*In Germany, the Producer Price Index (PPI) for May decreased by 1.4% on a monthly basis, which was below the expectations, and fell to 1.0% from 4.1% year-on-year. Data was expected to be 0.7% monthly, 1.7% annually.

*European Central Bank (ECB) Member Stournaras will start, will determine the next move of the ECB, the high ground said another move next month, and possibly one of this too, will flow, and the end of the interest strings will flow. Other ECB members said that the Rehn enrichment only loosened the facts, while Vujcic said that the pressure to distribute focus continues.

*Building Permits for the month of May, which we tracked in the USA, showed a monthly show of 5.2%, reaching 1.491 million units from 1.147 million units on an annual basis. Housing Starts, on the other hand, increased by 21.7% month-on-month to 1.631 million units annually.

Agenda of the day;

18:45 (GMT +3) Speech by FOMC Member Williams

20:10 (GMT +3) Speech by ECB Member de Guindos

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

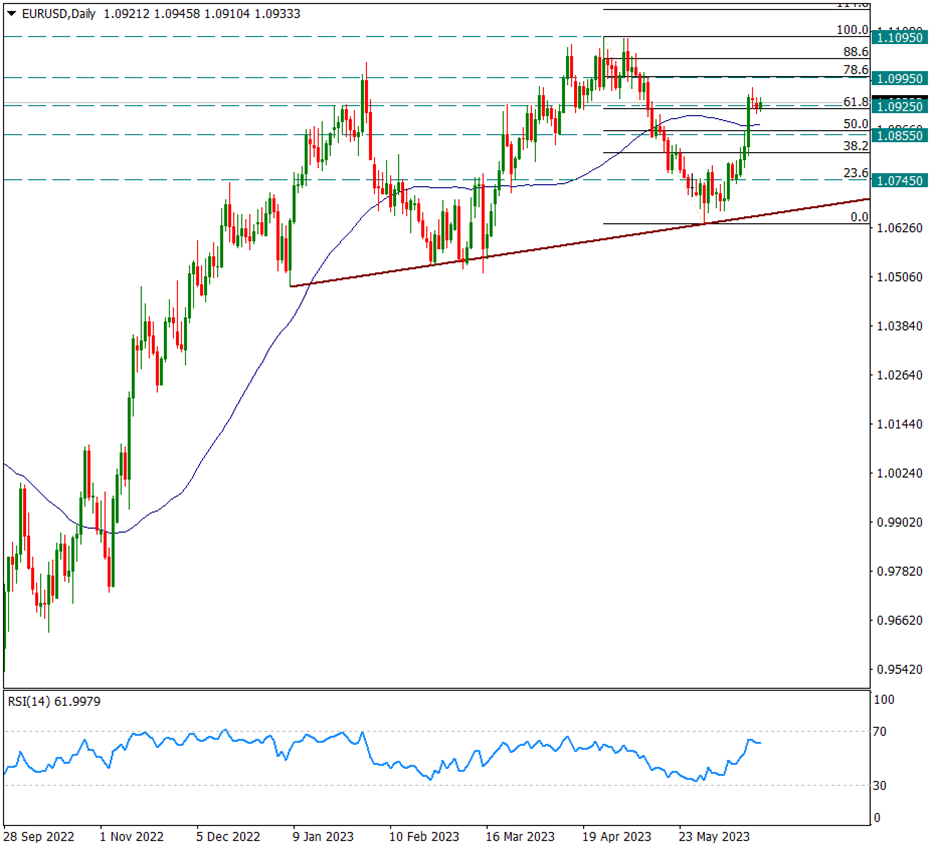

EURUSD

EURUSD – 1.0925 Important Support and Holds Here…

After the attack last week, the pair continues to hold on to the 1.0925 support. This was important as the 1.1095/1.0635 drop coincided with the Fibonacci 61.8 retracement. This support continues to keep prices technically. As long as the hold on this line continues, possible decreases can be seen as profit sales and we can watch the continuation of the movement in favor of the Euro.

As long as we stay above 1.0925 we will continue to watch the above 1.1095 resistance on a weekly basis.

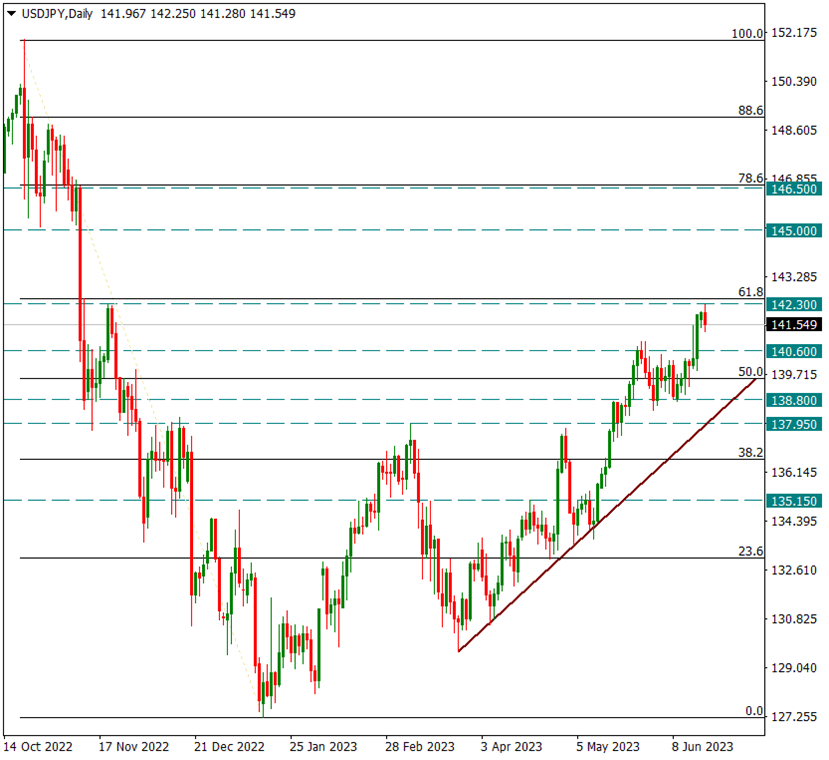

USDJPY

USDJPY – What is the Reason for Profit Selling at 142.30 Resistance?

The USDJPY pair paused the rise at the 142.30 resistance today, and there was a profit selling towards 141.50. We have already mentioned the importance of the 142.30 resistance. This resistance is a key zone as the 151.93/127.20 drop coincides with the Fibonacci 61.8 retracement. It is technically normal for the attacks to stop at this level and withdraw with profit sales. Our weekly support will be seen at 140.60 and our main resistance at 142.30.

If it goes above 142.30, we can follow the attacks towards 146.50. Besides, above 140.60 Yen can find strength again.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

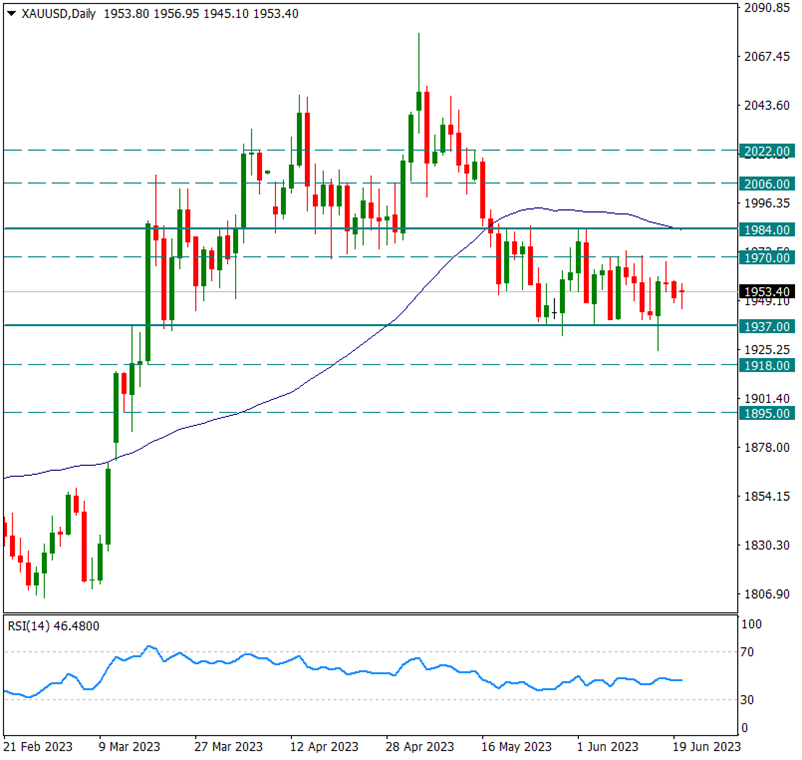

XAUUSD

Ounce Gold – We Continue to Watch Within the 1970/1937 Narrow Band…

While yellow metal continued in the 1984-1937 major range, this band was recently confined to the 1970/1937 range. We will remain neutral within this narrow range. While watching this band gap during the day, if the band is broken, a new trend can be formed in the yellow metal.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.