*We started the morning with inflation data from England. Headline CPI was 7.9% and Core CPI was 6.9%, falling behind the previous month. After the declining inflation data, we saw a pullback of about 100 pips on the Sterling side. This data is a positive development for the UK economy and could lower the odds of the Bank of England being overly hawkish.

*Inflation in the Euro Zone, which came at noon, slowed down on an annual basis and was realized as 5.5%. Monthly headline inflation was 0.3%. On the other hand, core inflation accelerated, increasing by 5.5% annually and by 0.4% on a monthly basis. In the light of these data (especially core inflation), we do not expect any change in the monetary policy language of the European Central Bank and we expect it to maintain its hawkish stance.

*Construction starts in the US decreased by 8% in June. It was well below the expectation and there was a high regression compared to the previous month.

*It was announced that more than 2 million tourists, both business and leisure, arrived in Japan last June for the first time since the pandemic. It was stated that although this situation is important for local businesses and tourism, it still remains 28% below the data in June 2019.

* In parities, EURUSD 1.1220, GBPUSD 1.2915, Ounce Gold 1975 and USDJPY parity are priced at 139.50.

The US 10-year bond yield did not recover much and remained around 3.75%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

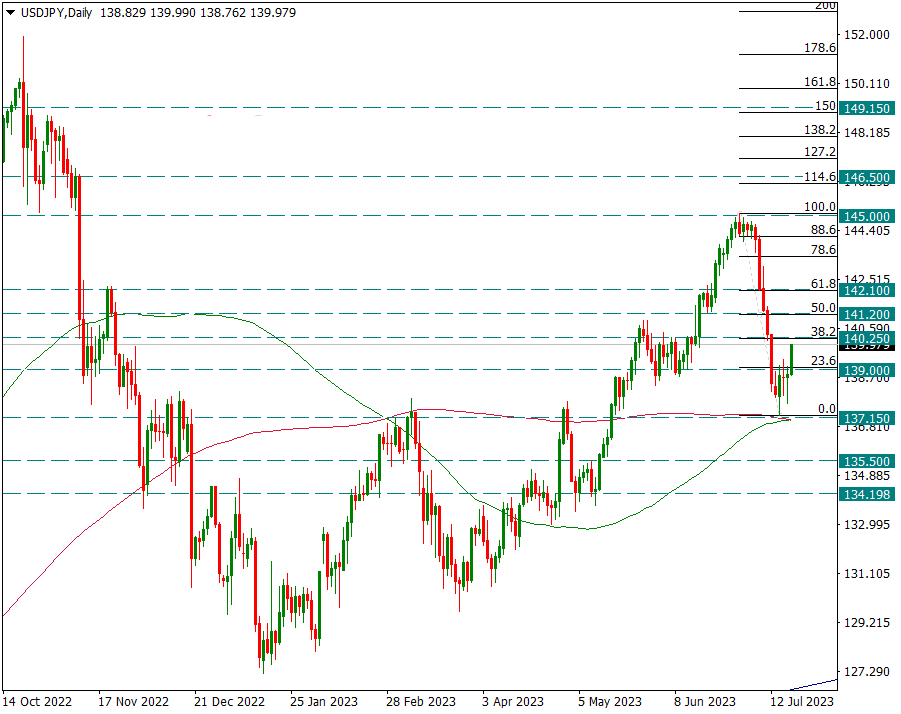

USDJPY

USDJPY – Yen Gives Back Gains After Critical Support Zone…

The support from the 137.15 level, where the 100 and 200-day averages intersect, caused prices to react and rise. Now we are watching the 145/137.15 drop correction. We will follow this process with Fibonacci retracements on the chart. The Fibo 61.8 retracement, i.e. the 142.10 level, will be an important resistance in the short term. If this region is to be broken, it may not be broken on the first try. However, if it is exceeded, the 145 level will be on our agenda.

The main support zone on possible declines is 137.15.

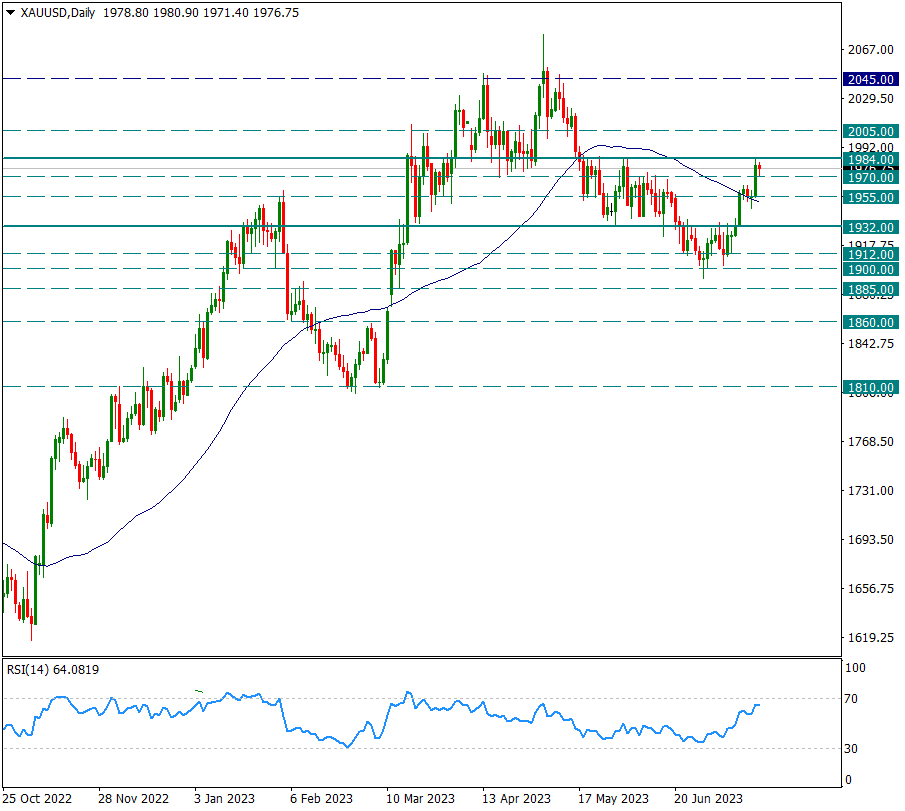

XAUUSD

Ounce Gold – Very Close To 1984 Resistance But Brakes Here…

The yellow metal retreated slightly after touching the 1984 resistance yesterday and closed the day close to this resistance. Today, it continues to operate in a region very close to this resistance, receiving support from 1970. As long as it stays above the 50-day average, it may continue to maintain its positive image in the short term, while this positive image may continue to gain strength above 1984.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

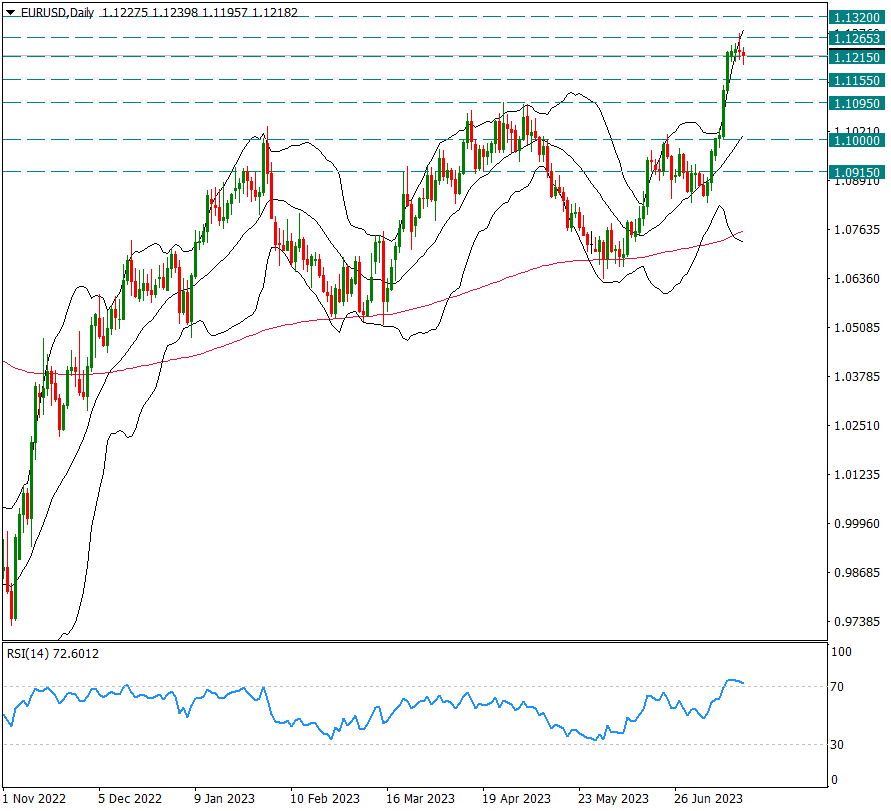

EURUSD

EURUSD – Forces 1.1265 Support Down With Slight Relaxation…

The pair has braked for the past two days after jumping to 1.1265. With the jump to 1.1265, it also tore the upper band of the daily bollinger band, and we see that it is braking at this stage.

In terms of price, there is a hold at 1.1215 support. Even if it sags below this region during the day, it is above the 1.1215 support for now. If 1.1215 is broken, a step-by-step pullback towards 1.1095 may await us.

In the continuation of possible attacks, 1.1265 is the main intraday resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.