*Ahead of the US consumer inflation data, which will be released tomorrow, there is a calm data flow today, except for Canadian construction permits and US crude oil stocks.

*In the first minutes following the opening in the US indices, we follow an uncertain direction and a calm course. The US inflation data to be announced tomorrow may increase the volatility in the markets.

The market is cautiously optimistic about the inflation situation in the USA

*When we look at the US bonds, although the 10-year rate has decreased to 3.99%, it continues at the rate of 4.02% at the moment. 2-years continue at a rate of 4.77%.

* While Crude oil reached the highest level of the year with 84.11 in the oil market, Brent continues to push its 4-month peak with 87.18. Oil buyers see the continuation of the strong recovery from yesterday’s sharp decline.

*Natural gas futures prices rose step by step in the past days, reaching $2.8 this morning. If we break 2.8 resistance strong during the day, it bounced as high as $3.03 and hit a five-month high.

*Canadian building permits were expected to decrease by -3.5% in June, but increased by 6.1%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

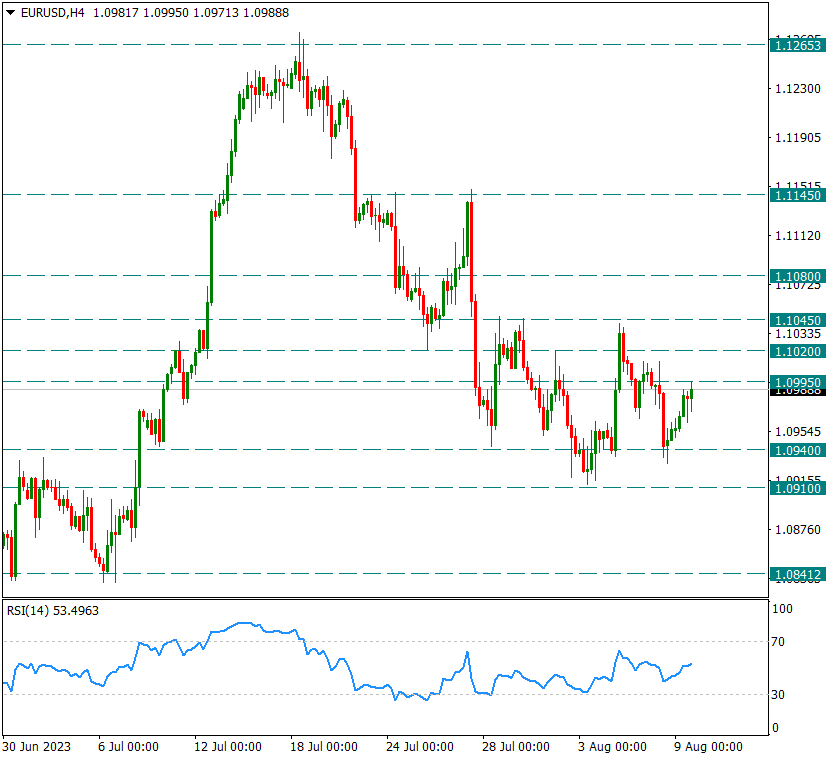

EURUSD

EURUSD – Tomorrow at 1.0995 Resistance Before US Inflation…

On the parity side, we see the intermediate reactions from the 1.0940 level. The main intraday resistance continues to be watched as 1.1045. Below, 1.0940 support is the level to be watched during the day. We think it would be beneficial to stick to the support and resistance levels seen on the chart until the US inflation is announced tomorrow. However, after the inflation data tomorrow, a new trend may start in the parity, depending on the level of disclosure of the data.

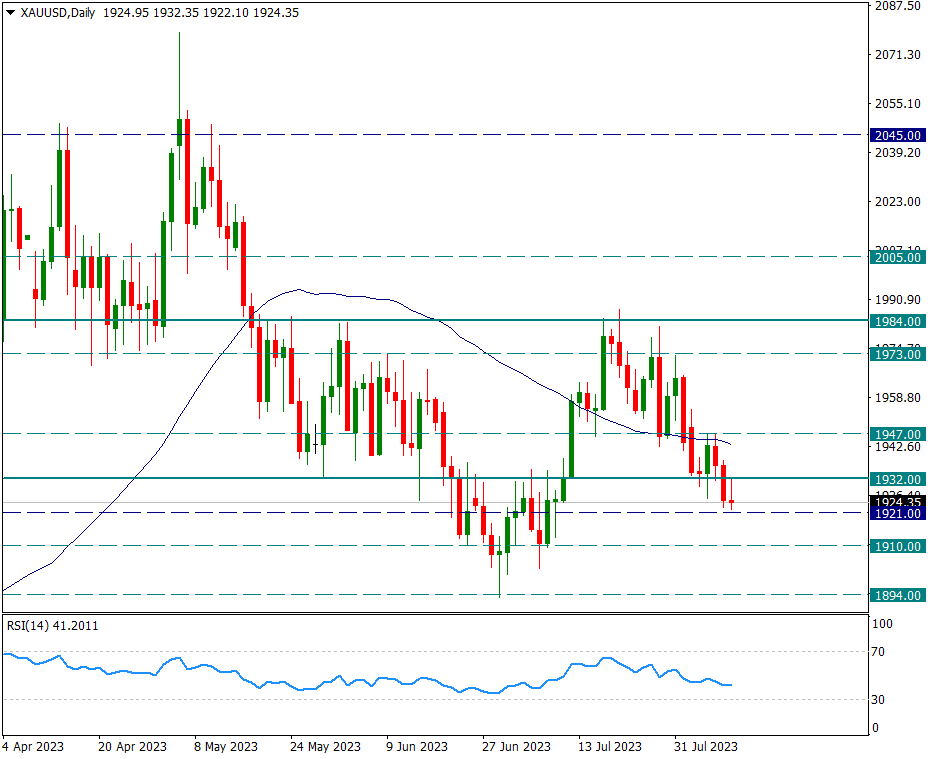

XAUUSD

Ounce Gold -1932 Negative Pressure Can Make You Feel…

After breaking the 1932 support yesterday, the yellow metal reacted to confirm the level it broke today, but soon after it fell back with profit sales. We see that the negative trend is making itself felt under 1932. In the continuation of the possible decline, the main weekly support is the 1894 level.

In the recent movements, 1932 will be followed as the first resistance during the day. Further above, the 1947 level, which corresponds to the 50-day average, will be followed on a weekly basis.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

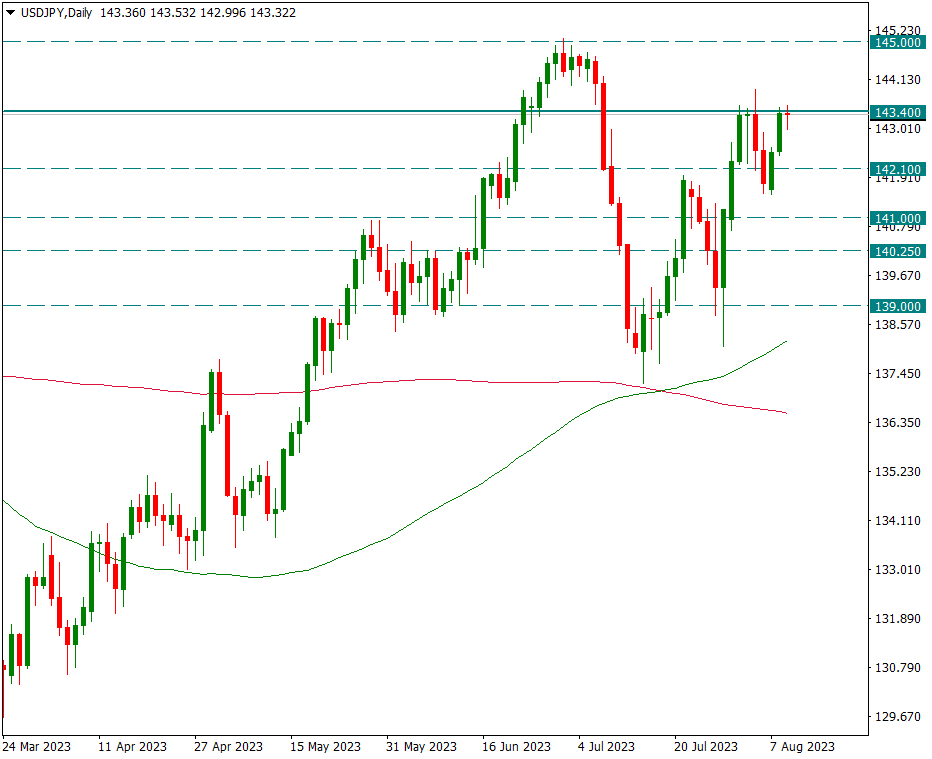

USDJPY

USDJPY – 143.40 Resistance Remains Important…

Movements in favor of the Dollar continue from where they left off last week, and 143.40 resistance stands out here. Since last week, this resistance has been tested in 5 trading days as well as today, but could not be passed. We are focusing on this 143.40 resistance for the continuation and strengthening of the uptrend. If this place is broken, the level of 145 may come to the fore and eyes may be turned on the Bank of Japan again.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.