*Today and tomorrow, we would like to remind you that there may be decreases in the trading volumes of certain products and changes in trading hours due to the “US Independence Day” holiday.

*While the manufacturing PMI in the Eurozone fell to 44.8 in May, it was expected to decline to 43.6 in June but dropped to 43.4 instead. Looking at Germany’s manufacturing PMI, it decreased from 43.2 to 40.6, with the UK’s manufacturing PMI accompanying the decline by dropping from 47.1 to 46.5.

*ECB/Nagel: “Inflation is not pulling back as desired. We still have a long way to go in terms of policy tightening. Monetary policy signals clearly indicate further tightening.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

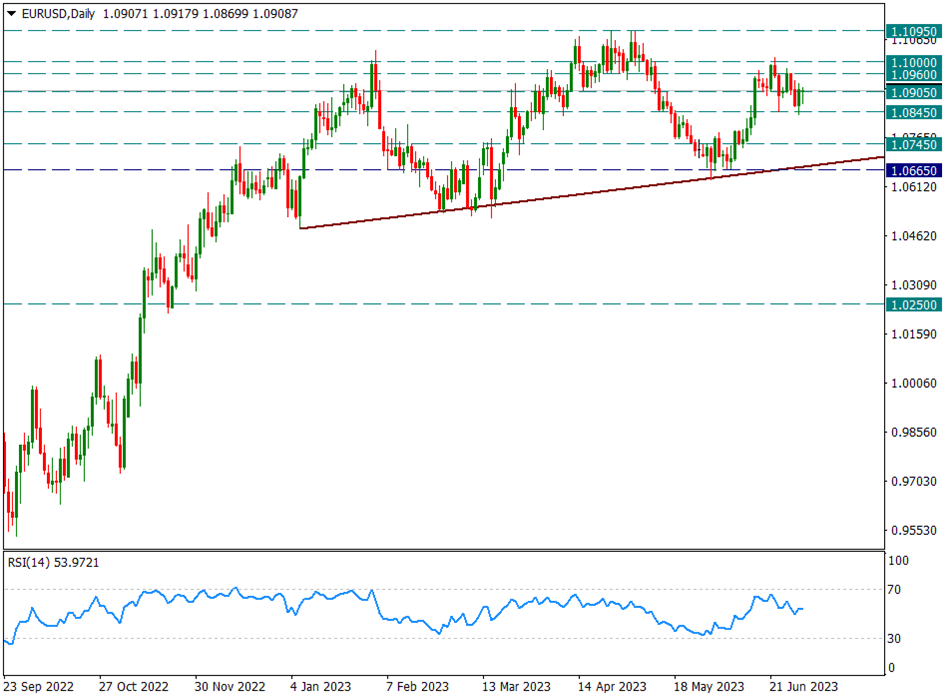

EURUSD

EURUSD – We Will Watch 1.0905 in the Short Term…

While moving within the resistance zone at 1.0905, the attacks on the currency pair remain feeble. Below, the level of 1.0845 serves as a support, and a break below this level could lead to a decline towards the 1.06 region.

In potential attacks, our short-term main resistance is primarily at the level of 1.0905, but we will also monitor 1.10 on a weekly basis as an upper level.

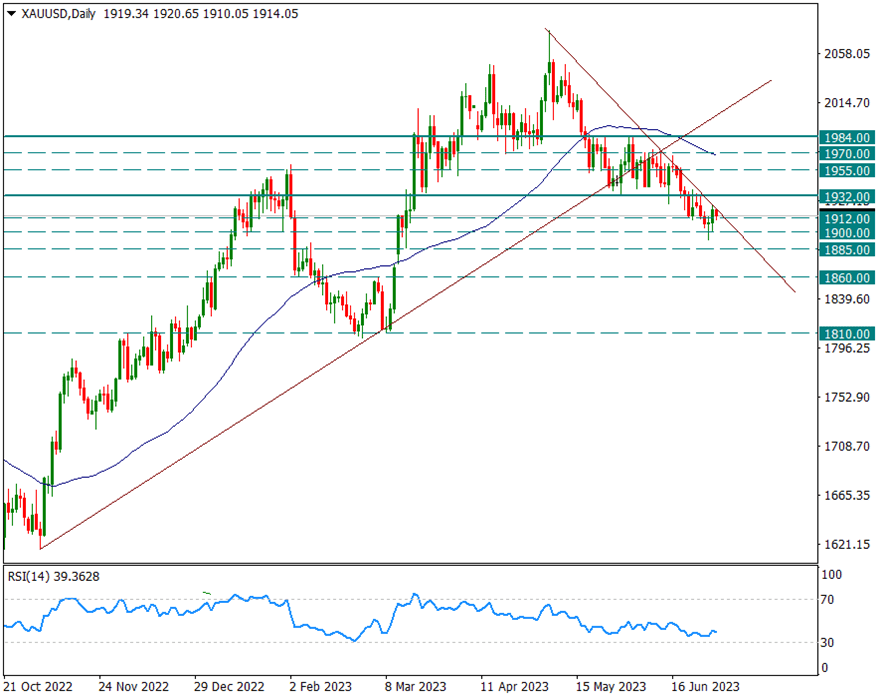

XAUUSD

Ounce Gold – Attention to the Trend Line, Where Attacks Cannot Be Permanent in the Short Term…

The yellow metal was able to sustain the rebound it made last week until the short-term downtrend line from the May peak of 2078. This region corresponds to the level of 1922. Therefore, the level of 1922 will be significant for potential rebounds in the short term.

On Friday, the rebound from this level reversed at 1922, and it is currently consolidating alongside the support level at 1900. In the short term, we will monitor the price movements between 1922 and 1900.

If this downtrend cannot be overcome, the retracements may continue step by step, and the level of 1860 could come into play. If the attempted rallies fail, we will keep an eye on the 1860 scenario.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

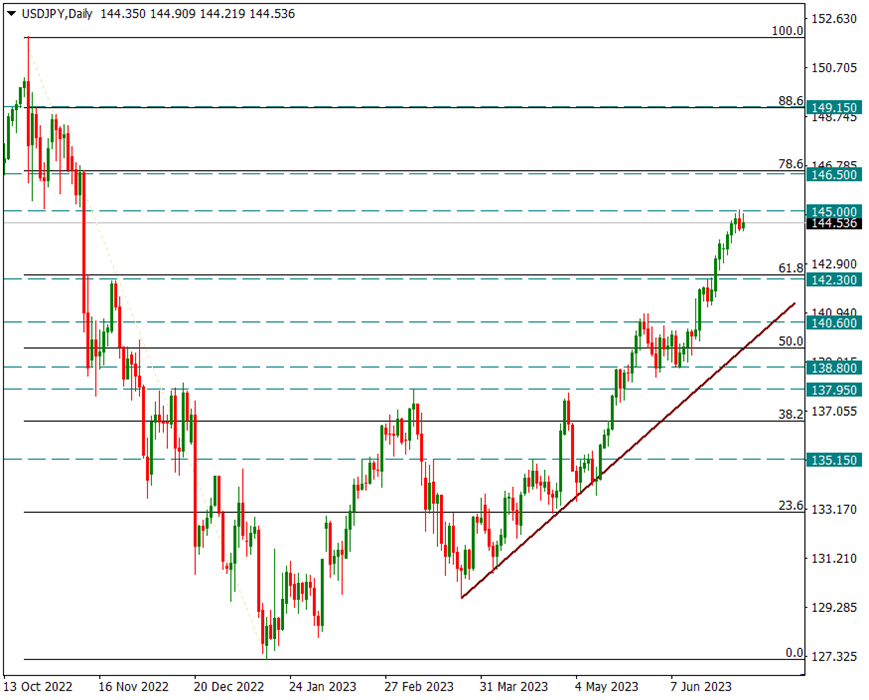

USDJPY

USDJPY – Continuing to Watch 145 Resistance…

The trend towards 145 continues in the Japanese Yen. The Japanese Yen experienced a slight retreat after Friday’s movement against the US dollar in global markets, but we did not witness a significant decline. As the new trading week begins, the USDJPY pair is once again moving towards the 145.00 level. If the pair exhibits pricing above 145, it could trigger the Bank of Japan. Therefore, we will monitor movements above 145.

In the event of possible declines, the main support line in the short term is at the level of 142.30.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.