* In his speech after keeping the interest rate at -0.10% level, Bank of Japan (BOE) Governor Ueda stated that there are both positive and negative effects caused by the weak Yen, the rate of decrease in prices is a little slow, and there is a lot of time to reach the 2% target. He said that they expect the global economy to recover from next year once inflation is under control.

*As expected, the Consumer Price Index (CPI) for the month of May in the Euro Zone, which was announced today, did not change at the level of 0.0%, but decreased to 6.1% from 7.0% annually. Core CPI also came in as expected, increasing 0.2% and 5.3%, respectively. European Central Bank (ECB) Member Holzman also said in his speech that if inflation continues, more measures will be required regarding interest rates.

*Richmond Fed Chairman Barkin said he would be comfortable doing more in interest rates if future data didn’t confirm inflation fell to the target level of 2%, that higher rates could risk a more pronounced slowdown, while high-income consumers continue to spend and the labor market remains strong. He said how to deal with inflation is a problem.

*FOMC member Waller was one of the first to make a statement after the FED meeting, stating that core inflation did not fall as he expected and gave the first messages that further tightening could be made. We have already seen this in the dot plot indicator, so this has not had an impact on the dollar index at the moment.

*Michigan Consumer Confidence Index rose compared to June’s leading data and was announced as 63.9(Previous: 59.2).

Agenda of the day;

20:00 (GMT +3) Number of US Oil Drilling Rigs

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

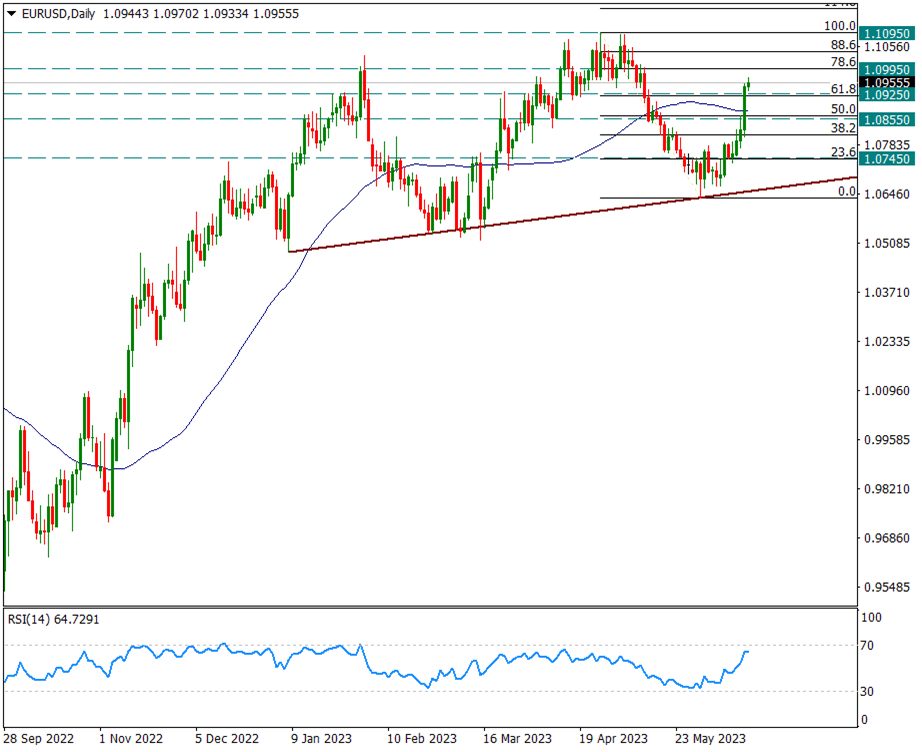

EURUSD

EURUSD – Above 50-Day Average, May Continue in Favor of Euro…

The ECB meeting held yesterday showed that monetary policy in Europe will continue to tighten. After this meeting, the Euro side got stronger and the EURUSD pair made a strong close above the 50-day average and even held above 1.0925.

The 1.0925 level was significant as it coincided with the Fibonacci 61.8 retracement of the latest 1.1095/1.0635 drop. We will now be following this uptrend above the 50-day average, that is, above 1.0855.

In the continuation of the possible rises, first the top of 1.1095 and then the level of 1.1230 in the short term may come to the fore.

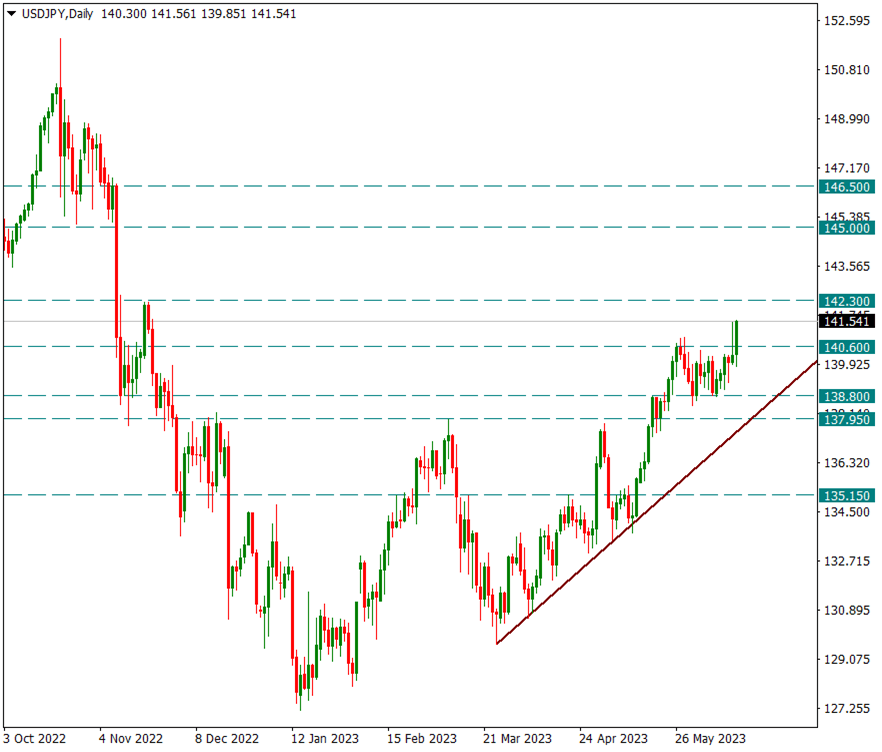

USDJPY

USDJPY – 140.60/138.80 Zone Broken Upward, Now Watch 142.30 Resistance…

The USDJPY pair, which has been stuck between 140.60/138.80 for a while, tried to surpass this horizontal line on the upside yesterday, but failed. Today, it has risen to 141.50 with a strong rise. 142.30 will be the first significant resistance for us. We find it useful to pay attention to 142.30.

The main weekly support in possible profit sales is 137.95.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

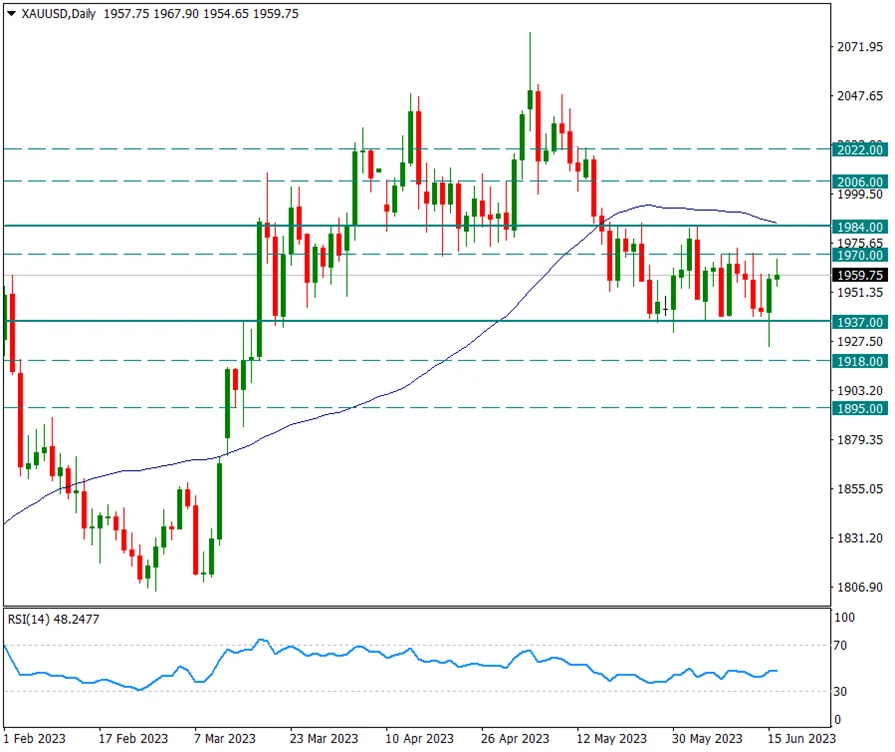

XAUUSD

Ounce Gold – A Fierce Struggle Is Going On In The Tight Zone…

While the yellow metal has been stuck between 1984/1937 levels for some time, it momentarily sank below 1937 during the ECB meeting yesterday. However, it still closed the day inside the 1984/1937 region. However, the rises continue to be stuck to the 1970 resistance for about 2 weeks.

1970 is the intermediate resistance and the first pressure zone. However, the 50-day average, which coincides with 1984, is the main resistance line. The rises below these regions are not permanent and result in profit sales.

Below is a 1937 support line holding the sell-off, and in this tight area there is a fierce battle between the long and short sides.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.