*In the UK, the Consumer Price Index (CPI) for April, which was announced today, exceeded the expectations and increased by 1.2% monthly and 8.7% annually. Data were expected to increase by 0.8% and 8.2%, respectively. The previous data showed an increase of 0.8% monthly and 10.1% annually. Core CPI, on the other hand, rose 1.3% month-on-month, rising to 6.8% year-on-year from 6.2%. In his speech after the inflation rates, Bank of England (BOE) Governor Bailey said that inflation decreased from 2-digit figures, inflation expectations came down and they were watching the data for the future interest rate decision.

* In Germany, the IFO Business World Index for May, announced today, decreased from 93.6 to 91.7. In the evaluation made by IFO after the data, it was stated that there was a strong collapse in the expectations in the industry, there may be a serious decrease in new orders, the expectations for industrial exports fell significantly, the interest rate hikes reduced the demand and the economy was heading towards stagflation.

*Tonight at 21:00, the minutes of the meeting held on May 3 by the FED, which increased the interest rate by 25 basis points to 5.25%, will be announced. It was also stated at this meeting that the balance sheet would be reduced as planned, inflation was high, and the banking system was robust and resilient.

Agenda of the day;

17:30 US Crude Oil Stocks

20:45 Speech by ECB President Lagarde

21:00 US FOMC Meeting Minutes

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Tries to Gain Strength from 1.0765 Ahead of FOMC Minutes…

Having regressed to 1.0765 support yesterday, the pair tested this support twice in two weeks. There is a slight reaction from this support today but away from 1.0855 resistance.

It remains calm before the FOMC minutes, which will be released tonight at 9 PM. In these minutes, if there is a note from the general members regarding the upcoming meetings that the rate hike may be continued and/or it is emphasized that the concerns about inflation are still very strong, the movements in favor of the dollar may continue from where they left off. For this reason, we care about the minutes at 21.00.

USDJPY

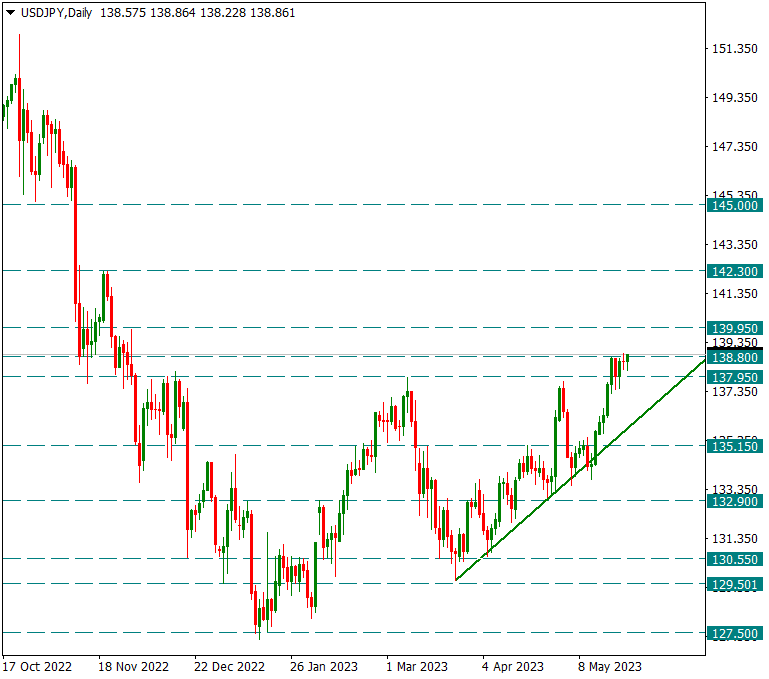

USDJPY – Uptrend Continues, 138.80 Resistance Struggling…

The USDJPY pair is in an uptrend again from where it left off today after breaking 137.95 and confirming strong momentum in favor of the dollar. With today’s move, 138.80 resistance is being tested. If this region is exceeded, 142.30 resistance may come to the fore step by step.

While the movement continues in favor of the dollar in general, this situation can be broken if the 137.95 support is broken with the daily candle. For this reason, we attach importance to support and resistance follow-ups.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAUUSD

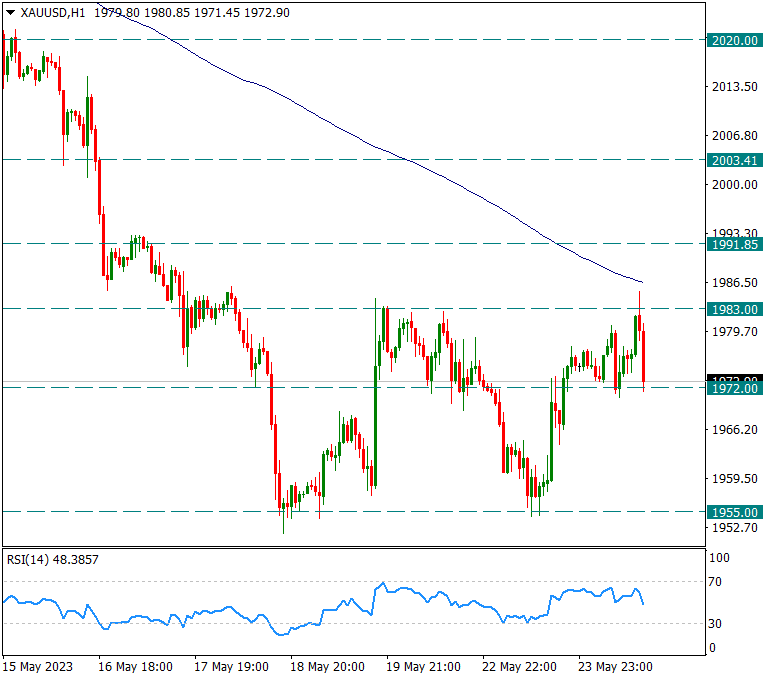

Ounce Gold – Recently Between 1983/1955 Horizontal Band…

Yellow metal tested the 1955 support twice in a short time and got a reaction from there. With this reaction, the yellow metal, which came to the 1983 resistance, fell back to the 1972 intermediate support during the day. In intraday pricing, 1983 will be followed as the main resistance and 1955 as the main support. While price movements are followed within this band, the FOMC minutes at 21.00 tonight may bring volatility in the yellow metal.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.