*The Central Bank of England made an unexpected move and decided to keep the interest rate constant at 5.25%. In the statements made regarding the decision, it was stated that the decision was made to keep inflation rates constant due to their recent decline, and that the tightening may continue depending on the situation of inflation pressures. Following the decision, GBPUSD parity dropped to 1.2234. This level was last seen 6 months ago.

*Makhlouf from the European Central Bank said in his statement: “An interest rate increase is possible in the next meeting, but if inflation remains the same, an increase may not be necessary. Interest rates may remain where they are for a long time. “There is very little chance of a rate cut before March.” He used his expressions.

*Kazakhs from the European Central Bank said in a statement: “The inflation rate is still very high. It is not yet clear whether we have reached peak interest rates. We are very pleased with the current level of rates. The increase in energy prices creates an upward risk on inflation. “The latest increase in energy prices is structural, not a short-term temporary increase.” He made his statements.

*The Swiss National Bank decided to keep interest rates constant at 1.75%. Expectations were for a 25 basis point increase. After the decision, intraday increases in USDCHF parity continued up to 0.9078 level.

*In the USA, applications for unemployment benefits were 201,000, below the expectation of 225,000.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Priced Around 1.0647…

The upward reactions in the parity last day were not permanent and the closing occurred with a red candle. Today, the withdrawals were effective up to 1.0616 level. However, with the subsequent reactions, it continues to be priced around 1.0647. Unless prices rise outside the downward channel, technically downward prices can be expected to continue.

In case of withdrawals, 1.0650 may form support. In upward pricing, 1.0670 and then the upper band of the downward channel may constitute resistance.

XAUUSD

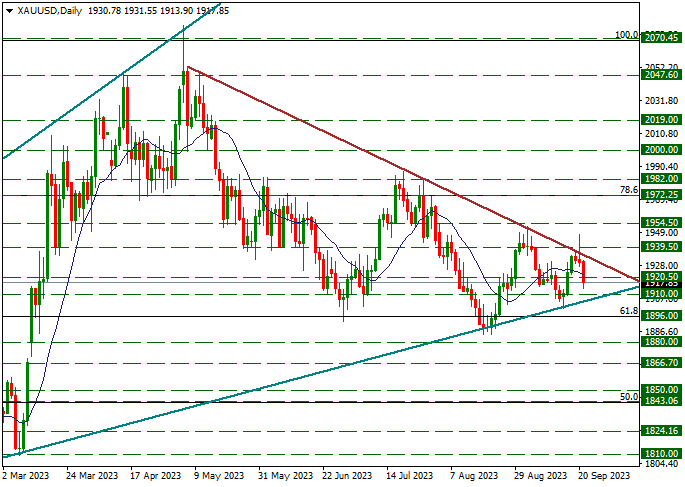

Ounce Gold – Triangle Formation Nears Its End With Fluctuating Prices…

There were upward attempts in the yellow metal towards the 1950 region due to the FED’s interest rate decision the other day. However, the increases were not permanent. Retreats were effective in the yellow metal today. Prices fell below the 1920.50 support. The yellow metal, which has been fluctuating in price for a while, is nearing its end in a triangle formation. The permanent direction that will take place from this area will be important for the progress of the yellow metal from a technical perspective.

In short-term movements, the level above 1920.50 may constitute resistance. On the downside, the 1910 level may form support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBPUSD

GBPUSD – Dropped Sharply After BOE Unexpectedly Left Interest Rates Constant…

The Bank of England made a decision contrary to expectations and kept the interest rate constant at 5.25%. In the statements made regarding the decision, it was stated that inflation had been decreasing recently and accordingly, the decision was taken to keep it constant. Additionally, it was stated that tightening may continue depending on the progress of the inflation outlook.

Sterling fell strongly following the Bank of England’s interest rate decision. The retreats, hanging below the lower band of the downward channel, continued up to the level of 1.2234, which was last seen 6 months ago. Then, it continues to price around 1.2260 with slight reactions.

If downward pricing continues in the parity, the 1.2200 level may constitute support. In upward pricing, the 1.2305 level may show resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.