*The US dollar index experienced a sharp decline last week following US inflation data. It started the new week in a narrow range but with a slight positive bias from the bottom. As a result, the EUR/USD exchange rate is at 1.1215, Gold is at $1947 per ounce, and the yield on the US 10-year Treasury bond is at 3.82%.

*US spot markets started the new week somewhat mixed. The Nasdaq maintained its upward trend with a 0.26% increase at the opening, while the Dow Jones and S&P 500 indexes remained relatively quiet.

*ECB member Vasle stated in a recent announcement that ‘core inflation remains high and resilient.’ This statement does not differ significantly from what other members have previously stated. Until the European Central Bank’s policy decision next week, there is unlikely to be much difference in tone and rhetoric regarding the policy from the ECB. Looking ahead, the September meeting will be interesting to see how they will navigate the policy given that there is currently almost no certainty regarding another interest rate hike in the near term.

*The Kremlin spokesperson, Dmitry Peskov, announced that Russia’s participation in the Black Sea Grain Agreement has ended as of today.

*The US New York Empire State Manufacturing Index came in at 1.10, while it was expected to be -4.30. Following the release of this data, we witnessed some appreciation in the US Dollar Index. When we look at tomorrow’s data traffic, notable releases include Retail Sales and Industrial Production from the US, as well as inflation data from Canada.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

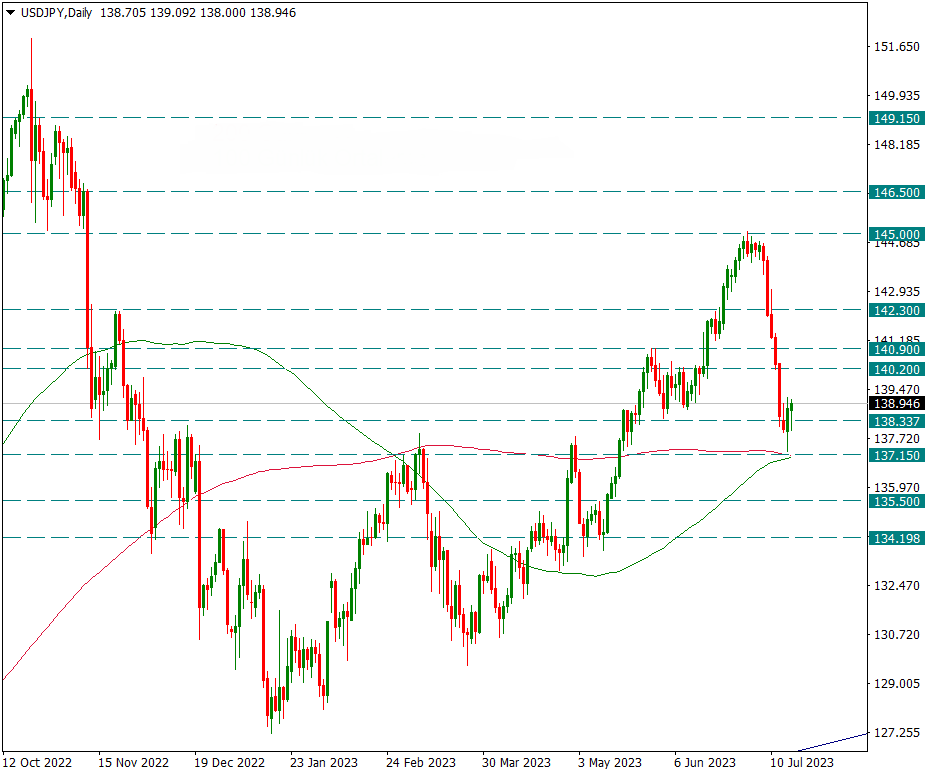

USDJPY

USDJPY – Response From Where 50 and 100-Day Average Intersect

After reaching 145.00, the currency pair experienced a strong Yen rally, finding support at the point where the 50-day and 200-day moving averages intersected. In this rebound, the first critical resistance to watch is at the 142.30 level.

If the rallies are not sufficient, in case of possible pullbacks, the key weekly support stands at 137.15. Breaking below this level could potentially reignite the Yen rally with significant strength.

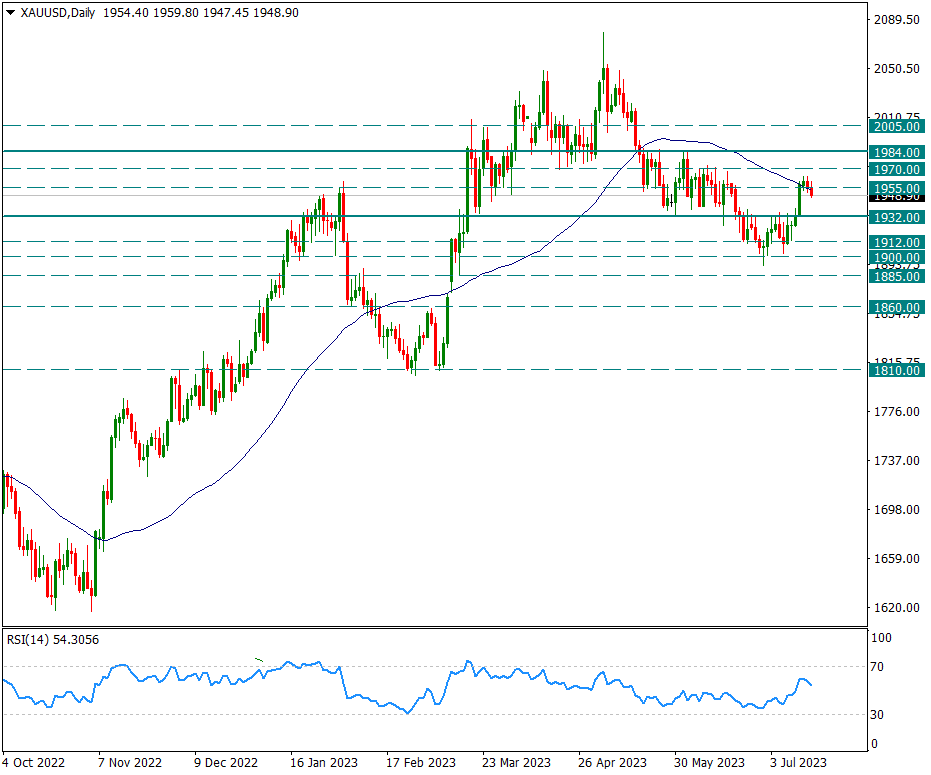

XAUUSD

Ounce Gold – Again Sagging Below 50-Day Average…

Last week, the yellow metal dropped back below its 50-day moving average after briefly trading above it, and it doesn’t seem to be able to hold above that level for now. However, it’s important to pay attention to daily closing prices. If we see consecutive closes below the 50-day moving average, it could bring the levels of 1932 and subsequently 1900 into focus for gold.

While monitoring the price of gold, it’s also important to keep an eye on the position of the US 10-year Treasury bond yield. Approaching 4% would be negative for the yellow metal, while staying above 4% could lead to a significantly negative situation for gold.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

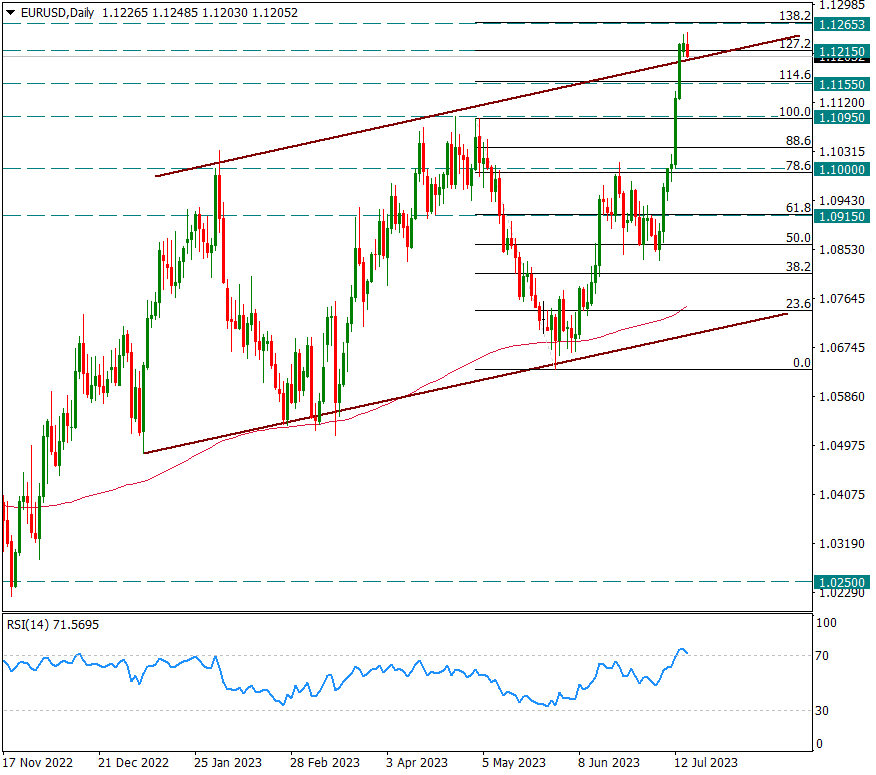

EURUSD

EURUSD – Slight Rebound Starts From Last Week’s Top…

Last week, the currency pair approached the 1.1265 resistance rapidly due to the lower-than-expected inflation data from the US and the decline in the US 10-year Treasury yield towards 3.75%. This level was an important resistance as it coincided with the Fibonacci 127.2% retracement. As the new week begins, there is some movement in favor of the US dollar index. It wouldn’t be surprising to see a slight correction in this upward movement. The main support level stands at 1.1095.

If the rallies continue, the primary resistance in the short term appears to be at 1.1375.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.