*After the Bank of Japan kept the interest rate constant at -0.10% last week. USDJPY parity, which accelerated its upward momentum, reached 149 levels today. Japanese Finance Minister Suzuki said that he is closely following foreign exchange movements with a great sense of urgency.

*Simkus from the European Central Bank said in his statement: “ECB policy is currently on track for 2% inflation in 2025. “We will not rush the timing of the interest rate cut.” He made his statements.

Müller from the European Central Bank: “In the current situation, I do not expect any further interest rate increases.” said.

*Construction permits in the USA were announced as 1,541 M, increasing by 6.8% compared to the previous month.

*International credit rating agency S&P Global revised its growth expectations upwards for the Turkish economy. While Turkey increased its 2023 GDP forecast to 3.5% with an increase of 1.2 points, it was shared that a growth level of 2.3% is expected with an increase of 0.3 points for 2024. Additionally, the report evaluated that domestic demand elasticity in Turkey will begin to decrease and the CBRT will continue tightening with orthodox policies.

*US 10-year bonds continued to rise in the bond market. It rose to 4.56% during the day, reaching its highest level in the last 14 years. This level was last seen in 2007. When we look at the 2-year period, it is trading at 5.13%. Likewise, the dollar index continues its rise around 106.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

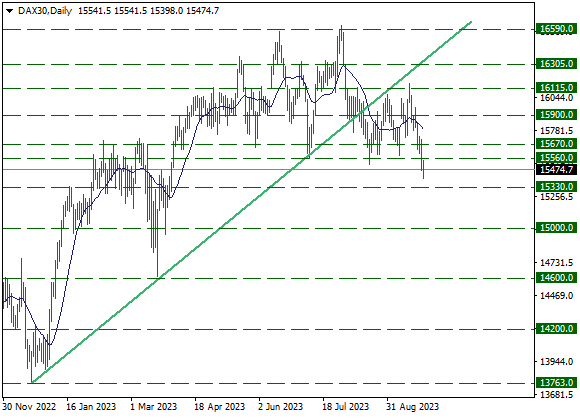

DAX30 – Downtrend Continues Where It Left Off…

The downward trend that has been effective in the index for a while continues to be effective today. After the daily opening at 15541, there was a retreat to 15398. Following the slight reactions received, instant pricing moves around 15474. In the continuation of the withdrawals, the 15330 level can be followed as support. In upward pricing, the 15560 level may constitute resistance.

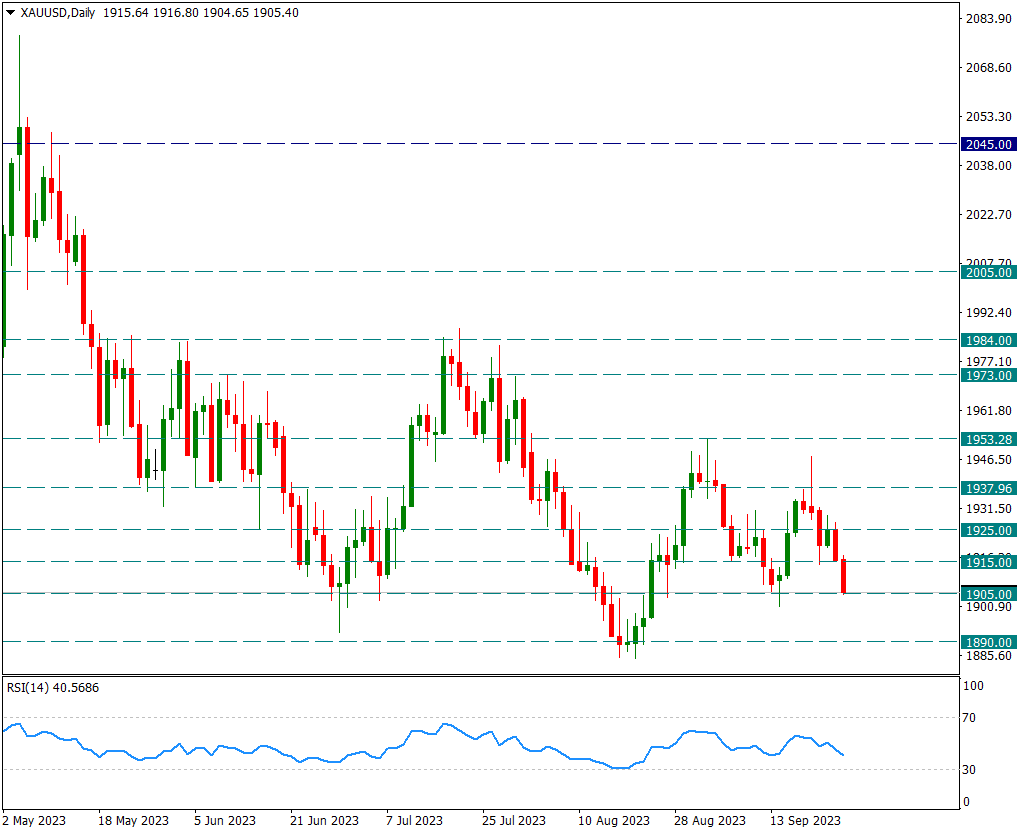

XAUUSD

Ounce Gold – While US 10-Year Strengthens, Yellow Metal Under Pressure…

The yellow metal, which has continued to retreat from the 1937 resistance since the FED meeting, continued its decline until the 1905 support today. This is the third test of the 1905 support since August 25. If this support is broken, a sag to the 1890 support can be expected. The 1890 support is the main support as it is the recent low area.

Situations such as the US 10-year bond interest rate rising above 4.5% and the strengthening of the dollar index cause the yellow metal to remain under pressure.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

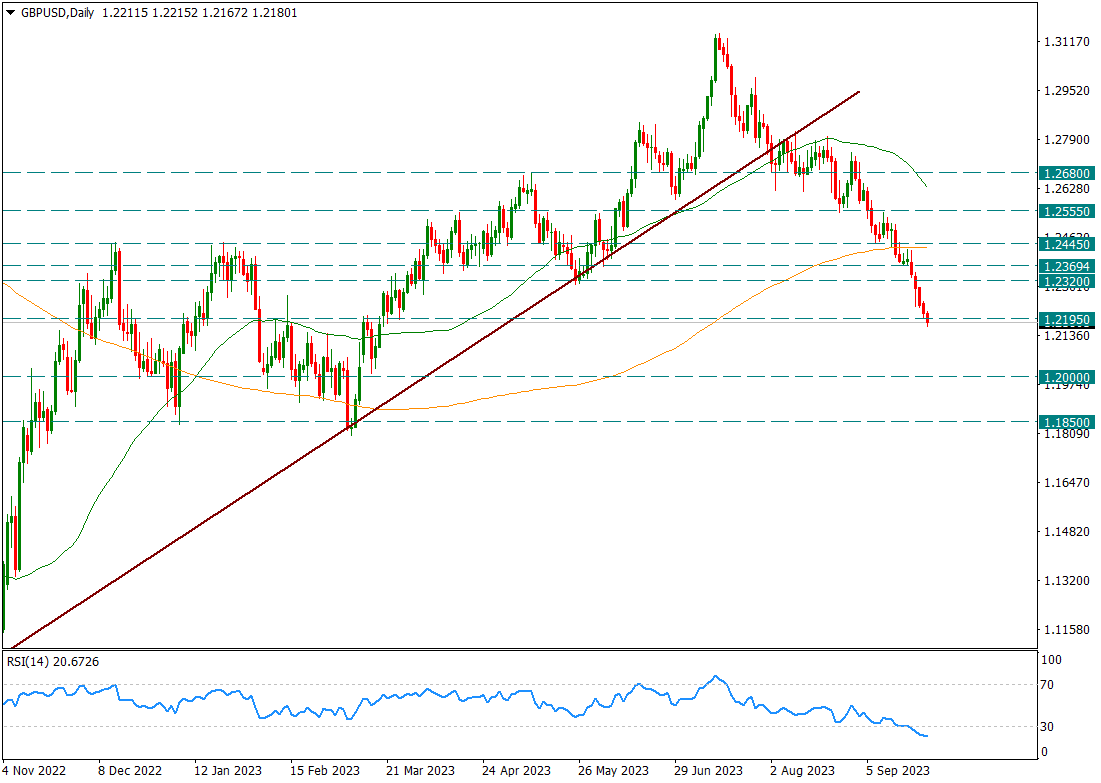

GBPUSD

GBPUSD – Red Candle Continues to Burn, But is in the Oversold Zone…

The sharp decline in sterling continues today. Shortly after staying below the 200-day average, the decline continued uninterruptedly and a red candle welcomes us on the fifth consecutive trading day.

It retreated to the 1.2195 support and is in the oversold zone. For this reason, if there are reactions to intraday movements, this will be extremely normal. However, if the gradual decline continues, 1.1850 support will come to the fore.

In case of strong reactions, the main resistance zone is at 1.2445.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.