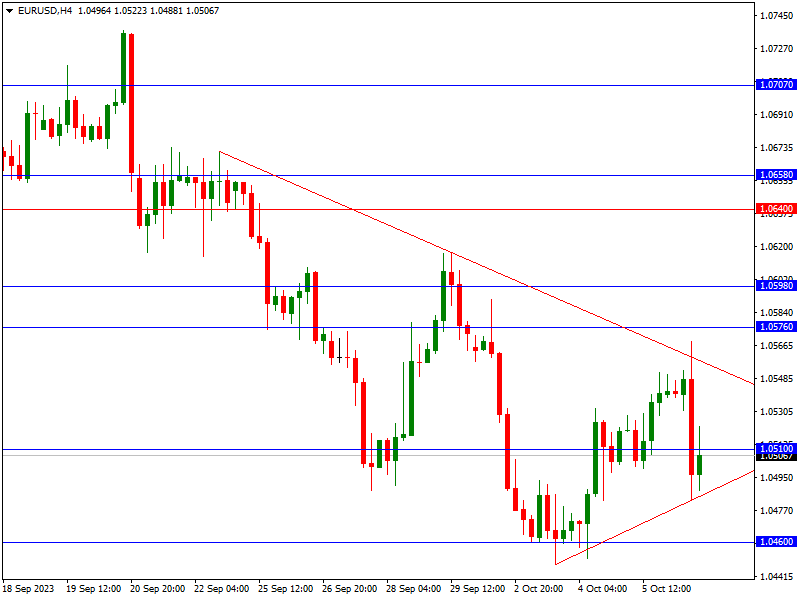

EURUSD

EURUSD – Recovering After Declines…

Nonfarm Employment Change in the USA increased by 336 thousand, well above the expectation of 170 thousand. With the effect of positive data, EURUSD parity decreased to 1.0482 level. It is also recovering with the support received from this level. In the continuation of the recovery, the upper band of the symmetrical triangle formation can be observed as important resistance. In case of withdrawals, 1.0510 and the lower band of the formation may provide support.

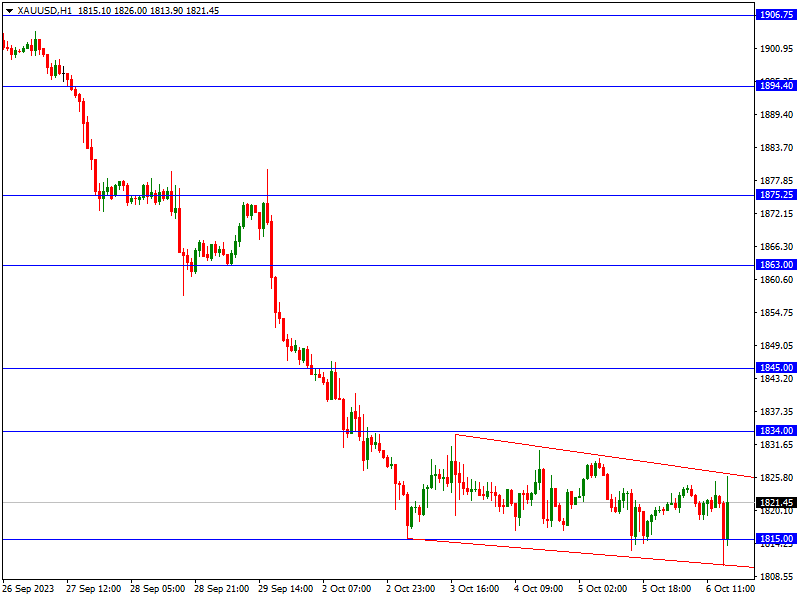

XAUUSD

XAUUSD – Rising to the Upper Band of the Channel…

Due to the positive employment data in the USA, Ounce Gold decreased to the lower band of the falling price channel that we follow on an hourly basis. The upper band of the channel was tested with the support received from the lower band. If the channel moves upwards, the increases may gain momentum. In this case, 1834 and 1845 can be viewed as resistance. In case of withdrawals, 1815 and the lower band of the channel may provide support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

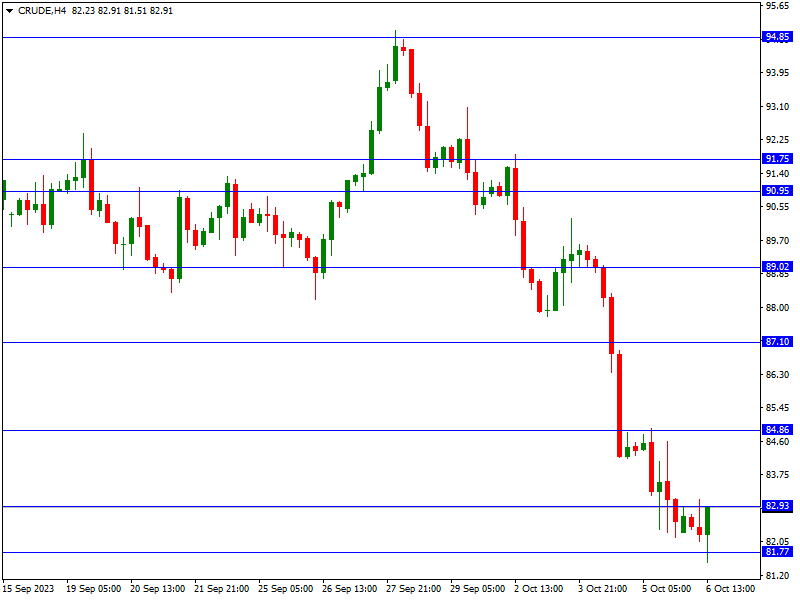

CRUDE OIL

CRUDE OIL – Rising with the Support from 81.77 Level…

With Russia’s loosening of its oil export ban and the impact of positive employment data in the USA, Crude Oil dropped to the 81.77 support level. Recovery is also seen with the support received from this level. In the continuation of the recovery, 82.93 and 84.86 can be observed as resistance. In case of withdrawals, 81.77 and 80.78 may form support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.