- We welcomed the day with the UK’s economic growth and industrial production data. In the UK, economic growth continues to weaken on a monthly and annual basis. It was -0.3% monthly and 2% annually. We also saw negative changes in Industry and Manufacturing production data. This is to be expected and the UK economy remains in recession as such. To beat inflation, they have to tighten up and endure this situation.

- On the domestic side, Industrial Production in August decreased to 2% on an annual basis.

- Almost the most important data of the day came from the USA. On an annual basis, the headline and core PPI were 8.5% and 7.2%, respectively. On the monthly side, we saw that the upward trend continued. Headline and core were 0.4% and 0.3%, respectively.

- While the inflation trend continues in the USA, the CPI data, which will be announced at 15:30 (GMT +3) tomorrow, gained importance.

- After the data, while the intraday gains in the US futures indices are given back, the dollar index continues to maintain its strength.

- The US 10-year bond yield has risen to 3.97% and closings that may be above 4% may further increase the rise.

- On the ECB side, Villeroy stated that discussions about whether the rate hike will be 50 or 75 basis points at the October meeting will be premature in volatile markets. Stating that the signs of recession should not affect the rate hikes, he stated that recession would be preferable to stagflation.

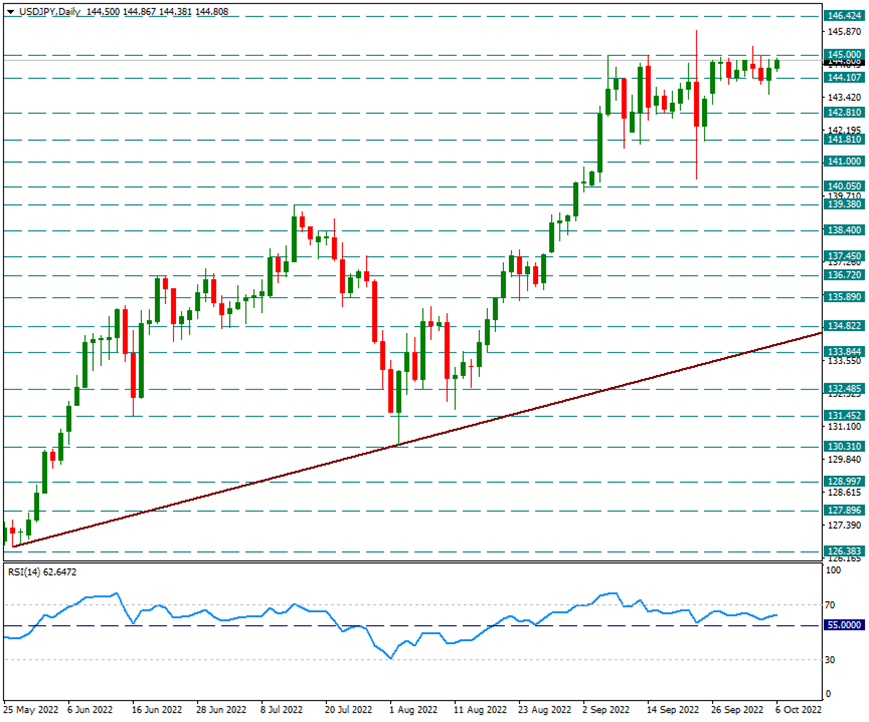

- The Governor of the Central Bank of Japan, Kuroda, evaluated the rapid and one-sided exchange rate movements as speculation. (natural state of markets) He added that this situation is bad for the economy. He stated that the weakness in the yen could have a good effect on the macro economy, but there are sectors that are affected by this situation. He stated that the government’s intervention in the Yen was appropriate.

- The USDJPY pair started the day with 146.40, surpassing 145.00. It climbed above 146.70 near the US session open.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

USD/JPY

USD/JPY – He Continued His Ascension After He Overcome The 145 Wall…

The USDJPY parity, which was about to exceed 145 at the end of September, with the intervention of the Bank of Japan, quickly retreated and hung up to 140.65 support. This situation was not permanent and with the monetary policy of BOJ, which diverged sharply from the FED, the USDJPY parity was again at 145 resistance. With the strengthening of the Dollar index this week, the 145 threshold has now been exceeded. It touched 146.40 resistance in the Asian session tonight.

We will see if there will be a possible intervention from the BOJ again and it is useful to be careful with the news feeds. The main intraday support will now be at 145. In the general trend, the upward trend of the USDJPY pair is preserved.

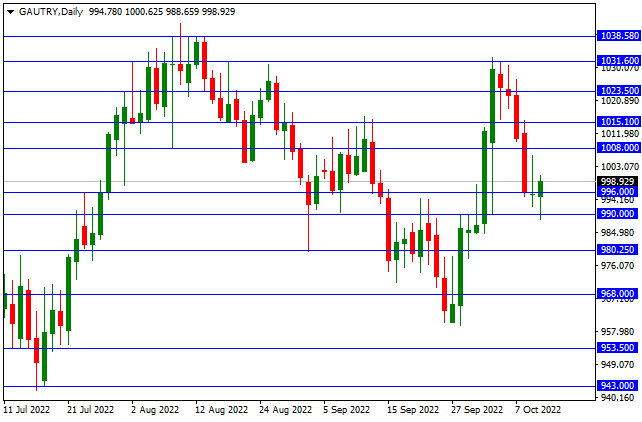

GAU/TRY

GAU/TRY – Recovering With Support From 990 Level…

After the pullbacks in Gr Gold TL, 990 support was tested. With the support received from this level, recovery is seen. In the continuation of the recovery, 1008 and 1015.10 can be viewed as resistance. In pullbacks, 996 and 990 can create support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

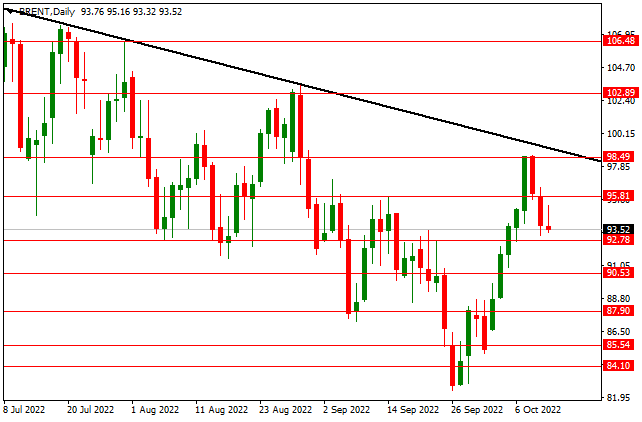

BRENT

BRENT – Pricing on 92.78 Support…

In the monthly report released by OPEC today, it was stated that oil production increased by 146 thousand barrels per day in September to 29.77 million barrels. The Producer Price Index (PPI), which we follow on the US side, increased by 0.4% monthly and 8.5% annually. With these developments, Brent Petrol is holding on the 92.78 support. As long as it is above this level, 95.81 and 98.49 can be followed as resistance. In pullbacks and 92.78 lower pricing, 90.53 and 87.90 can form support.

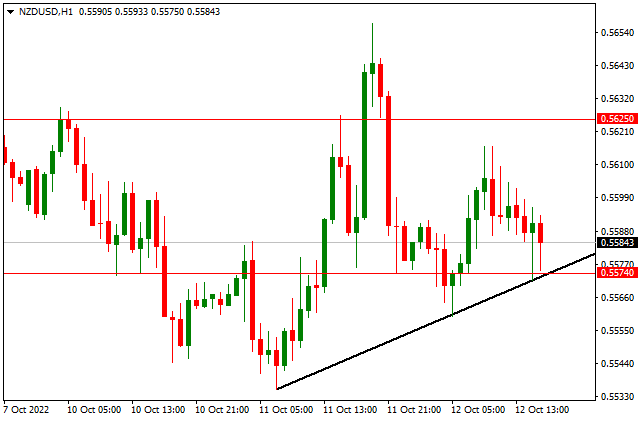

NZD/USD

NZD/USD – 0.5574 Support Tested After Inflation Data…

The US Producer Price Index (PPI), announced today, came in above the expectations, increasing 0.4% month on month and 8.5% year on year. The data was expected to increase by 0.2% monthly and 8.5% annually. After the data, 0.5574 support was tested in the NZDUSD parity. If a hold above this level is achieved, we can see recovery. In this case, 0.5625 and 0.5666 can be viewed as resistance. On the other hand, if the 0.5574 support is broken, the downside can gain momentum.

EUR/USD

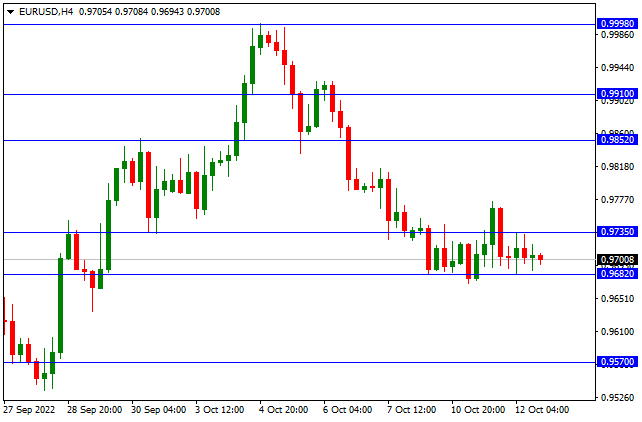

EUR/USD – US Holds On 0.9682 Support After Increasing Inflation…

The Producer Price Index, which we follow in the USA, exceeded the expectations, increasing by 0.4% monthly and 8.5% annually. After the data that increased above the expectations, the EURUSD parity continued to hold above the 0.9682 support. As long as it is above this level, 0.9735 and 0.9852 can be viewed as resistance. 0.9570 and 0.9500 can form support in pullbacks and pricing below 0.9682 level.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.