*Germany GFK consumer confidence index decreased from -25.6 to -26.5. Expectations were at -26.0.

*Elderson from the European Central Bank said in his statements: “Current interest rates will make a significant contribution to reaching our inflation target in the medium term. However, this does not exactly mean that policy rates have peaked.” He made his statements.

*Holzmann from the European Central Bank said in his statement, “Some shocks may require us to increase interest rates further. Inflation must be kept under control.”

*FED’s Kashkari said in his statement, “The resilience of the US economy has been surprising. We are committed to 2 percent inflation. There is a risk that interest rates will be higher, but it’s hard to know. High oil prices alone do not require further interest rate hikes. We let data drive Fed decisions. “Economic data shows that the FED is not as restrictive as it seems.”

*Durable goods orders in the USA increased by 0.2% in August, against the expectation of a -0.5% decrease. Core durable goods orders increased by 0.4%, against the expectation of a 0.1% increase.

*While the dollar index rose to 106.60, US bonds fell slightly today. While 10-year bonds are traded at 4.51%, 2-year bonds are traded at 5.07%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

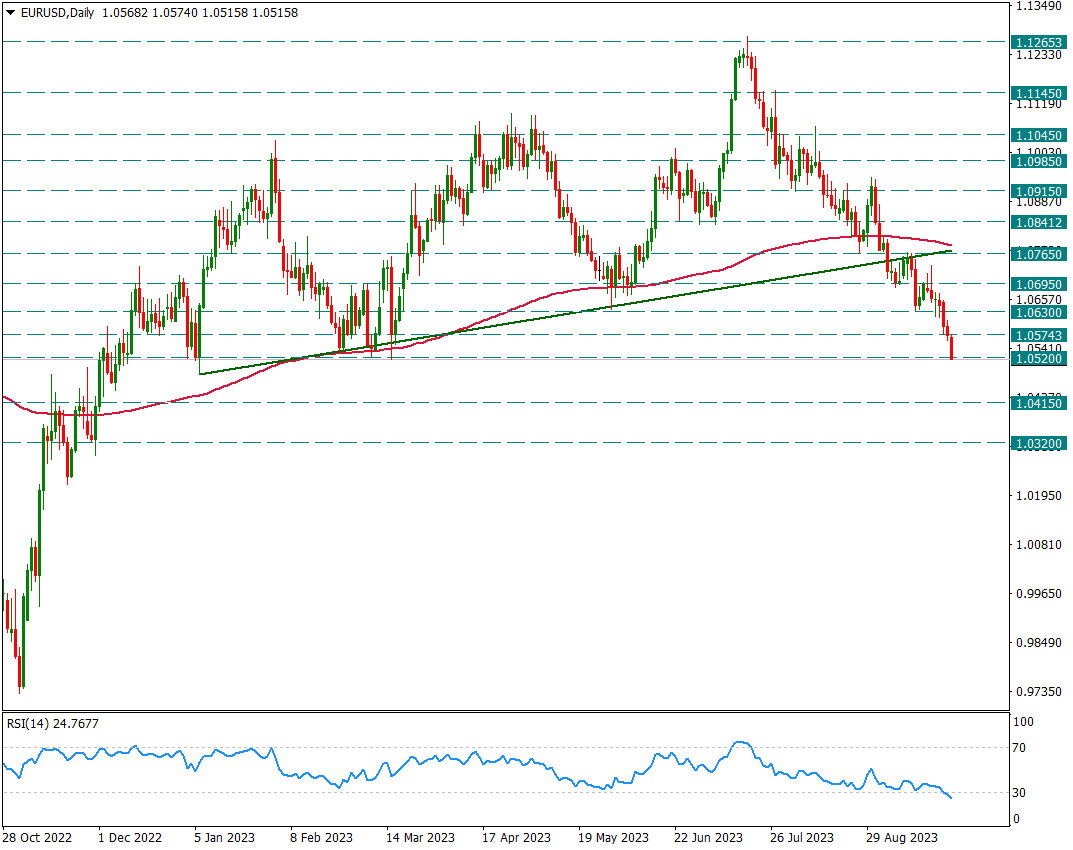

EURUSD – Declined to 1.0520 Support, Why Should You Pay Attention to This Area?

Intraday declines in parity continue from where they left off. The declines, which have been stuck at the 1.0575 support for two days, broke this region today and fell to 1.0520. Movements continue strongly in favor of the dollar.

The 1.0520 support is important because the gold of this region was last seen in December 2022. There may be a reaction from this line, but in general, as long as it cannot rise above the 1.0630 resistance in the short term, the reactions may create a selling opportunity again.

XAUUSD

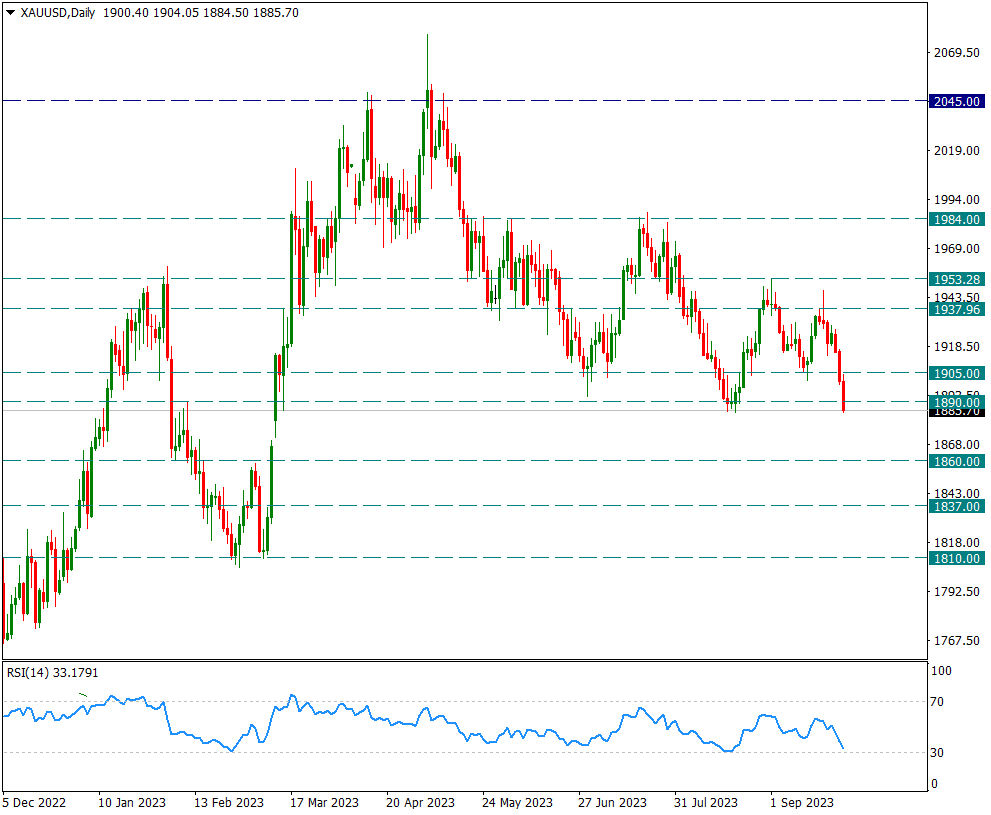

Ounce Gold – Preparing to Break 1890 Support with Daily Candle…

The strong downward trend in the yellow metal continues. It retreated from 1925 to 1884 levels in three days. The strong dollar index and rising US 10-year bond interest continue to put pressure on the yellow metal. Today, we will follow the daily candle closes below the 1890 support in the yellow metal. If this happens, the sales wave may continue to get stronger and the reactions may create a selling opportunity until it closes above 1890 again in the short term.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBPUSD

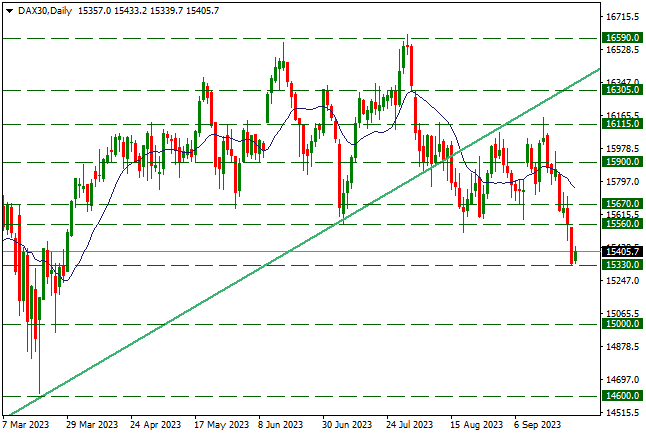

DAX30 – Support Reactions Received Today After the Withdrawals That Have Been Active for a while…

The index retreated to the 15330 support level the other day and closed at a level close to this region. The downward momentum, which has been effective for a while, was reversed today with the reactions received from the 15330 support. Instant prices are moving around 15400. If the rise continues, the 15560 level may constitute resistance. In downward pricing, 15330 and 15000 levels, respectively, may provide support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.