- Data from the US on Tuesday revealed that housing prices fell faster than expected in August and consumer confidence deteriorated in October. While this data is not very market mover, it seems to be an excuse for investors to support the expectations of a less aggressive Fed policy tightening after November. The weekly decline in the US Dollar index reaches 1.5%, while prices are in the lowest region of 4 weeks. The US 10-year bond yield fell as much as 4.02% in the European session today. The relaxation in Fed expectations helped EURUSD to recover to the 1.000 region before the European Central Bank meeting that will take place tomorrow.

US New Home Sales data for September, announced at 17:00 CET, decreased by 10.9%. Although there was a more optimistic regression than expected, the data for the previous August was revised to 24.7% from 28.8%. After the bad data, the US Dollar index fell back to 110, while the US 10-year yield approached 4%. EURUSD parity reacted up to 1.0050 level. On the other hand, ounce gold approached 1680 resistance.

- British Finance Minister Hunt announced that they postponed the announcement of the medium-term fiscal plan, which was decided to be announced on October 31, during the term of former Prime Minister Liz Truss, to November 17. Hunt said he had spoken to Bank of England Governor Bailey to delay the announcement of the plan and that postponing was the best way to make sure they were making the right decisions. Meanwhile, maintaining its uptrend, the British Pound hit a 5-week high of 1.16 against the US Dollar.

- We saw the policy rate decision this time from Canada at 17:00 CET. Canada increased interest rates by 50 basis points and raised the policy rate to 3.75%, surprisingly below expectations. After this surprise decision, the USDCAD parity reacted upwards. Canada revised its growth prospects, particularly 2023, downward. It gave a positive message by revising its inflation expectations slightly.

- Tomorrow at 15:15 CET we will learn the policy decision of the ECB. However, at 15:30 CET we will learn the first US growth forecast for the third quarter. We can say that it will be an important day in terms of consecutive data.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

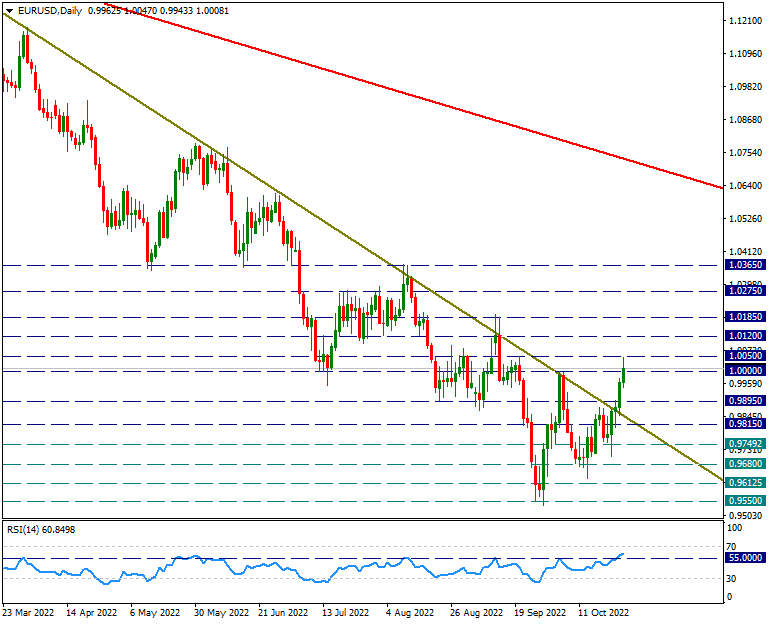

EUR/USD

EUR/USD – The Parity Carried Its Recent Rise to 1.00…

EURUSD parity continues to recover step by step. It is important to break the downtrend line from 1.15 yesterday. The uptrend continues today and the daily RSI(14) has broken above its 55 level. These situations can help the movements in favor of the euro maintain its strength. However, we will be watching the 1.0050 and then 1.0365 levels as resistance points.

The first support on possible declines will be 0.9895.

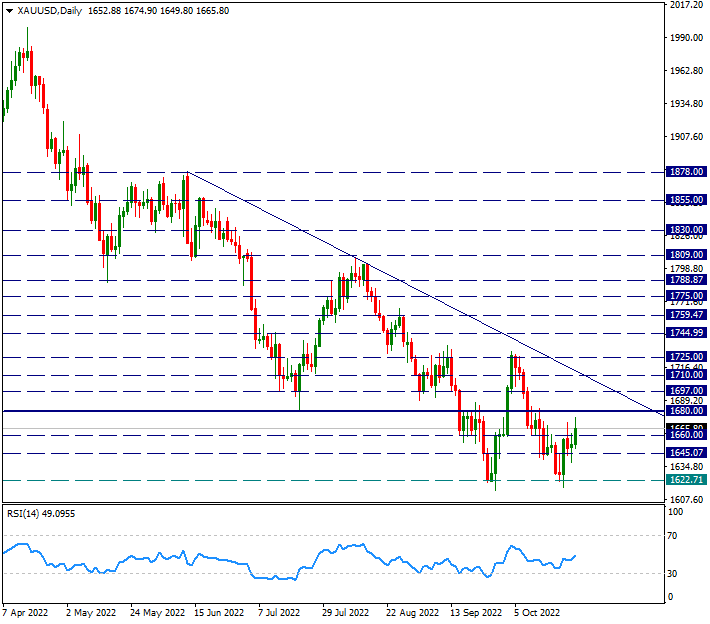

XAU/USD

XAU/USD – It may be premature to wait for the rally before 1680 is passed!

With the loosening of the US 10-year yields, there is a reaction in Ounce Gold starting from 1622, but it has not been able to exceed the 1680 level yet. This region will be important and it may be premature to expect a positive move in the scenario where it is not broken on the upside.

If it is above 1680 in possible upward movements, the next stop will be the downtrend line from 1878.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

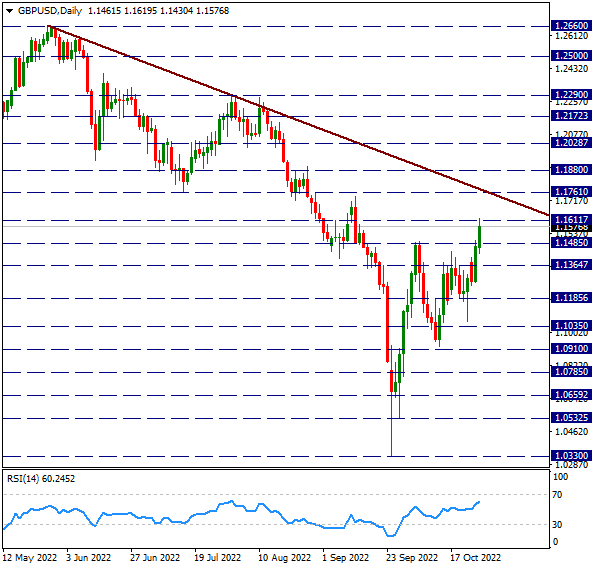

GBP/USD

GBP/USD – 1.1485 Resistance Exceeded and Response Extended…

With the change of Prime Minister, the recovery on the Sterling side continues. As of today, it is testing the 1.1611 resistance, surpassing the 1.1485 resistance it had tested before. In the continuation of possible reactions, we will be watching the downtrend line from 1.2660 as resistance.

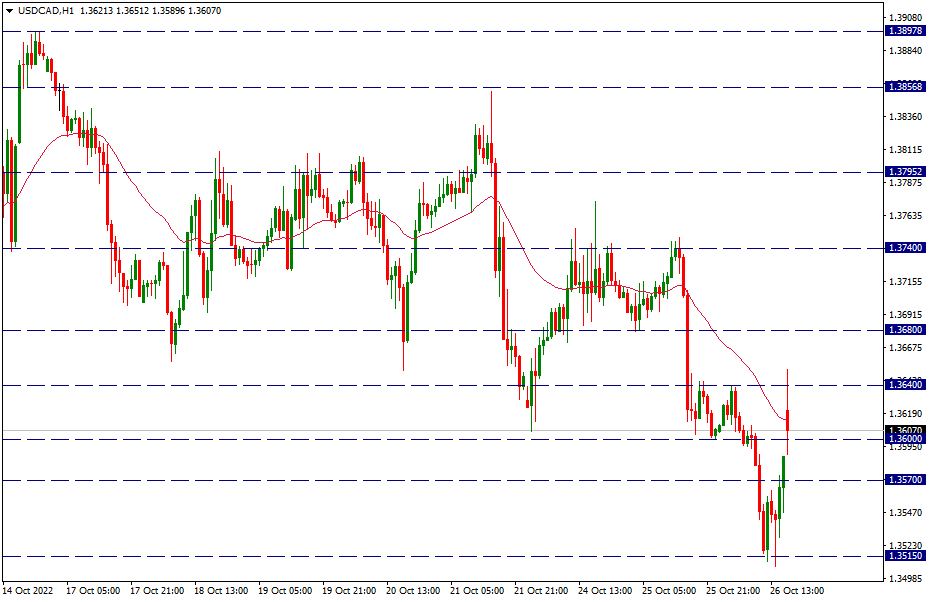

USD/CAD

USD/CAD – Canada Reacts to Sub-Expectation Rate Increase…

The Bank of Canada increased the policy rate by 50 basis points to 3.75% in the meeting decision announced as of 17:00 CET. The main expectation was for a 75 basis point rate hike. With this surprise low rise, the USDCAD side reacted against the Canadian Dollar and rallied as high as 1.3640.

Technically speaking, the decline at the beginning of the week brought the pair down to 1.3515. However, as can be seen from the chart, this is the support line of the last 1 month and it worked. In the continuation of possible reactions, it can be followed up to the 1.38 level. For now, we can talk about the possibility of a rebound in USDCAD as long as it stays above and above the 34-day average.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.