- On the fourth trading day of the week, there is almost a Central Banks parade. While the effects of the Fed meeting last night continued, decisions from other major Central Banks increased volatility.

- Global markets started early in the morning with the interest rate decision of the Bank of Japan (BOJ). The bank did not make any changes in the expected interest rates. After the BoJ decision, the USDJPY parity rose to the highest levels of the last 24 years with 145.90. However, this rise came to an end with the Japanese government’s intervention in the lots. Masato Kanda, the head of the foreign exchange markets, announced in the morning that the foreign exchange market was intervened due to the sudden and one-sided movements. After the intervention, the USDJPY pair fell by as much as 140.68, dropping by up to 3%. The pullback in the USDJPY parity also weighed on the US Dollar index and made other currencies breathe against the US Dollar.

- Another Central Bank decision we followed in the morning belonged to the Swiss National Bank. As expected, the Swiss National Bank increased interest rates by 75 basis points at its September meeting, and increased the policy rate to the positive zone after 8 years. While the bank revised its inflation expectations upwards, it gave the message that it is ready for further increases to rein in inflation. The USDCHF parity, which is in an upward trend after the Fed, rose to the 0.9850 band after the Swiss central bank’s decision.

- As expected, the Bank of England meeting, which was supposed to be held last week but was postponed to today due to the death of the Queen of England, increased interest rates by 50 basis points. The bank increased the policy rate from 1.75% to 2.25%. While the entire Board voted to increase interest rates, 4 members opposed the increase by 50 basis points. Members Haskel, Mann and Ramsden voted to raise rates by 75 basis points, and Dhingra by 25 basis points. The bank also agreed to start reducing the amount of government bonds in its portfolio after the meeting, as announced in August. The bond position will be reduced by GBP 80 million per month over the next 12 months. GBPUSD parity, which went up to the 1.1363 band before the decision, gave back some of its gains with the announcement of the decision.

- Domestically, the eyes were on the decision of the Central Bank of the Republic of Turkey. Contrary to the expectations, the CBRT continued its policy of interest rate cuts in the last meeting as well, and surprisingly lowered the policy rate, the One-Week Repo rate, from 13% to 12%. After the decision, the USDTRY parity broke a new historical record with 18.39.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

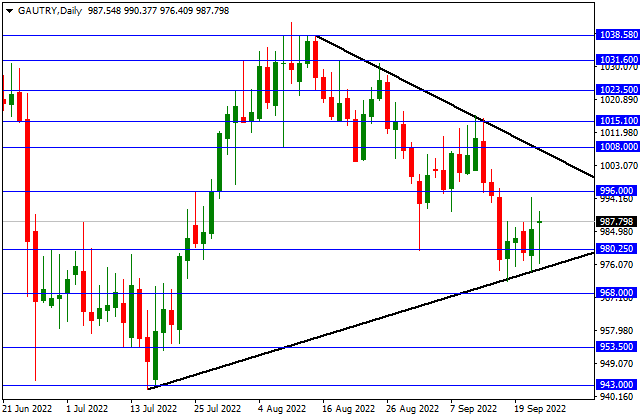

GAU/TRY

GAU/TRY – Interest Rate Rises After Decision…

After the meeting held today, the CBRT lowered the Policy Rate by 100 basis points from 13.00% to 12.00%. After the interest rate cut, there was an increase in Gr Gold TL. In the continuation of the rise, 996 and the upper band of the symmetrical triangle formation can be viewed as resistance. In retracements, 980.25 and the lower band of the formation can form support.

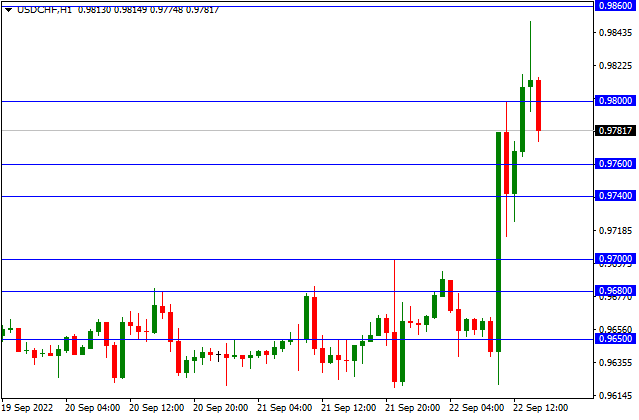

USD/CHF

USD/CHF – Rising After Interest Rate Increase…

The Swiss National Bank (SNB) raised the interest rate by 75 basis points to 0.50% at its meeting today. Last night, the Fed increased the interest rate by 75 basis points. After the interest rate decision, there was an increase in the USDCHF parity to the level of 0.9850. It is also pulling back with sales from this level. In the continuation of the pullback, 0.9760 and 0.9740 can be viewed as support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

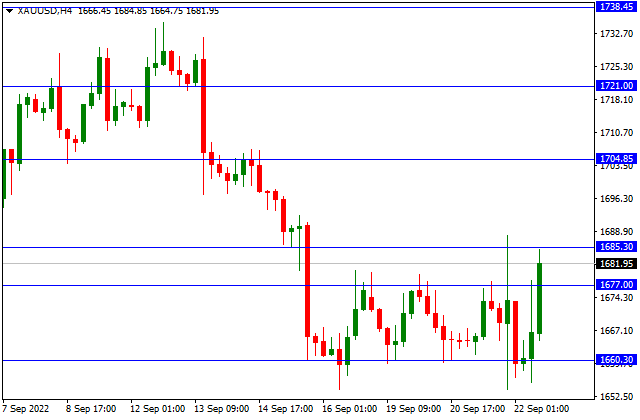

XAU/USD

XAU/USD – Rising Up To 1685.30 Resistance…

1660.30 support in Ounce Gold was tested many times but could not be broken. With the support received from this level, there were increases until the resistance of 1685.30. The upward momentum may increase in the pricing above 1685.30 level. In this case, 1704.85 and 1721 can be viewed as resistance. In retreats, 1677 and 1660.30 can form support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

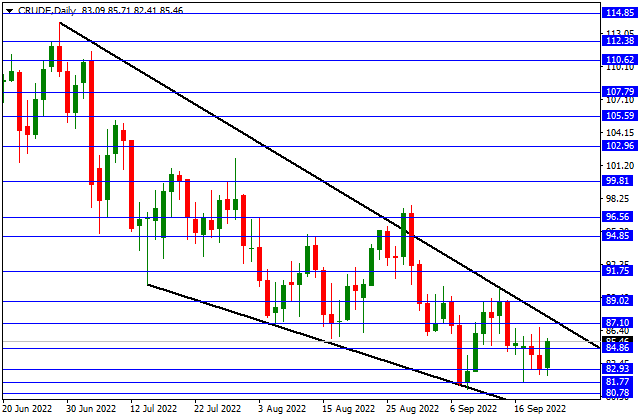

CRUDE

CRUDE – Rising With Support From 82.93 Level…

82.93 support in Crude Oil was also tested today and could not be broken. Increases are also seen with the support received from this level. In the continuation of the rise, the upper band of the falling price channel that we watch in the daily period can be followed as an important resistance. In case of an upside break from the formation, the uptrends can gain momentum. In pullbacks, 84.86 and 82.93 can create support.

Contact Us

Please, fill the form to get an assistance.