*Villeroy from the European Central Bank said in his statement: “When inflation returns to 2%, the ECB interest rate may decrease again.”

*Euro Zone current account gave a surplus of 20.9 billion euros in July, compared to the expectation of a surplus of 30.2 billion euros.

*In the Eurozone, consumer inflation in August increased by 0.5%, 0.1 points below expectations, and increased by 5.2% on an annual basis. Core inflation increased by 0.3% on a monthly basis, as expected, and increased by 5.3% on an annual basis. Inflation remains stubborn. The ECB, which increased by 25 basis points last week, may repeat this decision at the next meeting.

*Inflation in Canada increased above expectations. While it increased by 0.4% in August, it increased by 4.0% on an annual basis. Core inflation increased by 0.1% on a monthly basis and 3.3% on an annual basis. Following the announced data, downward pricing in USDCAD parity gained momentum. With the withdrawals, the level of 1.3375 was seen after a 40-day break.

*In the USA, construction permits for August were announced as 1,543M. Expectations were for 1,440M to be announced.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

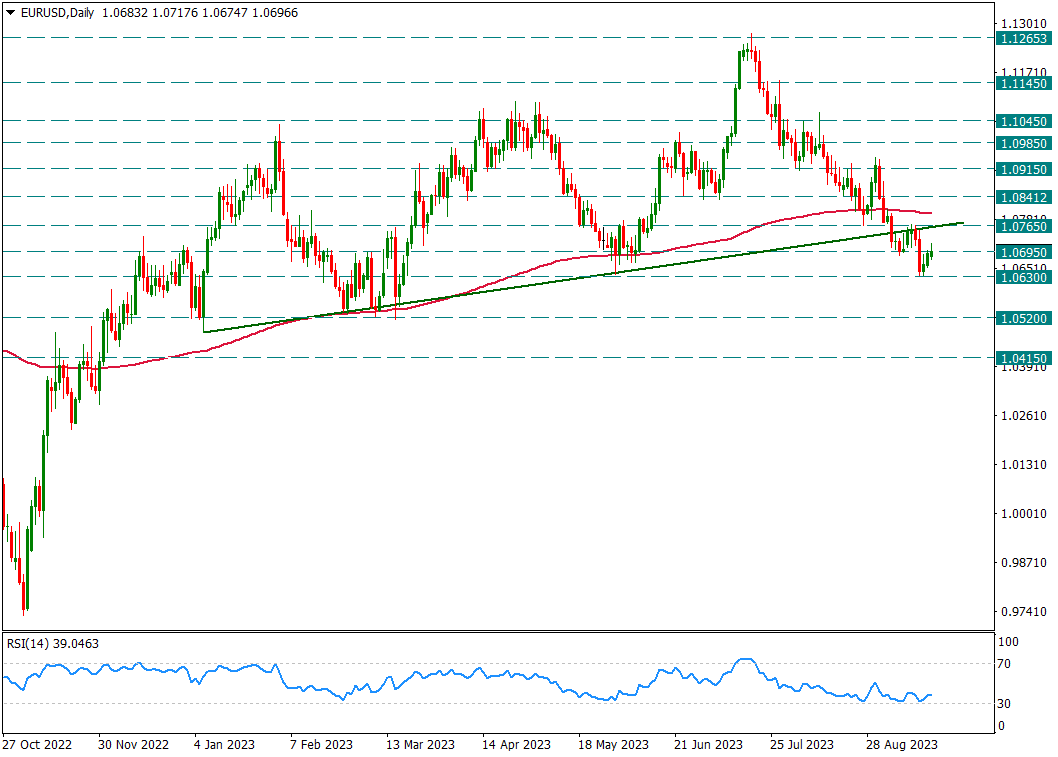

EURUSD

EURUSD – Reactions Continue to Remain Limited…

Inflation announced today in the Eurozone increased on a monthly basis and decreased slightly on an annual basis due to the base effect. We see pricing in favor of the Euro during the day. It is perfectly normal that there will be no clear action until the FED meeting and the attacks will remain limited.

These reactions continue up to 1.0695 resistance for now. There is currently pricing below the 200-day average and 1.0765 resistance.

As long as it remains below this zone, movements in favor of the dollar may continue where it left off.

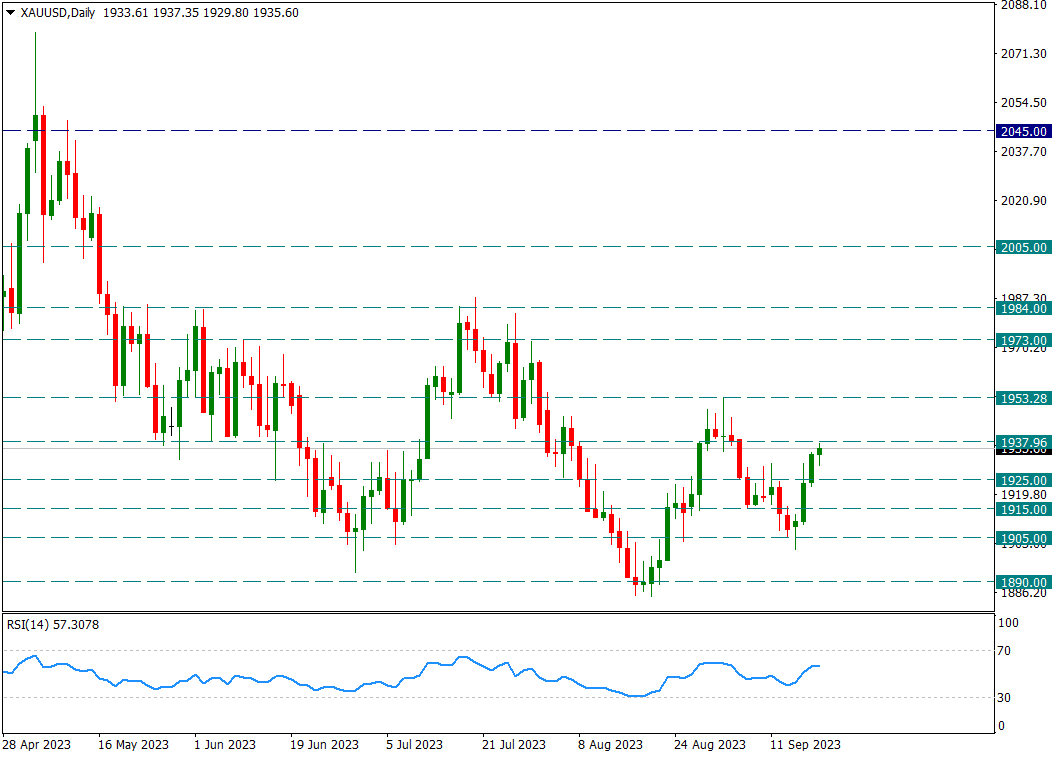

XAUUSD

Ounce Gold – The Rise Triggered Since 1905 Continues…

The yellow metal continues to rise with the support it has received from 1905 since last Thursday. With this rise, it rose to the 1937 resistance level. While the US 10-year bond interest rate is rising step by step to 4.35%, the fact that the yellow metal is also rising creates a bit of a contrast, but it is normal to see such movements until the FED meeting.

If we look at the yellow metal’s own technique, it is useful to monitor the resistances gradually. 1984 will be on the agenda after 1953.

Interim supports are important in possible profit sales, but 1905 is the main support for the day.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

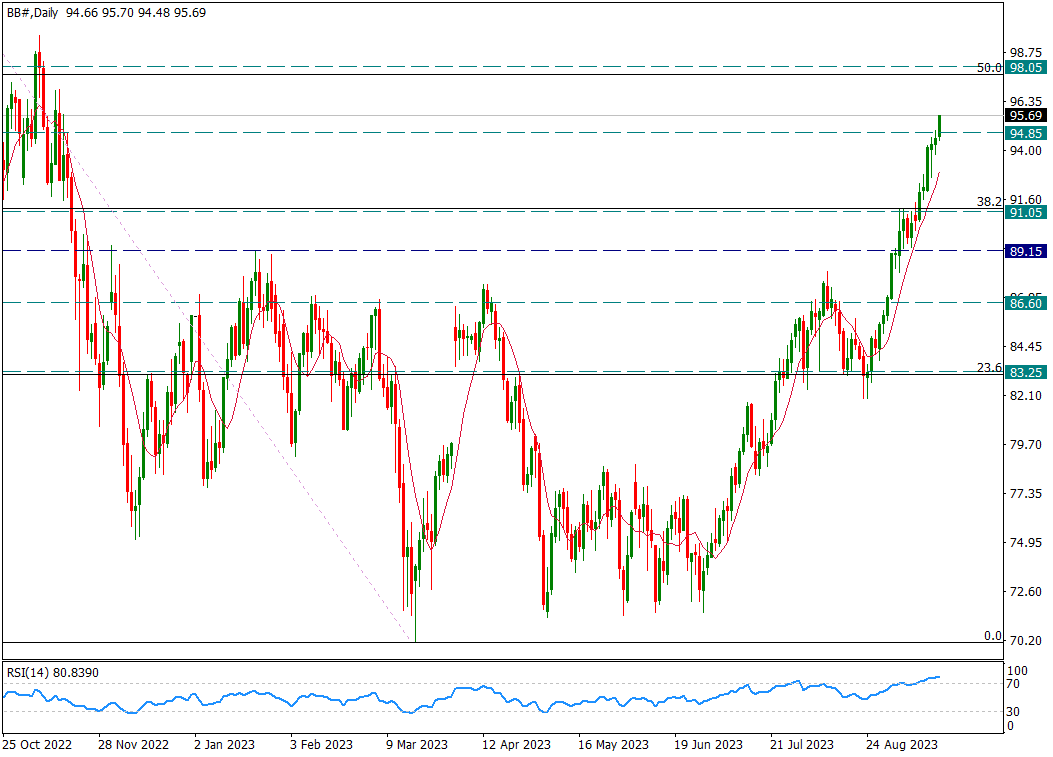

BRENT

Brent – The Rally Continues We Continue to Watch with the 8-Day Average…

On the Brent oil side, the rally continues unabated and we follow this rise with the 8-day average. Although it has reached the overbought zone, this rise continues rapidly and we think it is useful to follow the trend here. Having occasional profit sales can be considered normal when you are in an overbought zone. However, we can expect the trend to continue as long as the 8-day average is not broken by the daily candle closes.

Here we see that the correction of the 125.20/70.12 decline has been realized. The Fibonacci 50 correction is approaching step by step. The 98.05 area may be the first important resistance area if the rise continues.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.