*European Central Bank (ECB) Member Kazimir, in his speech today, said that the decline in inflation will extend a little, that he believes that the interest rate increase in September is the last, and that he confirms his expectations for core inflation in September.

*Weekly Unemployment Claims, which we follow in the USA, were realized at 207 thousand, below the expectation of 210 thousand. The previous data was also revised from 204 thousand to 205 thousand. Trade Balance, another important data announced in the USA, had a deficit of 58.30 billion dollars. The trade deficit stood at 64.70 billion last month.

*There is a slight relaxation in the pricing experienced throughout the week in global markets today. While the US 10-year bond interest rate is decreasing towards 4.71%, we are also seeing slight reactions from the EURUSD parity. Ounce Gold continues to remain under pressure below 1832.

We see that the generally negative trend continues in US futures stock market indices.

Agenda of the Day (GMT +3);

5:30 p.m. US Natural Gas Stocks

7:00 p.m. Speech by FOMC Member Daly

US Weekly Unemployment Claims: 207K (Expected: 210K Previous: 204K)

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – We are Watching Profit Selling in Dollar and Reactions in Parity…

While the US 10-year bond interest rate rose to 4.88% during the week, demand for bonds from this region began to increase. With the successive demands, the yields decreased to 4.71% and a small part of the gains in the Dollar index are given back through profit sales.

The EURUSD pair started to react after retreating as low as 1.0450 on Tuesday. Today is the second day of the rise and the 13-day average resistance line is the first area observed for trend following. The reactions are extremely normal, but gradually the level of 1.0695, which is the upper resistance zone, will be controlled after the 13-day average (1.0575).

At the point where these resistances cannot be overcome, it is possible that the reactions experienced will allow for a sales opportunity again.

The US Non-Farm Employment Report coming from the USA tomorrow may create a significant movement on the parity.

XAUUSD

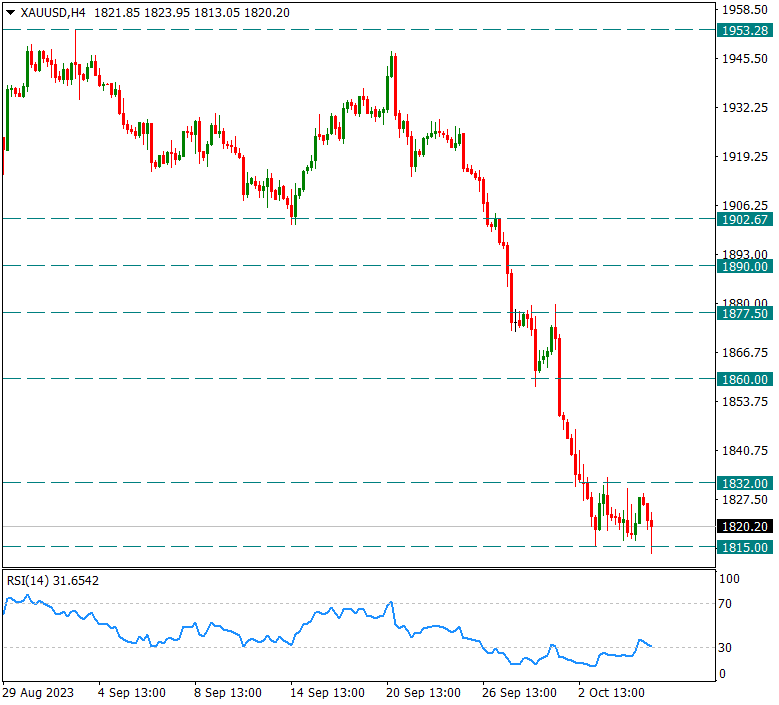

Ounce of Gold – Reactions Weak, Eyes Between 1832-1815…

The reactions in the yellow metal remain very weak and cannot move towards the 1832 resistance.

Although the US 10-year bond interest rate decreased from 4.88% to 4.71% today and the dollar index weakened, there was not much reaction in the yellow metal.

There is positive divergence on a four-hour basis, but four-hour closes above the 1832 resistance must be seen for this to be triggered.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

BRENT

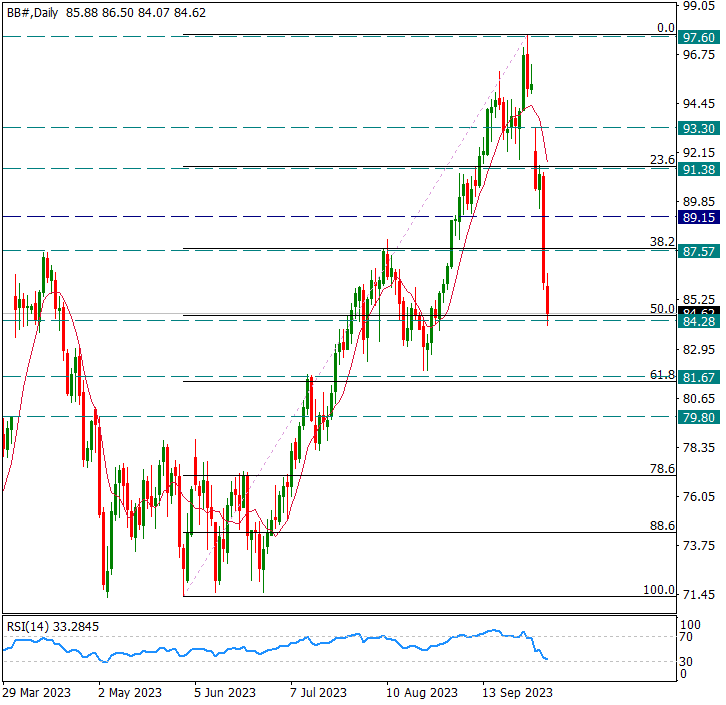

BRENT – Correction has arrived up to Fibo 50 of the Last Rally…

The sharp decline on the Brent side continues. Although it rose to 93.34 on Monday, it fell to 84.28 after the strong decline from there.

The intraday resistance zone we are now looking at is at 87.57 level. As long as it remains below this region, we can expect the pressure to continue and gradually decline to the Fibo 61.8 correction. Fibo 61.8 retracement corresponds to 81.67 level.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.