*In his speech on the interest rate hike process, European Central Bank (ECB) Member Kazimir said that they should increase the interest rates again in July, that stopping interest rate hikes too early is a greater risk than excessive tightening, that upside inflation risks still remain important, and that the interest rate meeting in September He said he would await analysis of the cumulative impact of recent ECB decisions.

*Another ECB Member, Schnabel, also made a headline saying that interest rates should continue to be raised until he sees evidence that inflation is sustainable and returning to the medium-term target of 2%.

Agenda of the day:

21:00 (GMT +3) Speech by ECB Member De Guindos

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

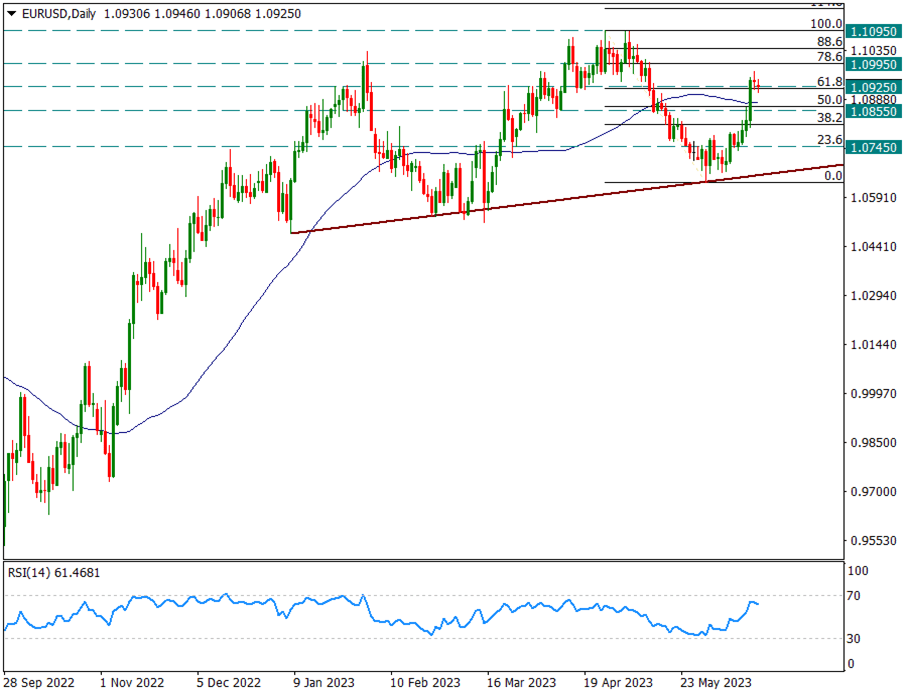

EURUSD

EURUSD – Holds at 1.0925 Despite Profit Selling of Hard Rising…

Despite FED Chairman Powell’s hawkish statements last week, the FED’s keeping the interest rate constant and the ECB’s uncompromising hawkish tone by increasing interest rates led to a strengthening on the Euro side and increased the EURUSD parity to 1.0970s. With the light profit selling of this rapid rise last Friday and the lack of volume in trading with the US markets closed today, the pair eased to 1.0925. But keeping 1.0925 is important for now. However, the pair remains above its 50-day average.

It’s technically important to stay above 1.0925. In addition, the fact that it remains above the 50-day average will cause us to see these profit sales as a temporary situation. Pricing that will remain above this line may support the technical continuation of the movements in favor of the Euro in the parity.

In the continuation of possible attacks, 1.1095 will be on our agenda.

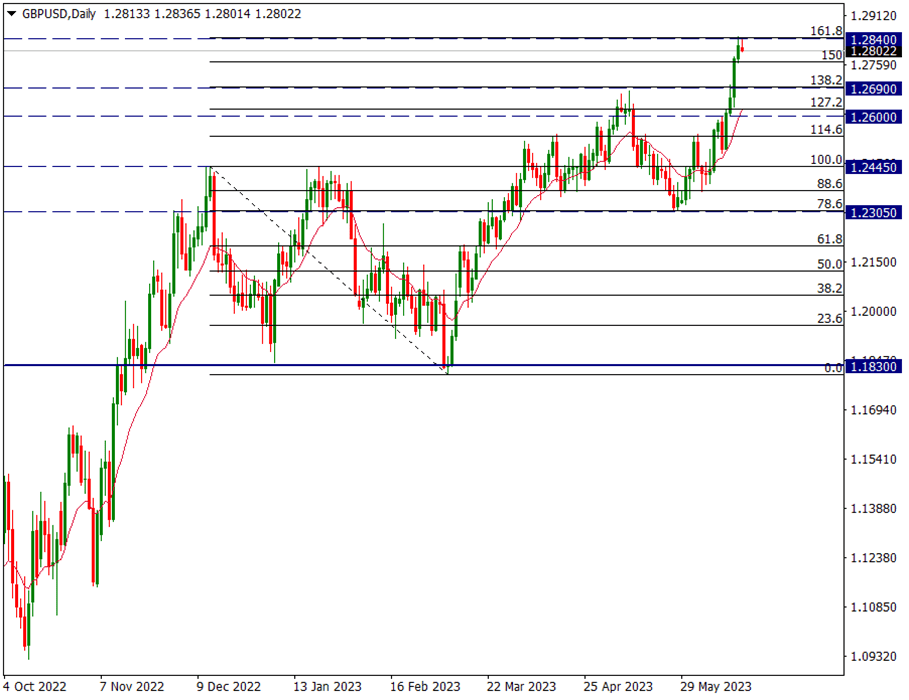

GBPUSD

GBPUSD – Upsides Brake at 1.2840 Resistance, 1.2690 Short Term Major Support…

On the sterling side, we saw a significant premium against the US Dollar last week. The GBPUSD parity also rose accordingly and saw the 1.2840 resistance. We have already mentioned the importance of this resistance. As you can see in the chart, when we drew Fibonacci to the 1.2445/1.1830 horizontal movement, the 1.2840 level coincided with the Fibonacci 161.8 retracement. After the rise experienced during the week, the 1.2840 level worked as resistance both on Friday and on the first trading day of the new week.

We continue to follow this uptrend on the weekly side with a 13-day average. Overall, the 1.2690 level is now support and as the hold above this support continues, the declines can be considered as profit selling.

As we hover above 1.2690, we expect price movements in favor of Sterling to continue.

If it is above 1.2840, the move in favor of Sterling may continue by getting stronger.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

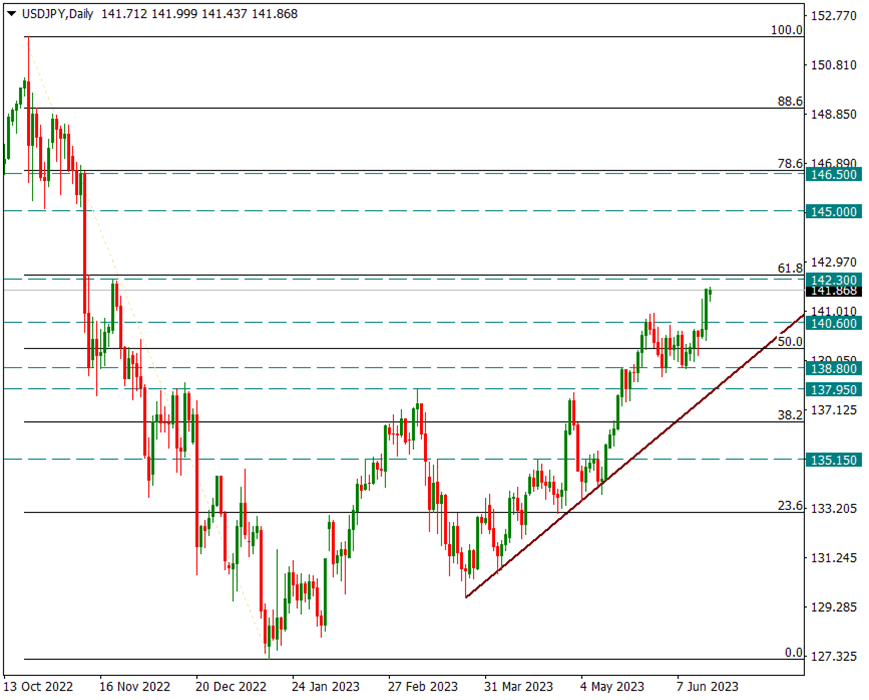

USDJPY

USDJPY – Main Resistance Now at 142.30 in Fast Uptrend…

The Bank of Japan left its monetary policy unchanged last week and made a decision to keep the 10-year Japanese bond ceiling at 0.50%.

The Japanese Yen broke out of the 140.60/138.80 band and continued to rise towards the 142.30 resistance, which we attach more importance to, with the US 10-year government bond rising gradually, while the Japanese 10-year government bond remained stable at 0.50%. This resistance is technically significant as the 151.93/127.21 drop coincides with the Fibonacci 61.8 retracement.

We will follow the rises up to this resistance, but it is technically difficult to break this resistance in the first place. However, our short-term support for trend tracking will now be 140.60 and if the main resistance of 142.30 is broken, ups to 146.50 can be foreseen.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.