- The Unemployment Rate for March in the UK, announced today, rose from 3.8% to 3.9%. While 182 thousand people were employed in March, the number of unemployed increased by 46,700.

The GDP that we tracked for the first quarter in the Euro Area grew by 0.1% on a quarterly basis and by 1.3% on an annual basis, as expected. Employment change, on the other hand, increased by 0.6% and 1.7%, respectively.

According to the monthly report published by the International Energy Agency (IEA), global oil demand will increase by 2.2 million barrels per day in 2023 to reach a record level of 102 million, China will account for 60% of the oil demand increase, global oil supply will increase in April. It was stated that the OPEC+ oil supply will decrease by 850 thousand barrels per day in the April-December period, while the non-OPEC+ supply will increase by 710 thousand barrels per day.

- April Retail Sales in the US, announced today, fell below expectations, increasing 0.4% month on month and 1.6% year on year. Data were expected to increase by 0.7% and 4.2%, respectively. Core Retail Sales rose 0.4% as expected. The volatility in pricing increased after the data that the FED watched closely during the interest rate hike process.

Agenda of the day (GMT+3);

17:00 Speech by ECB President Lagarde

19:15 Speech by FOMC Member Williams

22:15 FED Logan Speech

23:30 US API Crude Oil Stocks

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

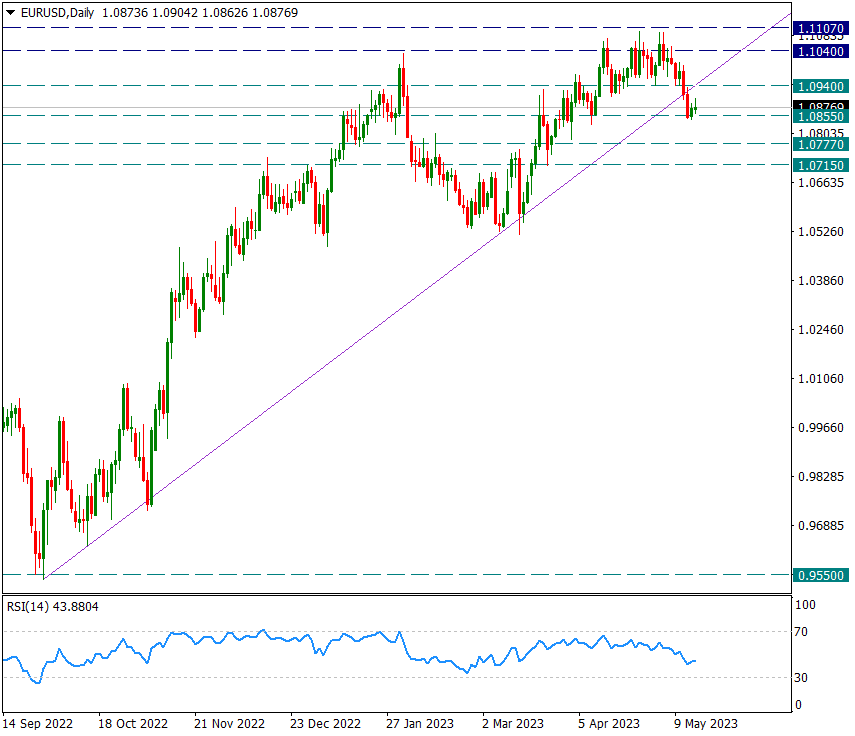

EURUSD

EURUSD – Reactions in favor of the euro remain limited…

At the beginning of the week, it had received a mild reaction from the 1.0855 support. In general, we think that we need to see daily candle closes above 1.0940 in order to form an image in favor of the Euro again. In this period, it can be expected that the image will strengthen step by step in favor of the dollar, as it is already below the uptrend from 0.9550.

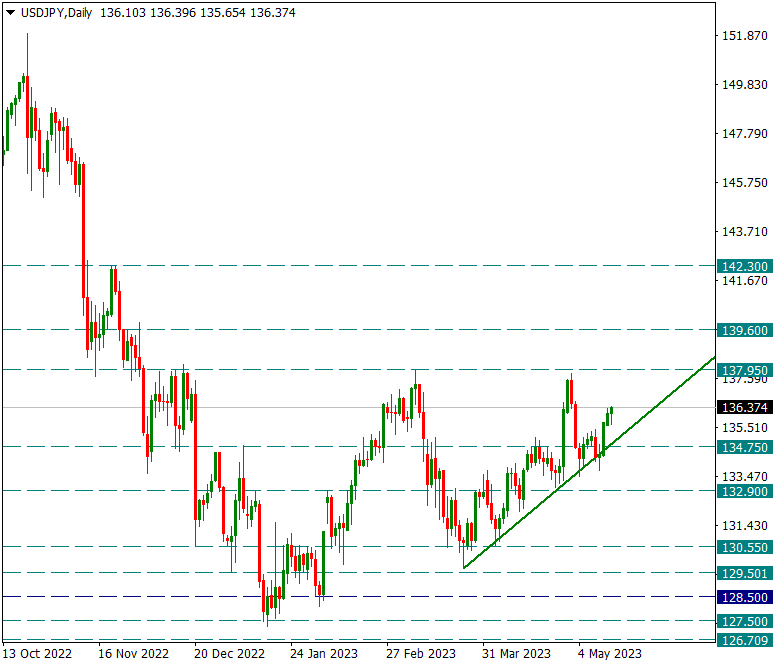

USDJPY

USDJPY – Step By Step Towards 137.95 Resistance…

With the recovery of the dollar index, the USDJPY parity continues to rise step by step towards 137.95 again. This resistance is very important as it cannot be overcome in the medium term. If this level is exceeded, a rapid move towards 142 can be seen.

Below, 134.75 level will be an important support during the day.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

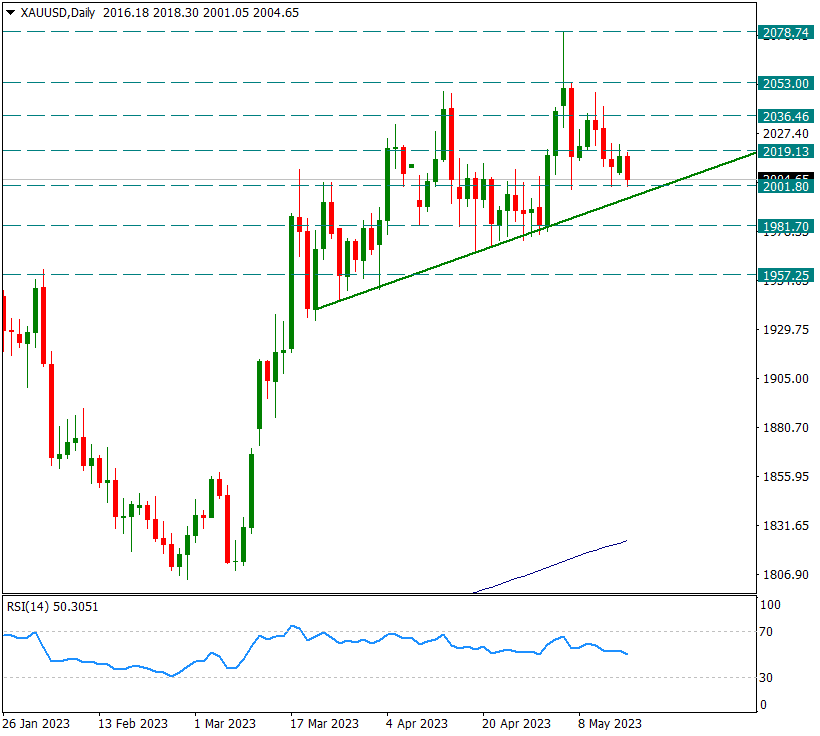

XAUUSD

Ounce Gold – 2001 Level Prices Continue to Hold…

With the recovery of the dollar index during the day, there is also a pressure on the yellow metal. The 2019 resistance suppresses the rise for three days, but the 2001 support for three days also keeps the decline. There is also a short term trend in the 2001 support as you can see in the chart and 2001 can be referenced for the negative positive case for now.

If it falls below 2001, sags until 1957 may be possible.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.