*Federal Reserve Chairman Powell’s eagerly awaited speech at Jackson Hole began today as of 17:05. Regarding the messages conveyed:

– If appropriate, we are ready to further increase interest rates, we will proceed cautiously.

– We will decide on the next policy move based on data.

– The Fed is paying attention to signs that the economy is not cooling as expected.

– We need to see a decrease in non-housing service inflation.

– We need to be sufficiently confident that inflation will sustainably reach 2% before we consider lifting interest rates from their restrictive level.

– We are ready to increase interest rates further when it is appropriate.

– The two months of good data are just the beginning to build confidence in the inflation path.

– Signs that the labor market is not softening might require more action from the Fed. Bringing down inflation will also require a softer labor market.

-We see evidence that inflation has become more sensitive to the labor market.

*Additionally, we will also follow ECB President Lagarde’s speech at Jackson Hole at 22:00 CEST. Given the poor PMI data this week, Lagarde’s Jackson Hole speech could be important.

Furthermore, on Saturday at 19:35, Bank of Japan’s Ueda will speak. Important guidance regarding Japan’s monetary policy could be provided.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – The Risings Beginning With FED Chairman Powell’s Speech Are Not Permanent…

The downward momentum in the pair, which started at 1.1270, continues to be active on the last trading day of the week. Today the pullbacks continued until the 1.0770 support, which also coincides with the uptrend line.

After FED Chairman Powell’s speech at the Jackson Hole symposium at 17:05, there was an upward trend in the parity towards 1.0845 resistance. However, these rises were not permanent and the pullbacks showed their effect again.

While instant pricing continues around 1.0788, we will continue to observe 1.0770 support in downward pricing. In upward pricing, 1.0845 may create resistance again.

XAUUSD

Ounce Gold – Priced Horizontally Between 1910 / 1920…

After the rises towards the 1920.50 resistance in the yellow metal, this resistance continues to be priced horizontally, even though there are reactions from this resistance. The direction to exit the range where the 1910 and 1920.50 levels are about to end or continue the downward momentum that has been going on for a while may be a sign for the direction of future pricing.

In the speeches of the FED and ECB presidents at the Jackson Hole meeting today, statements about interest rates and the local and global economy may create volatility in the yellow metal. We will follow and see.

In the short term, 1920.50 level can be followed as resistance in upward pricing. In the pullbacks, the 1910 level can create support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBPUSD

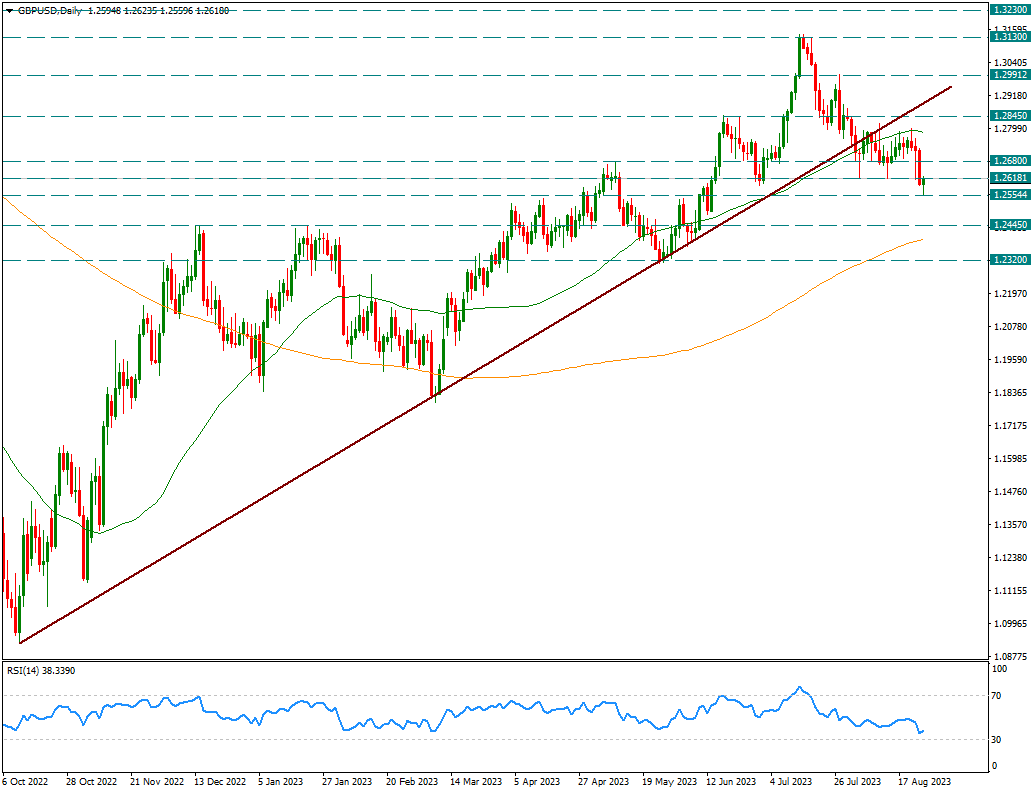

GBPUSD – We Follow Reaction From 1.2555…

The pair, which declined to the level of 1.2555 with the strong course of the dollar index, reacts slightly to Jackson Hole da Powell’s speech and tests 1.2620. However, if the uptrend fails to break above 1.2680, the reactions may be limited.

The reaction remains limited as the pair broke the medium-term uptrend line to the downside on August 2nd. That’s why we watch 1.2845 on a weekly basis for a possible change in direction.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.