- The European Central Bank (ECB) published the minutes of its September monetary policy meeting, in which it increased interest rates by 75 basis points. According to the minutes, it was stated that the depreciation of the Euro could increase the inflationary pressure for the Euro Area. While many members supported the rate hike by 75 basis points, some members stated that they preferred to increase their rates by 50 basis points. On the other hand, it was stated that the expected weakening in economic activity will not be enough to reduce inflation significantly, and that a very aggressive monetary policy response may make the recession even worse in the short term, although it will provide little benefit for inflation. EUR/USD fell slightly on the initial reaction.

- When we look at the economic data released today on the Euro front, Factory Orders in Germany fell 2.4% in August, the most since April. (Expected: -0.7% Previous: -1.1%). Eurozone retail sales, on the other hand, decreased by -2.05 (yoy) in August compared to the same month of the previous year.

- On the US front, the Dollar index is trying to maintain its recovery trend after the optimistic ADP private sector employment data and ISM Services PMI report on Wednesday. The index has recovered above the 111.50 band. After these reports, the probability of the Fed’s rate hike by 75 basis points at its November meeting was priced at 70%.

- The weekly unemployment benefits applications announced today were below expectations. Contrary to the expectation of 203 thousand, applications for unemployment benefits increased by 219 thousand. The Non-Farm Employment report, which will be announced tomorrow, will be important.

- On the other hand, the risk-averse market environment amid escalating geopolitical tensions helped the dollar erase some of its losses against its main rivals earlier in the week.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

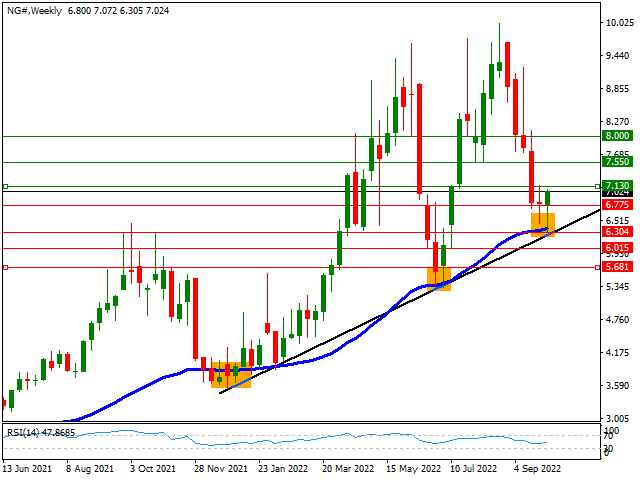

NG#

NG# – Extended Its Earnings Above $7.00 Band…

Natural gas price, which fell to the lowest region of 11 weeks with $ 6.30 at the beginning of the week, has recovered above the $ 7.00 band with the purchases made from this region. From a technical point of view, we see that the natural gas price has developed a reaction from the critical support zone. The $6.30 band was important as it coincided with the 55-week exponential moving average and the black ascending trendline. In case of possible pullbacks, this region will continue to be followed as the main support area. Before this region, it can be viewed as an intermediate support band of $6.77. On the upside, $7.13 and $7.55, the highs seen last week, can be followed as initial resistance zones.

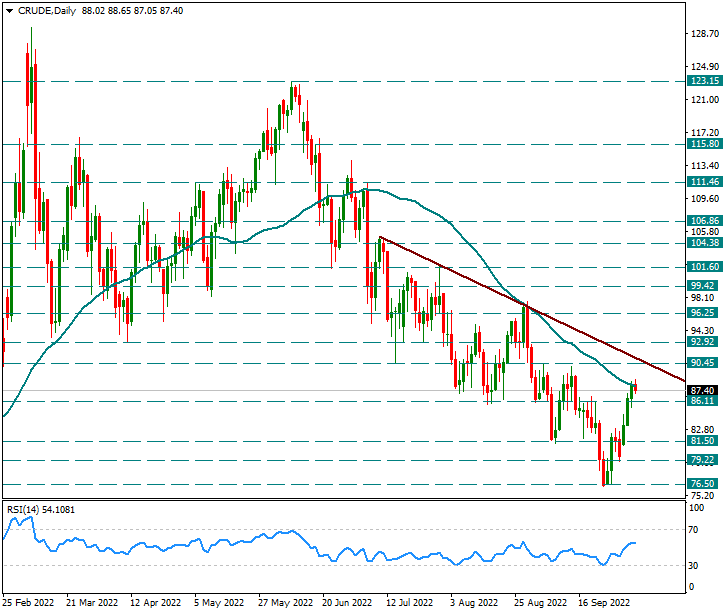

CRUDE

CRUDE – Stuck at the 50-Day Average…

Crude oil, which had priced this news before OPEC+ members went to 2 million barrels per day production restriction, could not rise further after the news and is facing resistance from its 50-day average. This average is technically important, if it is passed, it can lead to the downtrend line from 104 levels.

We will pay attention to 86.11 support in possible decreases. Selling pressure may occur again below 86.11.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

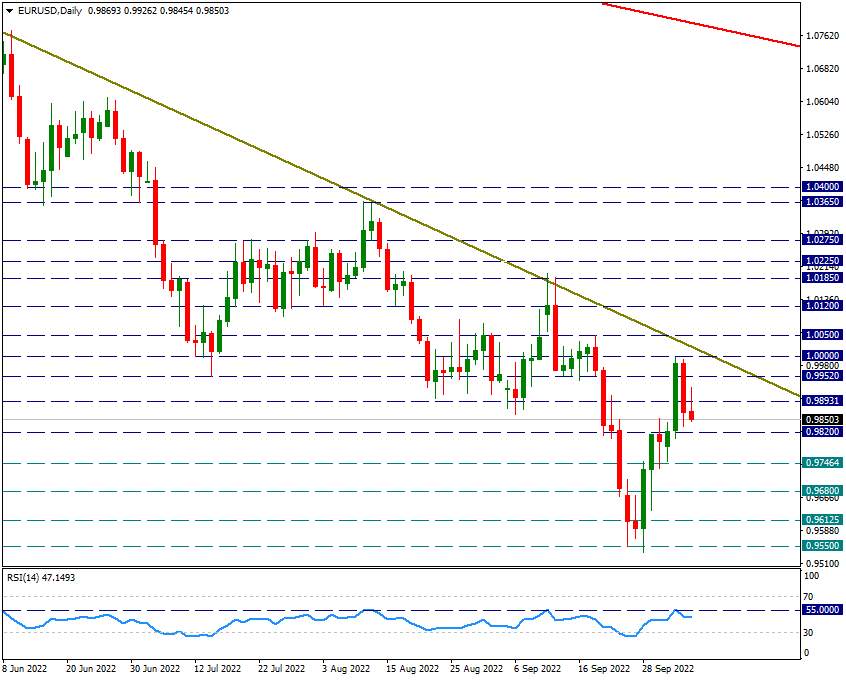

EUR/USD

EUR/USD – We see a move in favor of the dollar below 1.00…

The pair remains below the downtrend line from 1.15. The pair, which tested the 1.00 level at the beginning of the week and is approaching the trend, is retreating towards the 0.9820 support. It is important whether the daily close is below this level, if it does, the movement in favor of the current dollar may gain some strength.

In possible reactions, the most important resistance will be the 1.00 region in the short term.

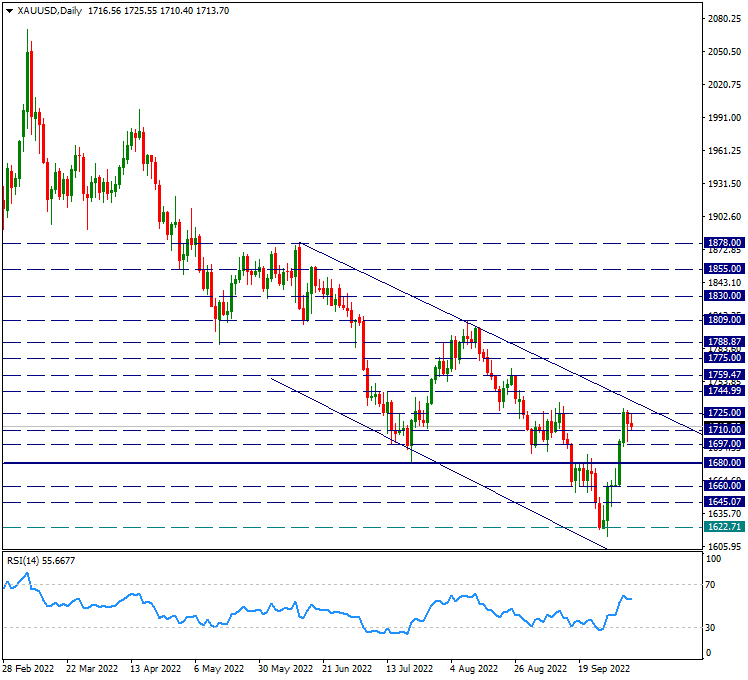

XAU/USD

XAU/USD – The Uptrend Stopped In 1725, What Significance of This Resistance?

In Ounce Gold, the pressure from the 1725 resistance continues with the strengthening of the dollar index during the day.

The 1725 level is an important region that has worked as support and resistance before. If this is broken in the upward direction, the door of 1800 levels can be opened. We pay attention here during the day. Below is the intraday support 1697 level.

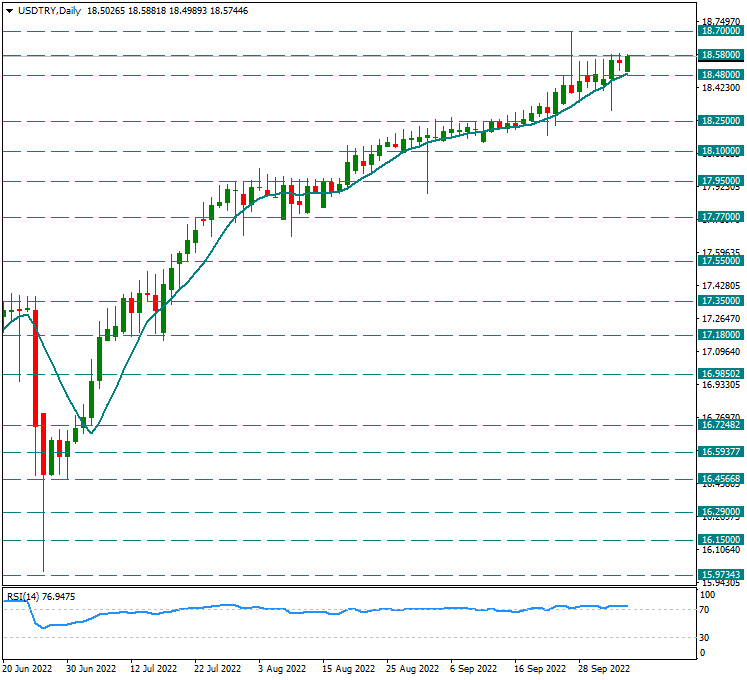

USD/TRY

USD/TRY – Maintains Its Current Image Above 8-Day Average…

While the dollar continues to hold its 8-day average, it is struggling to rise above the 18.58 resistance. There is a squeeze in this region, but we can foresee the continuation of the current picture as long as the daily candle close below the 8-day average is not confirmed.

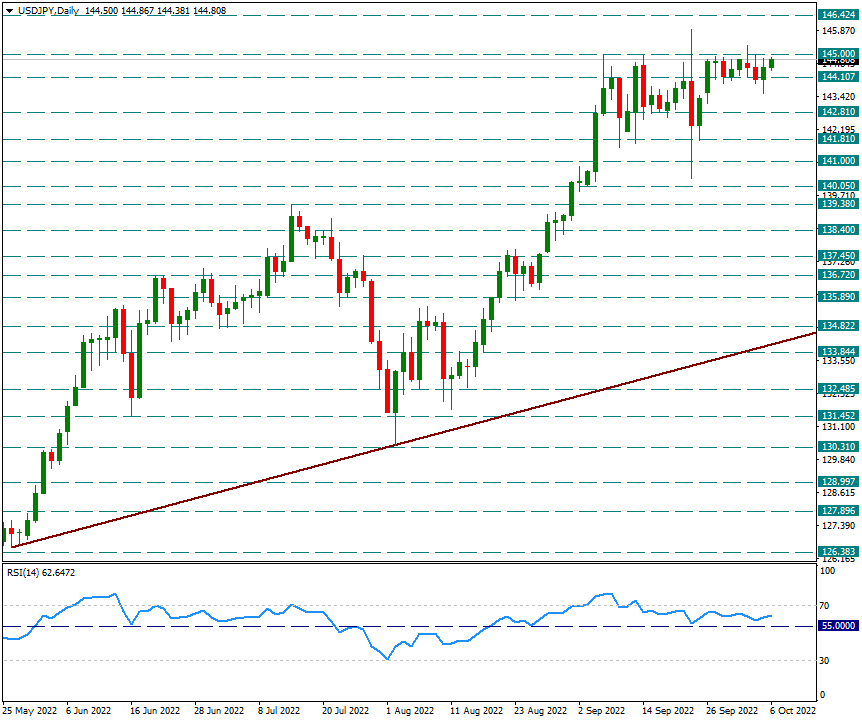

USD/JPY

USD/JPY – Stuck at 145.00 Resistance, Keeps Trying Here…

On the Dollar/Yen side, the tight price movement between 145.00-144.10 continues. After an attack at 145.00 level yesterday, he could not pass here. Another attack today. If there is a hold above 145, the 150 level may come to the fore here.

Intraday support remains at 144.10.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.