- Two days left until the FED meeting. When we look at the pricing, we see that the US 10-year bond yield continues to stay above 4%, while the EURUSD parity is again priced below 1.00 and in the 0.99 region close to the evening. Ounce Gold continues to be suppressed and close to 1622 support.

- In the Euro Area, leading inflation data for October and leading growth data for the third quarter were announced. As can be seen, inflation continues to increase in the Euro Zone both on the headline and core side. However, we see a noticeable slowdown in the leading third quarter economic growth. The markets did not react heavily, as this was a forecast expected by the ECB and said at the last meeting.

- Eurozone – Consumer Price Index (annual): 10.7% (Exp. 10.2% ; Previous: 9.9%)

- Eurozone – Consumer Price Index (monthly): 1.5% (Previous: 1.2%)

- Core Eurozone – Consumer Price Index (annual): 5% (Expected: 4.8% ; Previous: 4.8%)

- Eurozone – Economic Growth (quarterly): 0.2% (Exp.: 1%; Previous: 0.8%)

- Eurozone – Economic Growth (yoy): 2.1% (Previous: 4.1%)

- At the weekend, Russia announced that it canceled the grain corridor agreement. After this news, we saw an upward movement in wheat and corn prices. During the day, the Kremlin said in a statement that the Black Sea grain agreement was not viable as it failed to guarantee the safety of transportation.

- The Chicago PMI Index, which was announced in the afternoon, came in at 45.2, lower than the expectations and the previous month.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

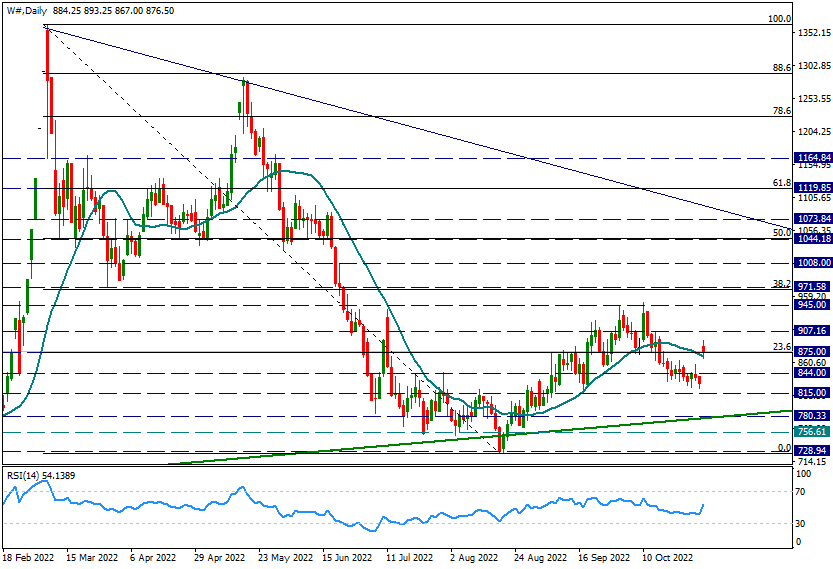

W#

W# – Prices Rise With Russia’s Withdrawal From Grain Corridor…

After breaking the 21-day average that we watched for trend tracking in the past weeks, it was gradually retreating to 815 support. However, over the weekend, Russia’s decision to unilaterally suspend the grain deal in the Black Sea has caused the price to open up in Wheat futures this week and is now priced above the 875 support, the 21-day average. It is obvious that Russia’s withdrawal from the agreement will create problems in terms of food. On the fundamental side, if Russia does not agree to a deal again, it is likely to create an upward push on prices. It will be necessary to follow the news flow here carefully. An effort can be made to reduce this tension and conflict at the G20 meeting to be held in Bali in two weeks.

On the other hand, there are news that there is a contraction in wheat production volume in Australia, another important wheat exporter, due to floods and storms.

From a technical point of view, the prices that jumped up with the news effect are now trying to get support just above the 21-day average. There may be a continuation of positive movements on this average. Technically this will follow. The main weekly resistance in possible attacks is the 945 region first.

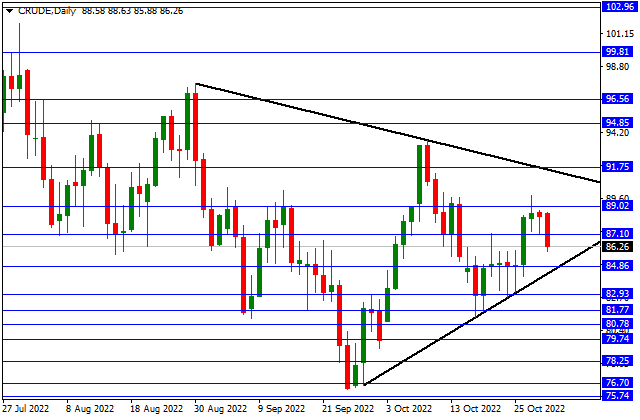

CRUDE

CRUDE – Declining Towards the Lower Band of the Formation…

Crude Oil is withdrawing due to the rise in the Dollar Index and the resistance encountered at 89.02. In the continuation of the retracement, the lower band of the symmetrical triangle formation that we observed in the daily period can be viewed as an important support. If the formation is exited to the downside, the declines can gain momentum. In case of staying in the formation, 87.10 and 89.02 may create resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

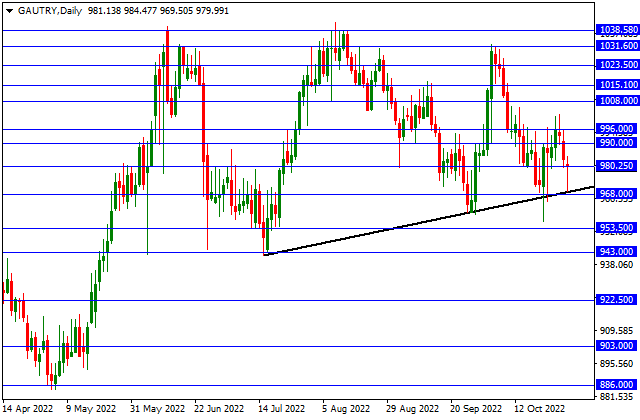

GAU/TRY

GAU/TRY – Recovered with Support from Rising Price Trend…

There have been decreases in Gr Gold TL, until the rising price trend, which we follow in the daily period, with the effect of the decreases in Ounce Gold. With the support of this trend, there were some recovery. In the continuation of the recovery, 990 and 996 can be viewed as resistance. On the pullbacks, 980.25 and the rising price trend can form support.

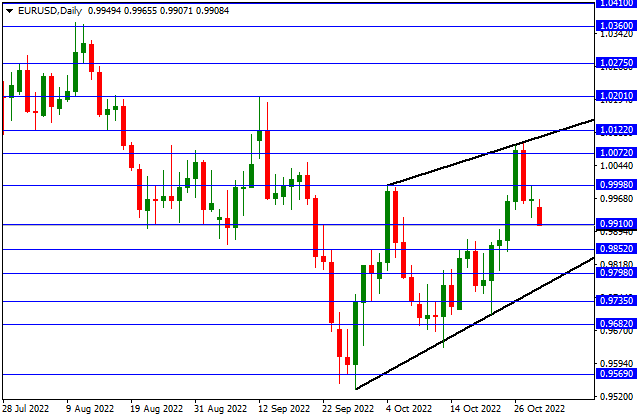

EUR/USD

EUR/USD – 0.9910 Support Tested…

After Russia’s exit from the grain corridor agreement, 0.9910 support was tested in the EURUSD parity, accompanied by increasing global concerns. If a hold on this level is achieved, we can see transactions in favor of the Euro. In this case, it can be viewed as 0.9998 and 1.0072 resistance. If the 0.9910 support is broken and below, the momentum may increase in favor of the Dollar.

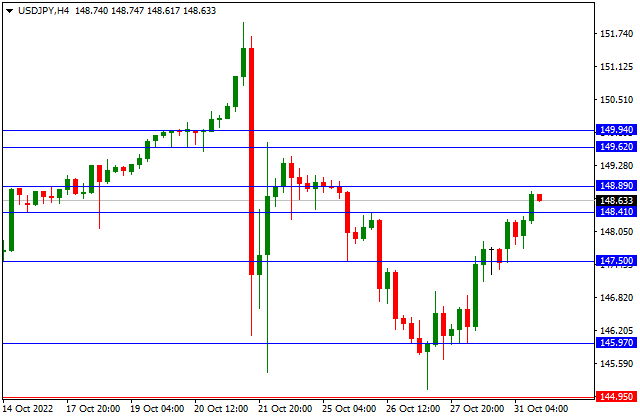

USD/JPY

USD/JPY – Rising Towards 148.89 Resistance…

After the pullbacks in the USDJPY parity, the rises that started with the support from the 145.97 level continue towards the 148.89 resistance. Pricing above this level can be viewed as 149.62 and 149.94 resistance. In pullbacks, 148.41 and 147.50 can form support.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.