*Today was PMI day in global markets and PMI data in Europe came well below expectations. When we take a look at these data that energized the market in the morning, we saw that the manufacturing sector, which had already contracted in Germany and the Euro Zone, experienced a slight movement, but still remained in the contraction zone. The service sector, on the other hand, regressed well above expectations and moved from the expansion zone to the contraction zone.

After the PMI data in Europe, the Euro side depreciated and the ECB’s 25 basis point rate hike probability scenario at the September meeting started to weaken. However, we do not know how the effects of the ECB’s pause here while fighting inflation will be. We will be able to get the earliest view on this in the near future with ECB President Lagarde’s speech at the Jackson Hole symposium on Friday evening.

*As we approach the evening hours, we also see a decrease in PMI data from the USA. The manufacturing sector is still in the contraction zone. Although the service sector declined from 52.3 to 51, it remained on the expansion side.

*When we look at the intraday pricing, Germany’s 10-year bond yield decreased from 2.64% to 2.52% due to the data at noon, while the intraday recovery ended with the PMI data from the USA and fell again to 2.52%.

The US 10-year bond yield, on the other hand, had gradually regressed since the night, but it quickly dropped from 4.29% to 4.21% with the PMI data at 16.45.

While the US stock markets remained calm and generally positive, the EURUSD parity regained some of its intraday losses. On the other hand, the Ounce Gold side reacted to the 1919 region from 1901 after the rapid decline in the US 10-year bond interest.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Pullbacks Are Not Permanent…

After the negative PMI data from the Euro Zone and Germany today, there was movement in favor of the dollar in the parity. Then, at 16:45, with the negative announcement of the PMI data from the USA, the pricing in favor of the dollar was given back and it was again above the 1.0845 level.

In the continuation of the upward pricing, the 1.0940 level can be followed as a resistance. In the pullbacks, the 1.0845 level can create support.

XAUUSD

Ounce Gold – Rising Rapidly After US PMI Data…

The rising reactions in the yellow metal that started the other day continued by putting it on today. It continued to rise with the support received from the 1896 level. While it is expected to remain stable in the PMI data from the USA at 16:45, the rise in the yellow metal gained momentum after the falling PMI data. Instant pricing has broken the 1910 resistance and continues to be priced towards the 1920.50 resistance. Technically, we will be waiting for the daily close on whether the rises are permanent or not.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAGUSD

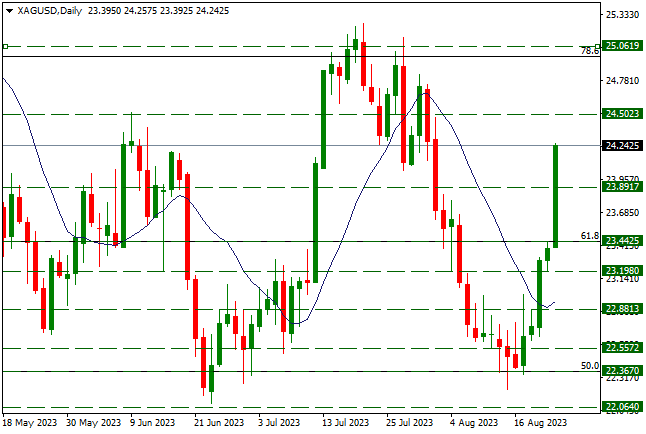

Silver – Uptrend Gained After Falling PMI Data…

The upward momentum, which started in the middle of last week, continued today by intensifying. After the PMI data from the Euro Zone and Germany, and then from the USA, the rises in silver continued until the level of 24.25.

In the continuation of the rise, the 24.50 level can be followed as resistance. In possible pullbacks, 23.89 level can create support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.