- Exports, which we followed in October, were 21.33 billion dollars and imports were 29.20 billion dollars. After these data, the Trade Deficit was 7.87 billion dollars in October and 91.49 billion dollars in January-October. The Trade Deficit was $9.59 billion in September. TURKSTAT Economic Confidence Index, which is another data announced in Turkey, decreased from 97.1 to 96.9.

- Confidence Indices for November in the Euro Zone were released today. Consumer Confidence Index remained unchanged at -23.9. While the Economic Confidence Index rose from 92.5 to 93.7 and the Service Sector Confidence Index rose from 1.8 to 2.3%, the Industry Confidence Index fell from -1.2 to -2.0.

- In Germany, the Consumer Price Index (CPI) for November, announced today, decreased by 0.5% month on month and increased by 10.0% year on year. The data was expected to decrease by 0.2% monthly and increase by 10.4% annually. Annual CPI was realized as 10.4% in October. Despite the decline in CPI, it is still above Germany’s target level of 2%.

- In Canada, the GDP we tracked for the third quarter was above expectations, growing by 0.7% quarterly and 3.93% year-on-year. The economy was expected to grow by 0.4% and 1.5%, respectively. Despite the positive data, the Canadian Dollar continued its depreciation against the US Dollar.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EUR/USD

EUR/USD – Finding Support from the 1.0330 Region, the Parity Headed to the 200-Day Average…

The EURUSD parity, which fell below the 200-day average with the sales after renewing the top level of the last 4 months with 1.0496 on Monday, is trying to recover with the support it received from the 1.0330 region in the European trading session on Tuesday. Resurgent sales in the US Dollar amid China’s reopening optimism seem to have given support to the Euro’s rebound. If the pair recovers above its 200-day average, 1.0485 and 1.0615 levels can be viewed as the next resistance zones. At the bottom, 1.0222 and 1.0116 levels can form support in the trends below the 1.0330 band.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBP/USD

GBP/USD – Bank of England Governor Bailey’s Statements Will Be Followed…

In GBPUSD parity, where recovery efforts are at the forefront on Tuesday after the decline experienced on Monday, the statements of the Bank of England Governor Andrew Bailey at the Economic Affairs Committee at 18:00 (GMT+3) may be important. In the pair, which finds support in the 50-unit exponential moving average, which we follow on the 4-hour chart below, 1.2065 and 1.2142 levels above can form resistance.

XAU/USD

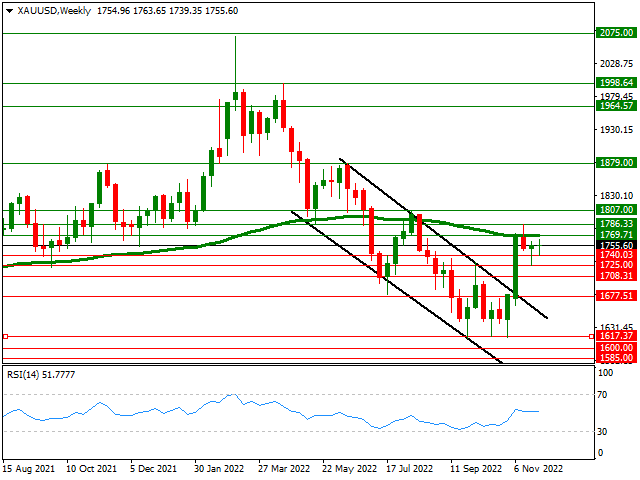

XAU/USD – Erasing Monday’s Losses…

Ounce Gold price is trying to reverse the previous day’s losses in the cautious optimism environment. Amid China’s reopening optimism and the easing in Covid numbers, resurgent sales in the US Dollar supported the move in favor of Gold buyers. If the Yellow Metal carries its gains further, the 100-week exponential moving average, 1769, stands out as the first important resistance zone. Below, 1740 and 1725 levels can form support.

CRUDE

CRUDE – Daily Rise Approached 4 Percent…

While China’s reopening optimism eased the fears of China-related demand for now, Crude Oil price recovered to the $80 limit yesterday with the purchases from the 11-month low region of $73. If the uptrend continues, the $82 level, the 100-week exponential moving average, can be followed as the first important resistance zone. Below, the $76 level before the $73 band can act as an intermediate support zone.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.