- European Central Bank President Christine Lagarde, in her speech at the conference she attended, said, “We expect interest rates to increase further. Withdrawal of monetary supports may not be enough. Interest rates are and will continue to be the main tool for adjusting our policy stance. However, we need to normalize our other policy tools as well. necessary,” he said. Lagarde’s statements had a limited impact on the EURUSD pair. The reaffirmation of Fed officials’ determination to raise US interest rates more than the markets currently anticipate was another factor that hindered the pair’s gains.

- The Central Bank of the Republic of Turkey published the market participants survey for November. Accordingly, a limited increase was observed in inflation expectations. According to the survey, market participants’ inflation expectation for the next 12 months was 37.47 percent. In the previous survey, this expectation was determined as 37.34%. In the November survey, the year-end inflation expectation increased from 67.78 percent to 68.06 percent.

Retail sales in the UK rose 0.6% in October compared to the previous forecast of -1.5%. Core retail sales, excluding automobile motor fuel sales, increased by 0.3% compared to the previous month. On an annual basis, retail sales fell 6.1% in October compared to expectations of -6.8%.

When we look at the data announced on the US front, construction permits increased by 1.526M in October, above the 1.512m expectation. When we look at the applications to benefit from unemployment rights, an increase of 222 thousand was recorded, contrary to the expectation of an increase of 225 thousand. The Philadelphia Fed Manufacturing Index, on the other hand, dropped sharply from -8.7 to -19.4 in November.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

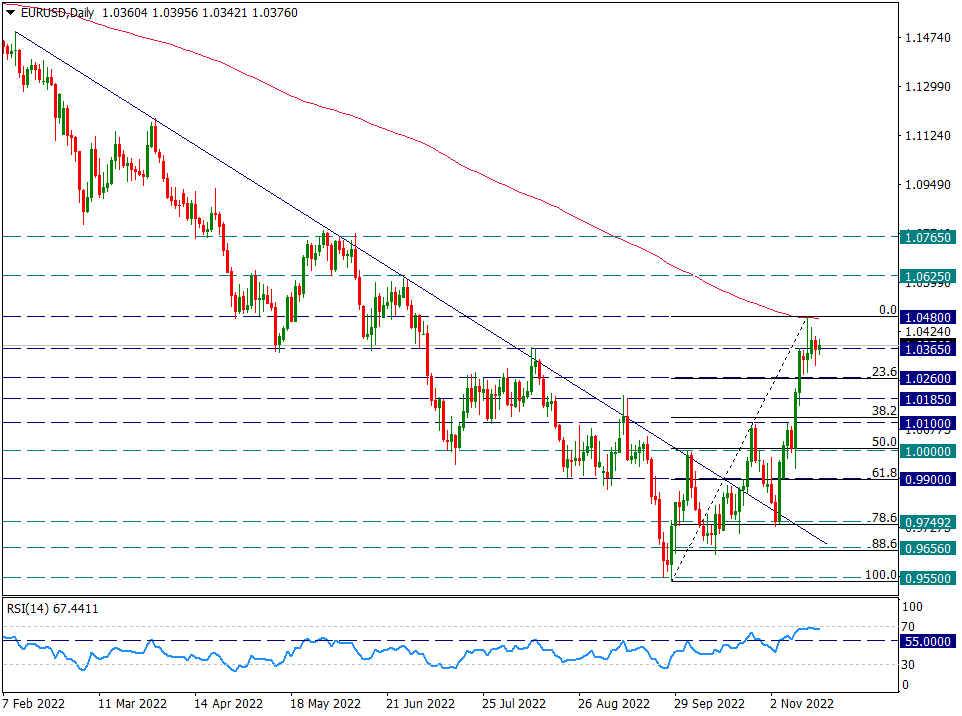

EUR/USD

EUR/USD – Still Horizontally Moving Below 1.0480…

We will follow the 1.0260 level as the main support during the day for the EURUSD parity, which stopped its rise and moved sideways after touching the 1.0480 resistance. Unless this level is broken, the short-term image in favor of the Euro can maintain its existence. However, the 233-day average, which is an important place in the Fibonacci number series, is now in the resistance position.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

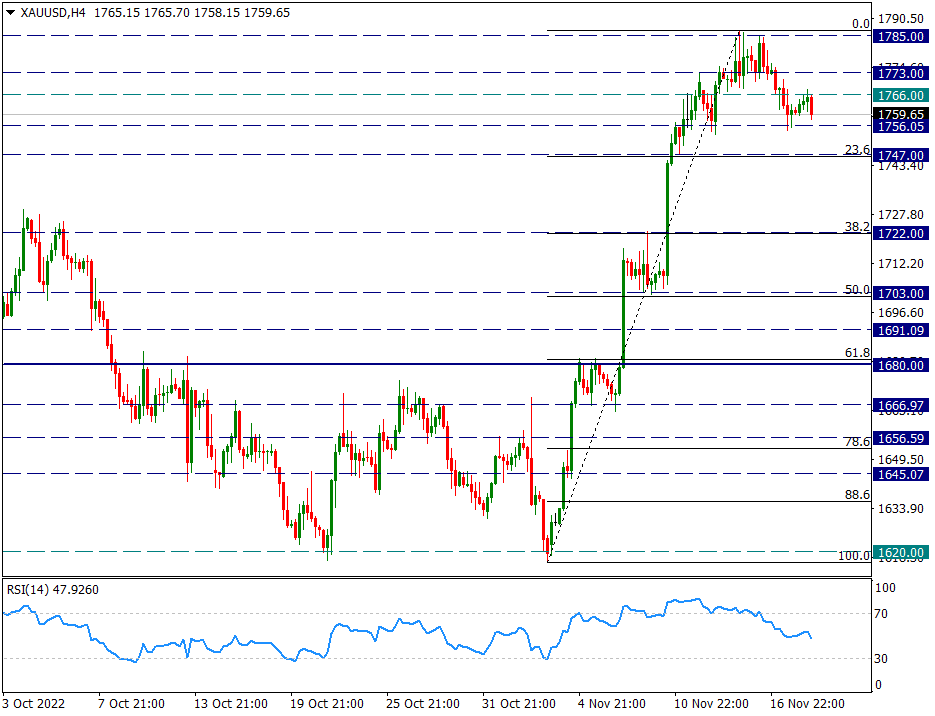

XAU/USD

XAU/USD – Attention Small Diameter Shoulder Head Shoulder Formation!

The yellow metal, which has risen step by step since the 1620 level and went up to the 1785 resistance, forms a short-diameter head-to-shoulder formation in this region. As of today, the right shoulder of the formation has pulled the price up to 1756 with the reverse flag formation. 1756 is also the body of the shoulder head shoulder. Thus, the 1756 level is an important support zone for the yellow metal’s profit selling to continue gaining strength. If it is broken, the Fibonacci retracement levels on the chart will be followed as step-by-step bearish stops.

There is no rule that every formation will definitely work. For this obo formation to work, 1756 will have to be broken. In possible reactions from 1756, 1785 resistance will be followed as the main resistance in the short term.

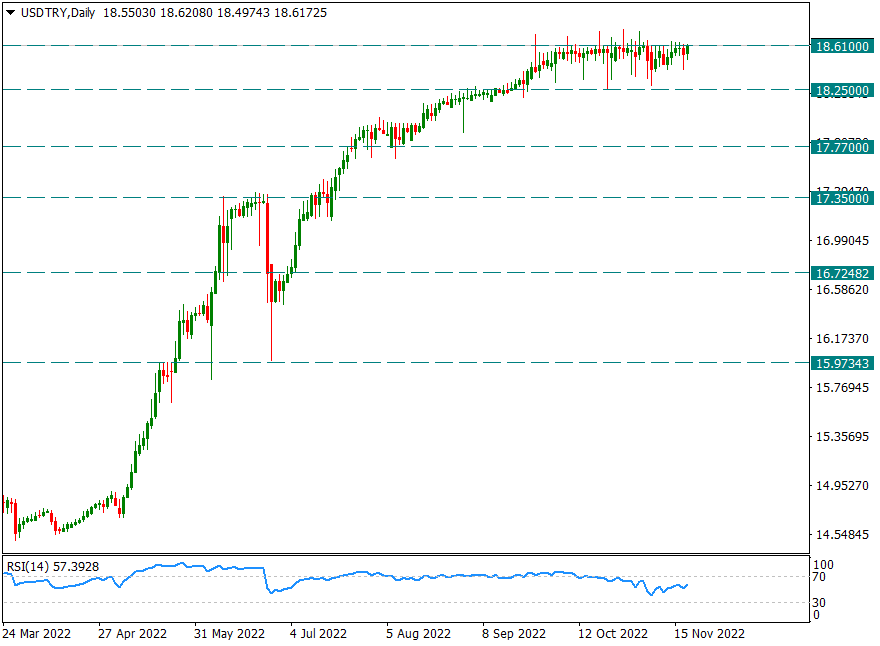

USD/TRY

USD/TRY – It continues with its closeness to 18.61…

Before the CBRT meeting to be held next week, the USDTRY parity continues to be priced in the 18.61/18.25 range it has been in for a long time and is mostly close to the 18.61 resistance. In case of step-by-step daily candle closes above 18.61, it may technically be possible to reach new highs, but for now, the 18.61 region is quite strong.

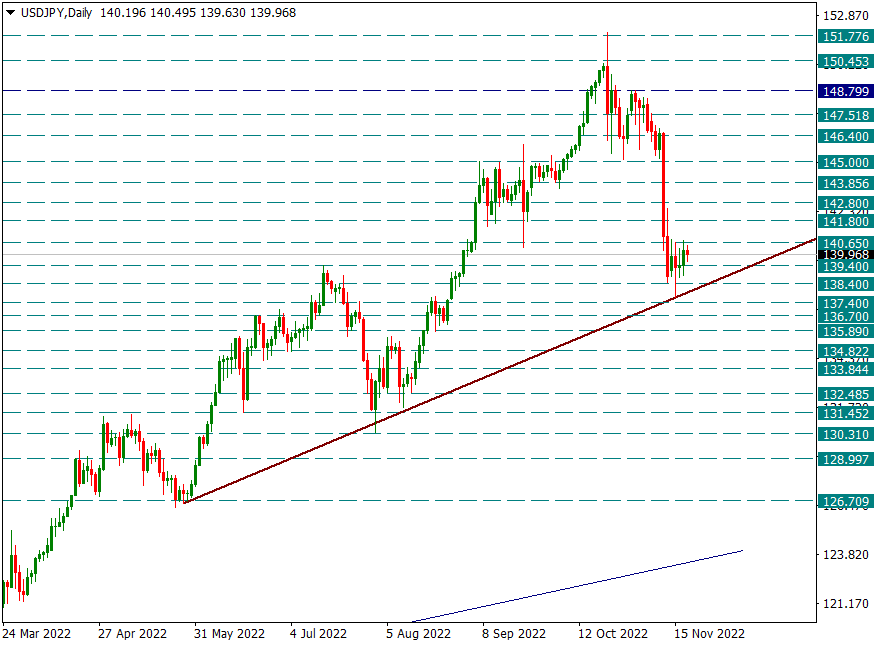

USD/JPY

USD/JPY – The Yen Prospect Continues, Reactions Still Insufficient…

Reactions were limited in USDJPY and stuck at 140.65 resistance. The possibility of a reverse flag should not be overlooked here. So possible reactions are of course important. However, as long as there is no hold above the 141.80 resistance, it can be predicted that the moves in favor of the JPY will maintain their strength.

If the declines in the pair continue, we will take the uptrend line from 126.70 as the main support line and this trend will determine whether the JPY rally will accelerate or not.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.