- Industrial Production in Turkey for September, announced today, decreased by 1.6% monthly and increased by 0.4% on an annual basis. Retail Sales, another important data announced at the same time, grew by 1.8% monthly and 9.7% annually. Apart from these data, the Current Account Balance, which we followed for September, had a deficit of $2.97 billion, more than $2.85 billion. After this data, the 12-month Current Account Deficit became 39.2 billion dollars.

- In the UK, GDP in September contracted by 0.2% QoQ and grew 2.4% YoY. The economy was expected to shrink 0.5% quarterly and grow 2.1% annually. Industrial Production, another important data announced in the UK, increased by 0.2% monthly and shrunk by 3.1% annually.

- Bank of England (BOE) Governor Bailey said in a statement after the economy contracted in the 3rd quarter, that interest rate hikes are likely in the coming months, monetary policy should focus on inflation, not on suppressing the movements of bonds and exchange rates, and that the UK economy is likely to enter a recession in the 4th quarter.

- In his speech, European Central Bank (ECB) Member De Guindos said that the market overreacted to the inflation rates announced yesterday in the USA, that the ECB should do quantitative tightening very carefully and that the ECB’s goal is to protect the anchor in inflation expectations.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

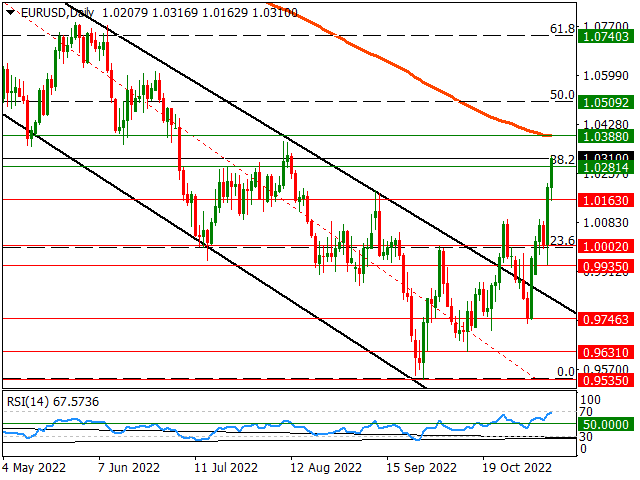

EUR/USD

EURUSD – Post-US Inflation Up Rally Carries Parity to Two-Month High…

Following the surprise US inflation figures announced on Thursday, the EURUSD parity, which continued its upward rally on the last trading day of the week, rose to 1.03 levels. From a technical point of view, the 200-day exponential moving average stands out as the next important resistance zone in the pair, which rose above the 38.2% fibonacci zone of the 1.1490-0.9535 decline. On the other hand, 1.0163 level can be viewed as the first support zone in possible profit sales of the parity.

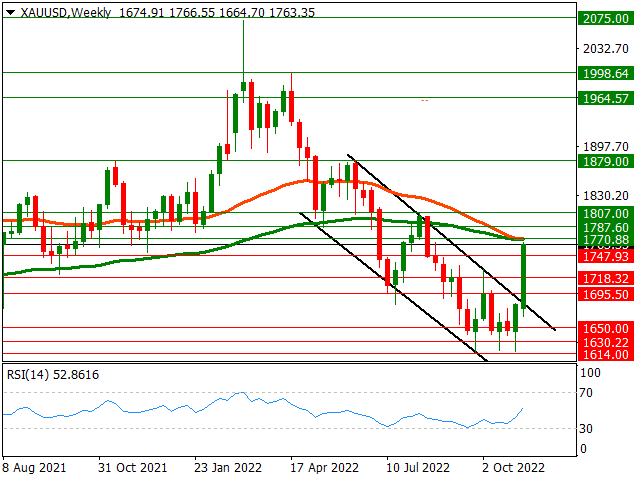

XAU/USD

XAUUSD – The 50 and 100 Weekly Averages Approached the Limit…

With the upward rally that started after the US inflation figures, weekly earnings in Gold Ounce reached 5%. From a technical point of view, the 1770 region, which coincides with the intersection of the 50-week and 100-week exponential moving average, stands out as the first critical resistance region in Precious Metal. On the other hand, 1747 and 1718 levels can be followed as the first support zones in possible profit sales in Yellow Metal, which is approaching the limit of this resistance zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

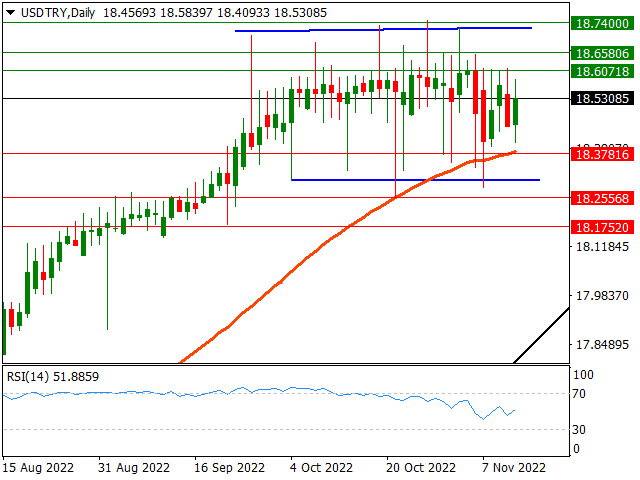

USD/TRY

USDTRY – Response from the 100-Day Average Limit…

After the US inflation report on Thursday, the USDTRY parity, which fell to its 100-day average limit with the loss of the US dollar in the Global Market, faced reaction buying from this region on the last trading day of the week. Above the pair, 18.60 and 18.65 levels can be viewed as the first resistance zones. Below, 18.25 and 18.17 levels can be followed as the next support zones for possible trends below the 18.37 band, which is the 100-day exponential moving average.

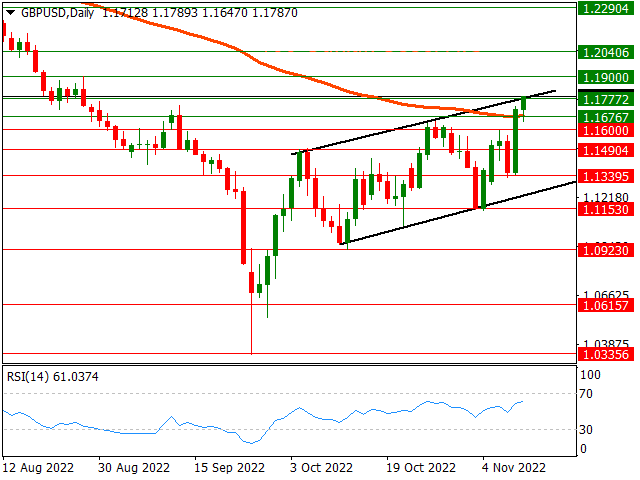

GBP/USD

GBPUSD – Tests the Upper Band of the Ascending Channel…

The GBPUSD parity, which carried its gains to a two-month high after the UK growth figures announced today, is testing the upper band of the ascending channel. If the pair rises above this resistance zone, 1.1900 and 1.2040 levels can be viewed as the next resistance zones. On the other hand, if the parity is suppressed from the upper band of the channel, the 100-day exponential moving average can now be followed as the first support zone.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.