*ECB’s Kazimir said in his statements: “I hope that the interest rate increase has ended, but we cannot ignore further interest rate increases. “Only the March forecasts can confirm that we are firmly on track towards our inflation target.” He used his expressions.

*ECB’s Guindos said in his statements, “The main elements of inflation remain moderate. The worst situation in the infrastructure of inflation has disappeared. There is uncertainty about the impact of the increases on activity. “Increasing energy prices increase uncertainty.” He used his expressions.

*In Canada, the producer price index increased by 1.3% in August, against the expectation of a 0.5% increase. There was a -0.5% decrease in annual data.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Dollar Index Still Continues to Stay in Favor…

The EURUSD parity started the new week, in which we will follow the FED meeting, by being above the 1.0630 support and with very weak reactions. The parity may remain on the calmer side ahead of the FED decisions to be announced on Wednesday evening. However, even though the market does not expect an interest rate increase from the FED at this meeting, the FED may be surprised in this regard. For this reason, we can say that the EURUSD parity is pregnant with surprises this week.

Generally speaking, when we look at the technique, a parity below the 200-day average maintains its outlook in favor of the dollar. If it does not rise above 200 days, we can see that the movements in favor of the dollar may continue step by step, especially as long as it does not rise above 1.0765.

XAUUSD

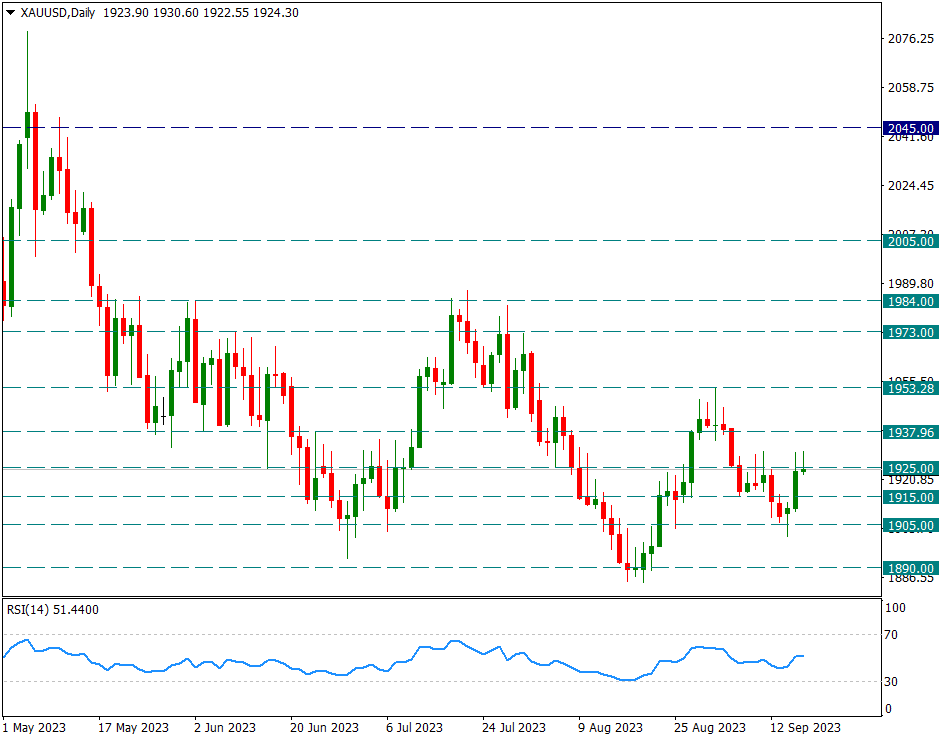

Ounce Gold – Attacks are Blocked in 1925. Which Levels Should Be Monitored Closely?

We see a pressure on the ounce side. It has been under pressure both on the downside and on the upside in recent days. The yellow metal, which had fallen to the 1905 support level last week, carried the reaction it received from here to the 1925 resistance level. It is difficult to overcome this resistance both last Friday and the new week. If 1925 is exceeded, 1953 resistance is important on a weekly basis.

In general, as long as it remains below the resistances we have mentioned, it is quite possible that the yellow metal will tend to be negative on a weekly basis and the rises will provide a selling opportunity.

It is necessary to pay attention to the movements in the yellow metal before the FED meeting.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

BRENT

BRENT – While the Uptrend Continues, We Watch with the 8-Day Average…

The upward trend continues on the Brent oil side. The price increase, which increased with the supply shortages in Saudi Arabia and Russia, caused the transactions to reach the 94.85 price level in the new week. In

general, we continue to monitor the transactions with the 8-day average in the short term. Although it has reached the overbought zone, we can expect the current trend strength to continue unless the 8-day average breaks downward on a daily basis.

In general, it can be predicted that possible declines in this process will be buying opportunities again.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.