*August inflation in the UK increased by 0.3%, while it increased by 6.7% on an annual basis. Core inflation increased by 0.1% monthly and 6.2% annually. The data generally showed an increase below expectations. However, inflation still continues its strong course. Following the announced data, there were downward reactions in the GBPUSD parity.

*In Germany, August producer inflation increased by 0.3% against the expectation of a 0.2% increase, while annual data decreased by -12.6% as expected.

*ECB’s De Cos said in his statement: “Inflation risks are now balanced. Keeping rates at 4% is consistent with the 2% price target. There is uncertainty about the economy and inflation remains high. “We cannot afford constantly high inflation.” He made his statements.

*In the statements made by Goldman Sachs, it was claimed that interest rates in England have reached their peak and that the Bank of England will probably keep interest rates constant tomorrow.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Reactions are Receiving from 1.0670 Support Towards the FED Decision…

As we get closer to the interest rate decision that the FED will announce at 21:00, reactions continue to be received from the 1.0670 support in the parity. Although the expectations regarding the FED interest rate decision are to keep the policy rate constant, we will wait and see the decision to be announced. Let us remind you again that there may be movement in the parity with the announcement of the decision.

In the continuation of upward movements, the 1.0770 region can be followed as resistance. In downward pricing, 1.0670 and 1.0605 levels can be followed as support, respectively.

XAUUSD

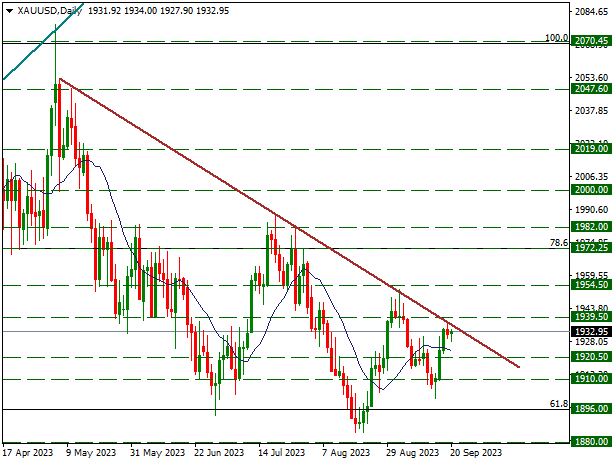

Ounce Gold – FED’s Interest Rate Decision May Cause Volatility in the Yellow Metal!

The upward movements in the yellow metal received slight downward reactions the other day due to the resistance reactions it received from the 1939.50 region, which coincides with the downtrend line. The withdrawals continued partially today. Current quotes are trading around 1932. With the interest rate decision to be announced by the FED at 21:00, there may be activity in the yellow metal.

We will continue to monitor the 1939.50 resistance in upward pricing. In case of withdrawals, the 1920.50 level may provide support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

BRENT

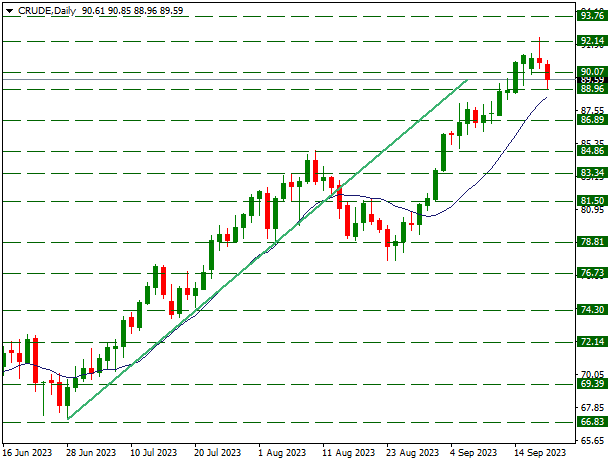

Crude Oil – Withdrawals Continued Until 88.96 Support…

The strong upward momentum in crude oil, which has been continuing for a long time, had its effect on downward pricing due to the reactions received from the resistance in the 92.14 region. These withdrawals continued today. The declines could not hold at the 90.07 support and retreated to the 88.96 support. With the slight buyer reactions that followed, it continues to be priced around 89.59. Although the withdrawals have been effective for 2 days, pricing continues to remain above the 14-day average.

If the 88.96 support does not remain valid during the continuation of the retreats, the declines towards the 86.89 region may accelerate and this level may form support. In upward pricing, the 92.14 level may continue to constitute strong resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.