*In the UK, annual headline inflation, which was 7.9% in the previous data, decreased to 6.8% in July, as expected. On a monthly basis, negative inflation was realized as -0.4% against the expectations of -0.5%. When we look at core inflation, there was no change on an annual basis. As in the previous data, it was seen at an annual rate of 6.9% in July. Monthly-based core inflation increased by 0.3% with an increase of 0.1 percentage points compared to the previous month. After the announced data, rapid rises occurred in the GBPUSD parity. Along with the ups, 1.2727 resistance was exceeded.

*Industrial production data in the Euro Area came in better than expected. In June, an increase of 0.5% was recorded, while a monthly decrease of -0.1% was expected. Although a negative picture of -1.2% is seen in the annual data, it surpassed the more negative expectations with -4.2%.

*Statements from the Chinese cabinet meeting, “We will strengthen the coordination of various policies to accelerate growth. We will expand policy space to support consumption, we will do more to encourage investment, attract and attract foreign investment.”

*Fitch Ratings lowered its medium-term GDP forecasts for 10 advanced economies. Adverse economic shocks from Covid-19 and the European gas crisis are thought to have had a lasting negative impact on the supply side.

*US Building Permits increased by 0.1% in July, versus the expectations of -1.7% and Industrial Production in the USA increased by 1.0% in July, above the expectations. The expectation was for an increase of 0.3%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

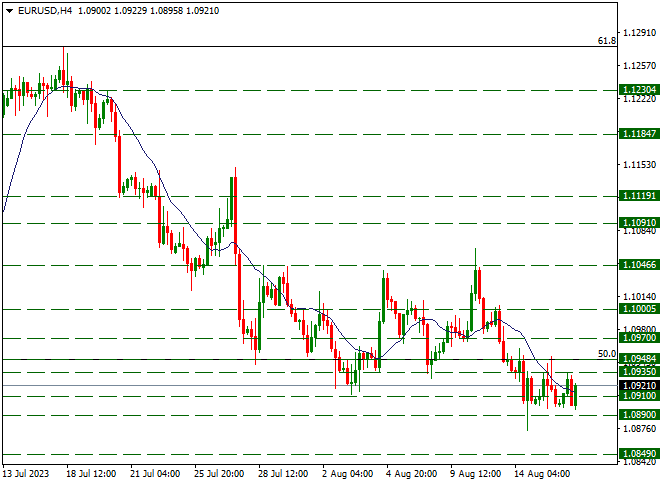

EURUSD

EURUSD – Watching Sideways in the Range of 1.0890/1.0935…

Pricing in the pair maintains its horizontal course, while the 1.0890 level provides reactions as support. Although the 1.0910 level is exceeded from time to time in upward pricing, the rises are limited at 1.0935 resistance. In the short-term, if these levels are broken, 1.0849 level can form support in downside pricing. On the upside pricing, the 1.0948 level may form resistance.

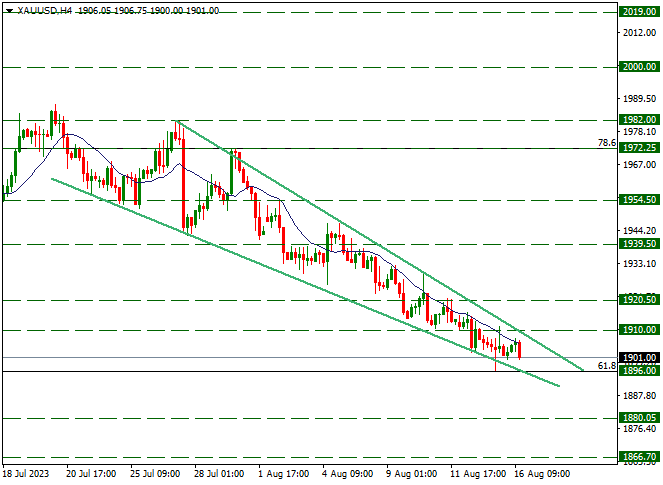

XAUUSD

Ounce Gold – Continues to Hold on 1896 Support…

Although the yellow metal continues to price just above the 1896 support it tested about 1.5 months ago, the downside remains limited at this support. At the same time, we see that the downward channel is getting tighter. In the coming days, if there is a downward trend from the 1896 support, the declines may be more severe. We’ll wait and see.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

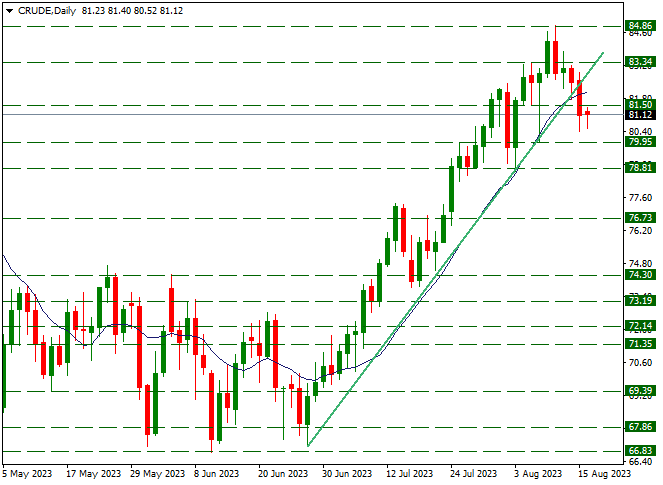

CRUDE OIL

Crude Oil – Priced Around 81…

The upward momentum in crude oil, which started at the 67 level, could not exceed the 84.86 resistance. The pullbacks, which started with the strong reactions of this resistance, gained momentum in the past day. The dips tended to rebound before reaching the 79.95 support. While the 81.50 level creates resistance in instant pricing, the 79.95 level continues to form support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.