*Retail sales in the USA for June were the data expected by the markets during the day. Core retail sales were announced as 0.2% on a monthly basis and headline sales at 0.2% on a monthly basis.

*EURUSD continues to price in a region close to its 1.265-week high during the day, with very limited pullbacks. On the other hand, the yellow metal Ounce Gold side continued to rise inversely with the US 10-year bond yield falling below 3.77% during the day and saw 1970 levels during the day. While the dollar index is also followed closely, we followed the double bottom formation at 99.55, which is seen more clearly on the four-hour chart during the day. If the reactions exceed 100, we can see that the dollar index can recover somewhat.

* ECB Member Knot, in his statements on monetary policy today, stated that an interest rate hike is possible but not certain after the July meeting. He stated that the expectation that inflation will reach the target of 2% in 2023 is an optimistic forecast.

*In Canada’s June inflation data, annual inflation continued to decline and stood at 2.8%.

*Deutsche Bank lowered its forecast for China’s full-year GDP growth to 5.3% from 6.0% previously.

*Tomorrow night at 01:45 CEST, inflation data from New Zealand will be the first important data we will encounter. We will watch the UK inflation data at 09.00 in the morning and the Euro Zone inflation data at 12.00.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

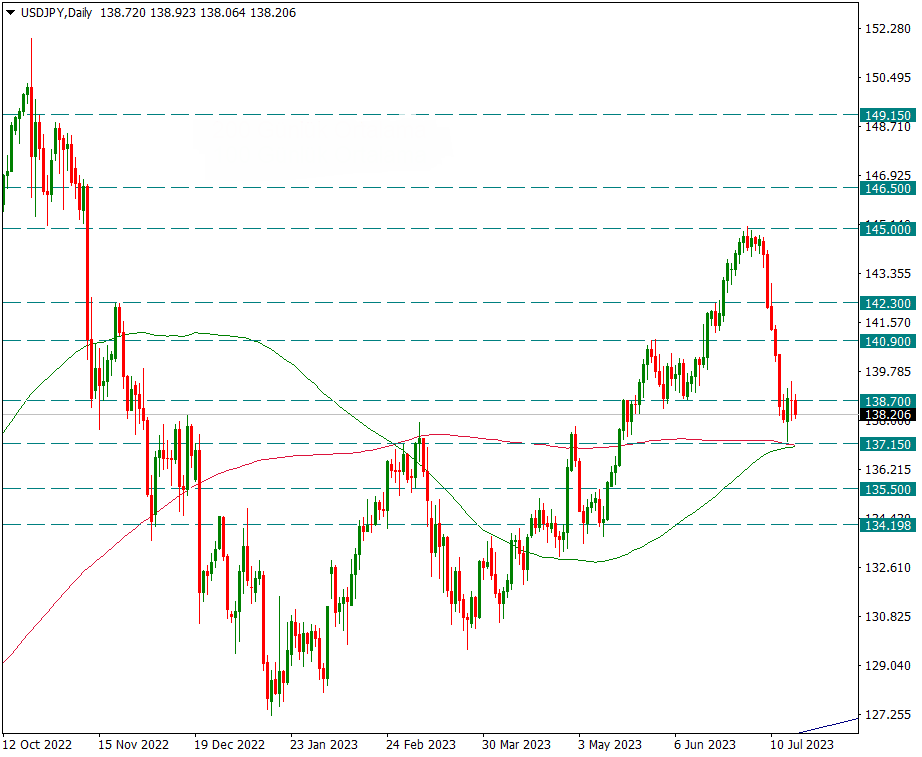

USDJPY

USDJPY – Holds at 100-200-Day Intersection…

After the Japanese Yen retreated from 145, it found support at the intersection of the 200-day and 100-day averages. This support line, which coincides with the 137.15 level, continues to hold the USDJPY pair. We will follow the 140.90 resistance in the continuation of possible attacks from the support. Before this resistance is overcome, it may be technically premature to expect it to head towards the main resistance 145.00 on a weekly basis.

The main support is 137.15.

XAUUSD

Ounce Gold – Struggling to Settle Above the 50-Day Average…

As of the new week, the yellow metal seems to be settled well above the 50-day average. Although it touched the 1970 resistance and retreated during the day, it still receives support from the average. As we hold on to this 50-day average corresponding to 1955, our first main weekly resistance will be 1984. Positive movements over 1984 may continue to gain strength.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

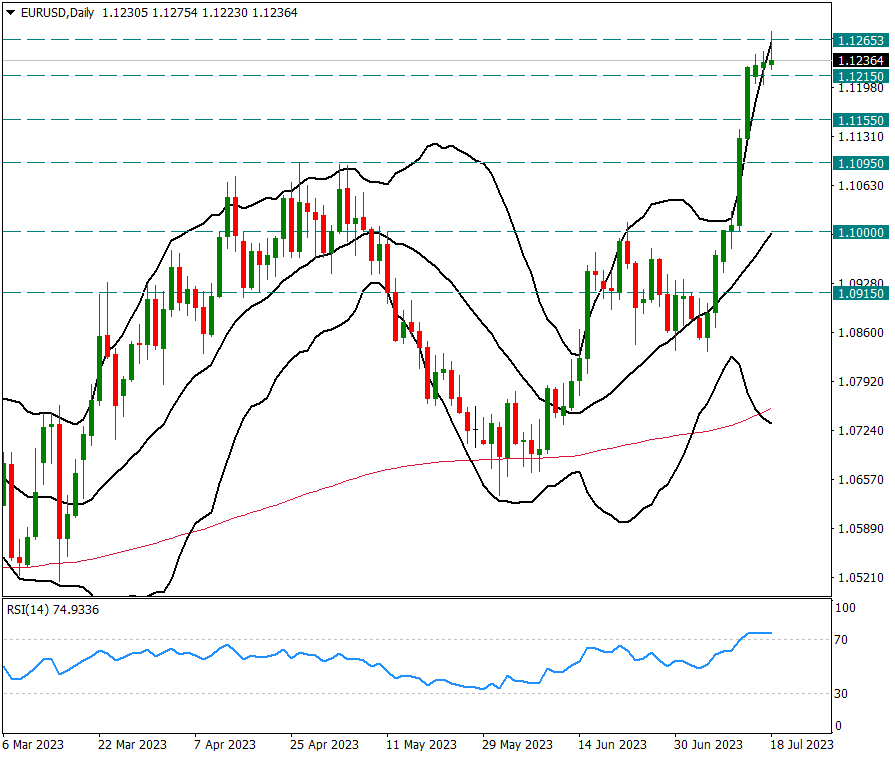

EURUSD

EURUSD – Breathing at 1.1265 Resistance and Bollinger Band Outlook…

In the EURUSD parity, which has been rising almost breathlessly last week. We see a respite at the 1.1265 resistance.

Breaking the upper band of the daily bollinger band, last week’s rises are now somewhat normalized and the daily candle formations remain above the upper band of the bollinger. Profit selling may be triggered if the advancing daily candles diverge from the upper bollinger’s upper band in the negative direction.

However, there is a possibility that we will see a rise up to 1.1375 in case of candle formations that may not leave the upper band of the bollinger and try to tear it off.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.