- The US Dollar Index started to give back its gains one day after making a very positive start to the new year. Before the minutes of the FOMC meeting at 22:00 (GMT+3), we see that the movements on the Dollar side are getting a little better.

The US 10-year bond yield continues to decline today, as it was yesterday, and the 10-year bond yield decreased to 3.67%. Likewise, we have been seeing consecutive decreases in the German 10-year bond interest for 3 days.

- Ounce Gold continued its rise today and reached the level of 1865.

- The minutes of the Fed’s December meeting will be published at 10 p.m. (GMT+3) in the evening. The FED entered into a relatively hawkish policy and discourse at the last meeting. Dot plot charts revealed that the Fed is in a more hawkish outlook for interest rates. At least, that’s what the FOMC members’ expectations were shaped. While the relative inflation pressures in the USA and Europe have decreased, we will follow how this increasing hawkish outlook is explained. Besides, it would be interesting to take a look at how policy makers feel about labor market conditions and the economy. It may be a matter of curiosity whether there will be any expression from some members that they have a concern about “over tightening”.

Any message from the minutes that will soften the hawkish attitude may increase the risk appetite again and a situation may arise against the dollar. Otherwise, the dollar trend may continue from where it left off and the shyness of the market may continue.

- When we look at the intraday data, according to the December inflation results announced from Switzerland, annual inflation was 2.8% and monthly inflation was -0.2%.

- Services PMI Index of Germany and Euro Area has been announced. Germany remained in the contraction zone, with 49.2 and the Eurozone 49.8, below 50.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

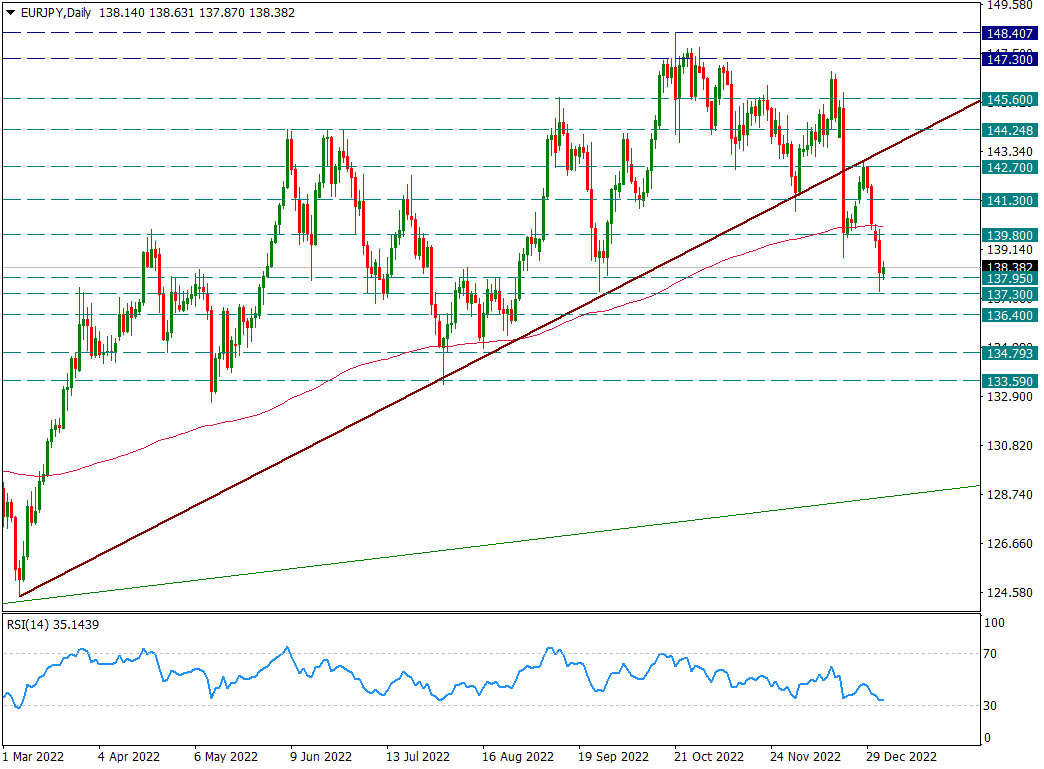

EUR/JPY

EUR/JPY – 200- Below 200-Day Average with JPY Favor Image…

The Japanese Yen has been strengthening since the day the BOJ raised the 10-year Japanese bond yield ceiling to 0.5% from 0.25% last December. With this movement, the uptrend line, which has been continuing since 124.40, was broken. Even though it reacted once from the 200-day average, after touching and confirming the trend it broke, we saw moves in favor of JPY again. As of the new year, it started to close below the 200-day average. In this sense, as long as it does not hold above the 139.80 level again, we can think that the movements in favor of JPY will continue in the short term. Support zones can be watched carefully for possible reactions.

XAU/USD

XAU/USD – 2070/1615 Fixes Its Decline Step by Step…

Although it showed its upward trend before the beginning of the year, Ounce Gold, which kept it very limited, started to rise rapidly as of the first trading day of the new year. Continuing to rise today, it rose to the resistance of 1865. With this rise, it is moving step by step towards the Fibonacci 61.8 retracement level of the 2070/1615 decline. For this reason, we will follow 1895, which coincides with the Fibo 61.8 correction zone, as the main weekly resistance.

Step-by-step supports will be important in possible declines, but for now, we will carefully monitor the 1805 support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

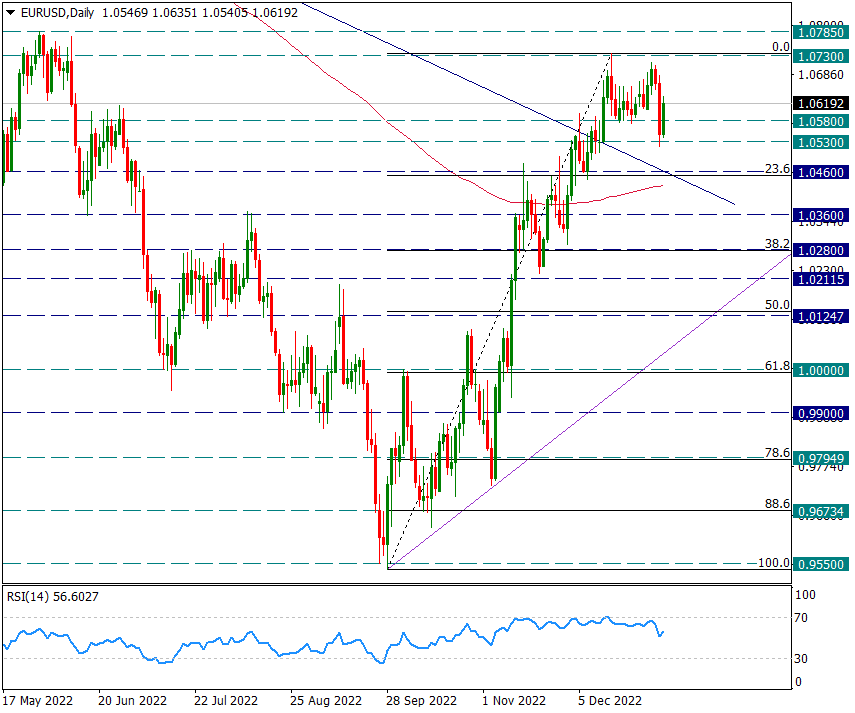

EUR/USD

EUR/USD – Reacted Today and Above 200-Day Average…

The pair, which had withdrawn rapidly yesterday, is reacting today by finding support at 1.0530. Movements have been volatile and unstable lately. However, the pair still remains above the 200-day average. It may be technically premature to wait for another dollar rally before this average breaks down to 1.0460.

If the reactions continue, the 1.0730 level will be on our agenda again.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

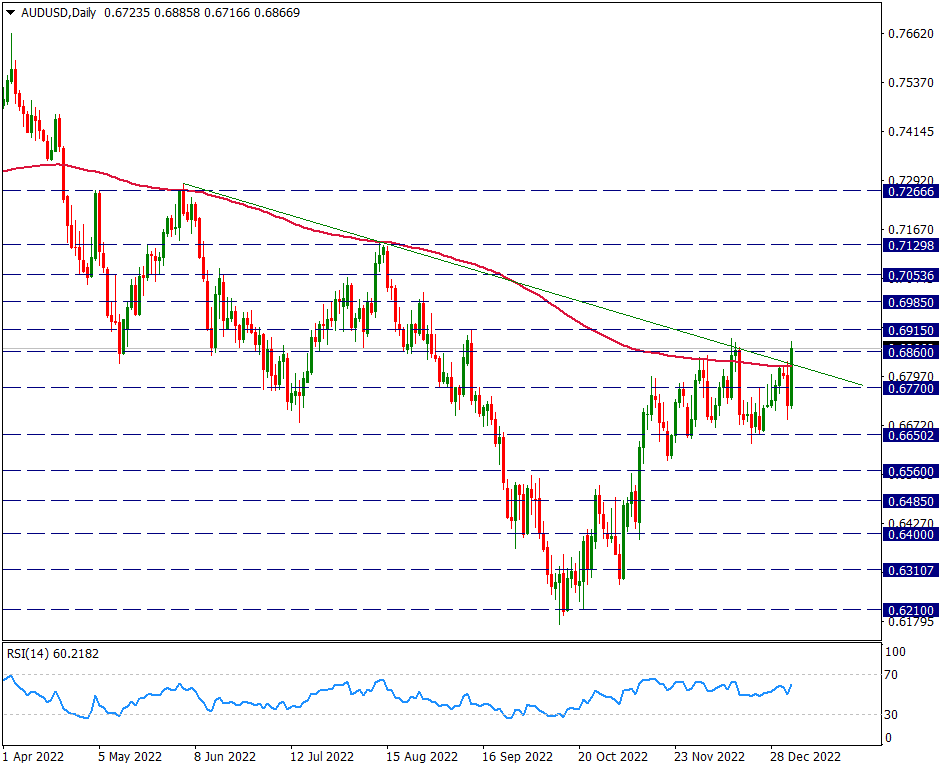

AUD/USD

AUD/USD – Pushing Its 200-Day Average Upward…

Although there has been a slight upward trend lately, AUDUSD prices, which have been fluctuating a lot, are above the 200-day average as of today. However, it also broke above the downtrend line from 0.7265 dated June 2022. If the daily candle closes continue to form above 0.6860, we can see the move in favor of AUD. However, we would like to emphasize that the 200-day average region, which corresponds to the horizontal level of 0.6860 and 0.6830, is important here. Permanence on this line may be required as a technical condition for the continuation of the movements in favor of the AUD.

Contact Us

Please, fill the form to get an assistance.