*In Russia, over the weekend, there was an attempted coup by the Wagner forces. Currently, there seems to be a somewhat inconclusive ceasefire in place. While there have been reports of an agreement between the Wagner forces and Putin, it may still be too early to determine a final ‘forgiveness’ situation. At the same time, due to Putin’s apparent full control, the possibility of a full-scale civil war seems less likely.

The markets for oil, natural gas, and wheat showed limited upward reactions to the developments over the weekend.

*In the minutes of the Bank of Japan’s monetary policy meeting, it was expressed that inflation may not fall below 2% until the middle of the fiscal year. However, it was also announced that they will continue the current monetary easing policy.

One of the main reasons cited by the BOJ for this policy is that the risks on inflation remain low in the long term. As a result, a member called for a review of the 0.50% cap on 10-year Japanese government bond yields.

Surprising decisions could be made at the Bank of Japan meeting on July 27-28.

*In Germany, the IFO Business Climate Index was announced at 88.5 in the morning hours, falling behind the previous month.

The German Central Bank stated in its announcement today that they expect inflation to slow down in the coming months.

*The international credit rating agency S&P Global has lowered China’s 2023 growth forecast from 5.5% to 5.2%. S&P noted that economic recovery in China continues, but at an uneven pace.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

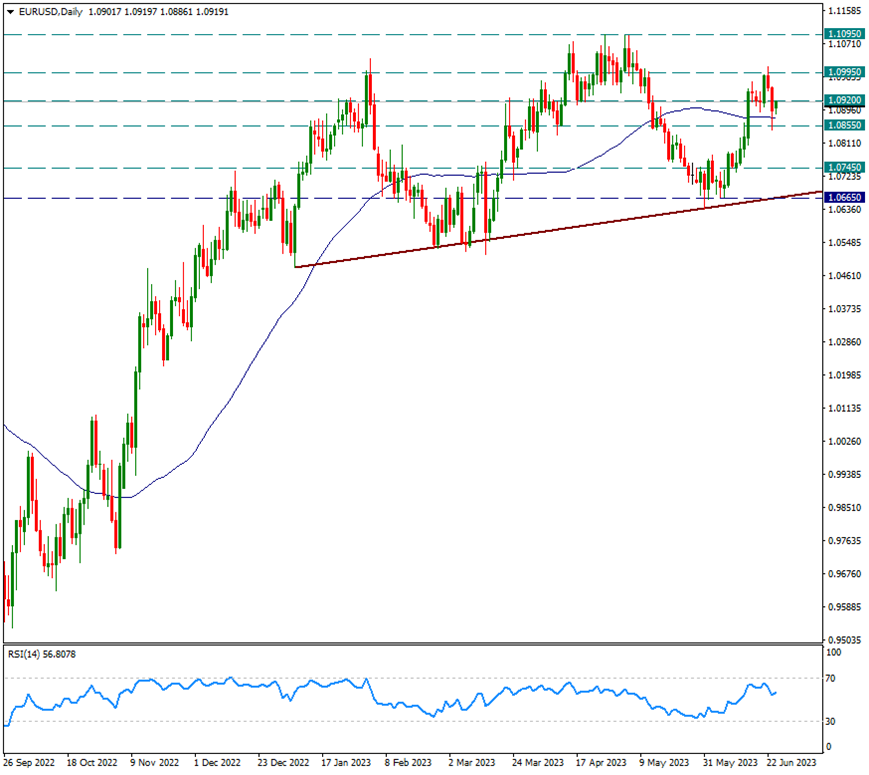

EURUSD

EUR/USD – Started the Week Calmly, Opening Near the 1.0920 Resistance Level...

Last week, the exchange rate dipped down to the support level of 1.0855 and showed some rebound shortly after. However, these rebounds today failed to surpass 1.0920. In intraday price movements, we will consider 1.0855 as the main support level, while 1.0995 will be monitored as the main resistance level.

During this week, German inflation data will be released first, followed by US GDP growth and the US core PCE price index data. These data releases have the potential to increase volatility in the exchange rate.

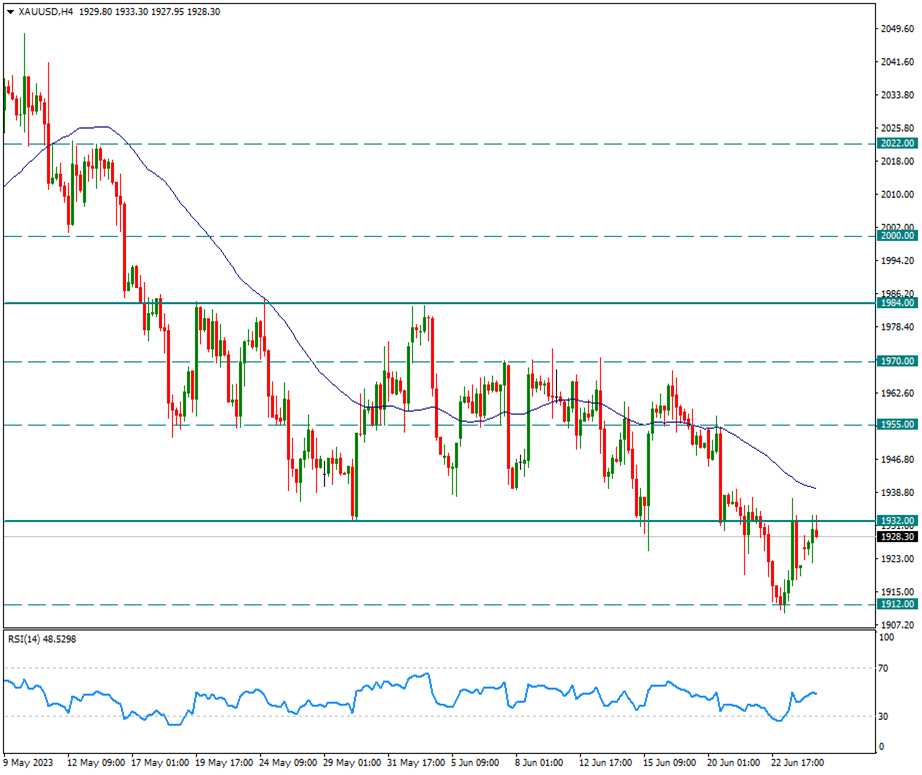

XAUUSD

Ounce Gold – We Follow the Attempts of Attack to 1932…

Last week, after breaking the short-term critical support at 1932, gold prices declined to 1912. Following a successful test of this support level, we observed a confirmation rally towards the previously broken level at 1932. However, if the price fails to move back above 1932, it is possible for the negative pressure to resume from where it left off.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

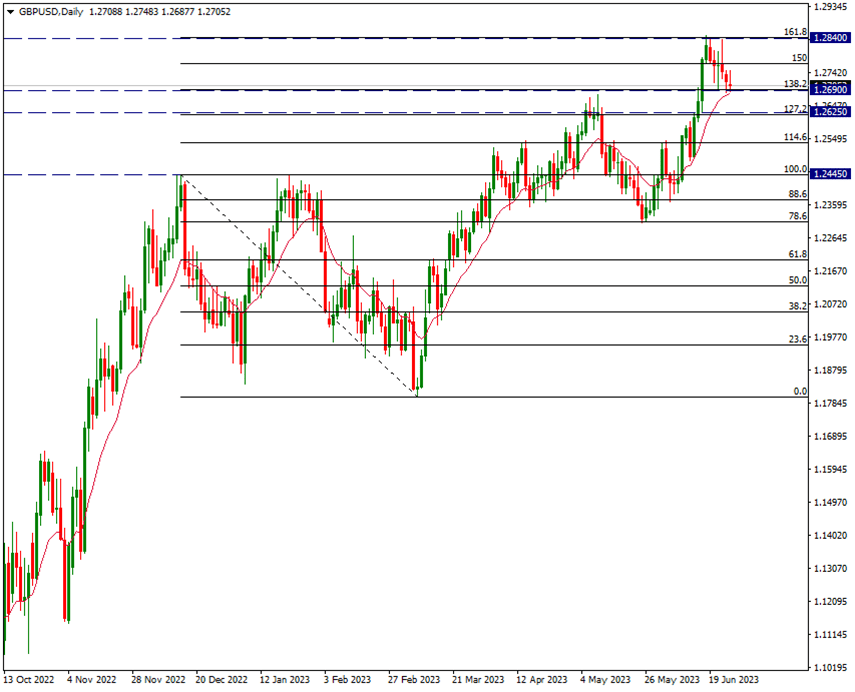

GBPUSD

GBPUSD – 13-Day Average Stops On The Drop From Last Week…

Last week, we witnessed pullbacks from the critical and significant resistance level we previously mentioned at 1.2840. These declines, both on Friday and the first trading day of the new week, are being held by the 13-day moving average. Breaking below this average could potentially deepen the declines in the currency pair.

In any potential rebounds, the main resistance level to watch is still at 1.2840.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.