*In the US, the ADP Nonfarm Employment Change for June significantly exceeded expectations, coming in at 497,000 compared to the anticipated 228,000. Following the release of this data, there were rapid increases in US 10-year and 2-year yields. US 10-year yields reached levels of 4.05%, while 2-year yields climbed to 5.11%, the highest level since 2007. Additionally, initial jobless claims came in close to expectations at 248,000, just shy of the estimated 245,000.

Another data release from the US was the trade balance for May, which stood at a deficit of $69 billion as anticipated. Furthermore, the ISM Non-Manufacturing PMI for the previous month came in higher at 53.9, surpassing the previous month’s reading of 50.3. As a result, we observed a return towards the support level of 1.0840 in the EUR/USD currency pair, while there was a decline in the price of gold towards $1900 per ounce.

*In Germany, factory orders for May exhibited a significant increase, surpassing the expectation of a 1.2% rise with a growth rate of 6.4%. In the UK, the construction PMI for June was expected to decline from 51.6 to 51.0 but instead experienced a sharper drop to 48.9, falling below the threshold level of 50. In the Eurozone, retail sales remained unchanged in May but showed a decrease of 2.9% compared to the same month of the previous year. In Canada, the trade balance for May was anticipated to have a surplus of 1.15 billion Canadian dollars but instead recorded a deficit of 3.44 billion Canadian dollars. The Governor of the Bank of England, Andrew Bailey, stated that he could not provide a specific date for when interest rates would begin to decrease.

*Logan, a spokesperson from the Federal Reserve, expressed concerns about whether inflation would decline rapidly enough and mentioned that the process of economic rebalancing has been slower than expected. Referring to the delayed impact of previous Fed interest rate decisions, he stated that a rate hike in June would be beneficial.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURUSD

EURUSD – Gets Support From 1.0840 But Prices Are Stuck…

The exchange rate continues to find support around the 1.0840 level, and we are witnessing a consolidation with the short-term downtrend line coming from 1.10. Today, the pair approached 1.09 again with a rebound from the 1.0840 support, but it has not yet broken the downtrend line. If it breaks, we could see a new movement in favor of the Euro towards 1.10, but currently, the prices are being suppressed.

Although 1.0840 is currently acting as support, if this zone is broken, we could anticipate a pullback towards the 1.0745 area.

GBPUSD

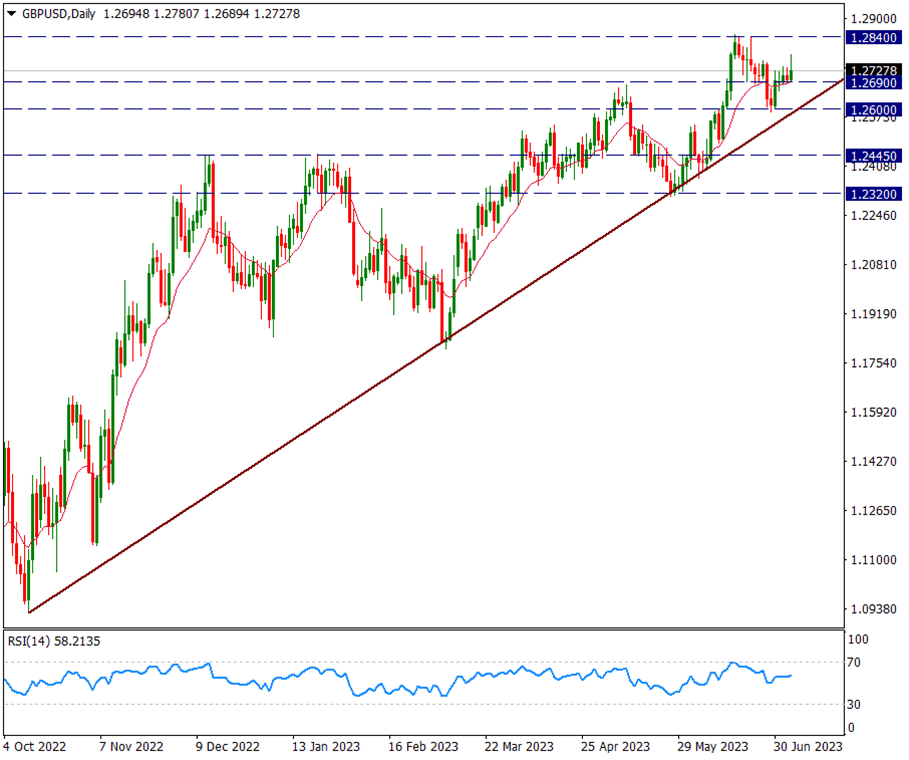

GBPUSD – Watching 1.2690 Support in the Short Term…

The exchange rate is continuing its price movements above the approximately nine-month uptrend line coming from 1.09. After reacting to the trend support, the pair is making efforts to hold above the 13-day moving average. In the short term, the support level at 1.2690 is important as it aligns with the 13-day moving average and could trigger a move towards the 1.2840 peak.

If 1.2690 is broken, the key support level at 1.2600 comes into play, and a break below this support could trigger strong movements in favor of the dollar. In that case, we could see a retracement towards 1.2320.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAUUSD

Ounce Gold – 1932 Re-Tested and Withdrawn Again…

The yellow metal retraced back to the 1900 level and tested the critical level of 1932. After the re-test of this zone, we can observe that the price has retreated again and is approaching 1900. In the short term, we will monitor 1932 as the intraday key resistance and 1900 as the main support.

For the potential tracking of a reverse head and shoulders pattern, we should pay attention to whether 1912 is not broken with a daily candle close.

The Nonfarm Payrolls data from the US tomorrow will be significant in this regard.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.