- Exports in Turkey for the month of August, announced today, were 21.34 billion dollars, and imports were 32.53 billion dollars. With this data, the Trade Balance gave a deficit of 11.19 billion dollars. Exports for the January-August period were 165,608 billion dollars, and imports were 239.43 billion dollars. The 8-month Trade Deficit increased by 146.3% to $73.435 billion.

- The Consumer Price Index (CPI) for September, which we follow in the Euro Zone, rose to double digits on an annual basis. CPI increased by 10% annually and 1.2% monthly.

- With the continued increase in inflation, the expectation of aggressive interest rate hikes from the European Central Bank (ECB) rose. Unemployment Rates, another important data announced in the Euro Zone and Germany, remained unchanged and were 6.6% and 5.5%, respectively.

- The Personal Consumption Expenditure Index (PCE), announced in the US for August, increased by 0.3% monthly and 6.2% annually. Core PCE, which was followed more closely by the FED in the interest rate hike process, was above the expectation and increased by 0.6% monthly and 4.9% annually. After the PCE is still increasing, it seems like FED has a long way to go in the interest rate hike process.

- FED officials made statements after the PCE data. San Francisco Fed Chairman Daly said that their priority is to reduce inflation, that the economy is not in a recession, it should slow down, and that the rate hikes received and projected will bring inflation back. In his speech, Fed Vice Chairman Brainard stated that monetary policy will be restrictive until it brings inflation back to 2%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

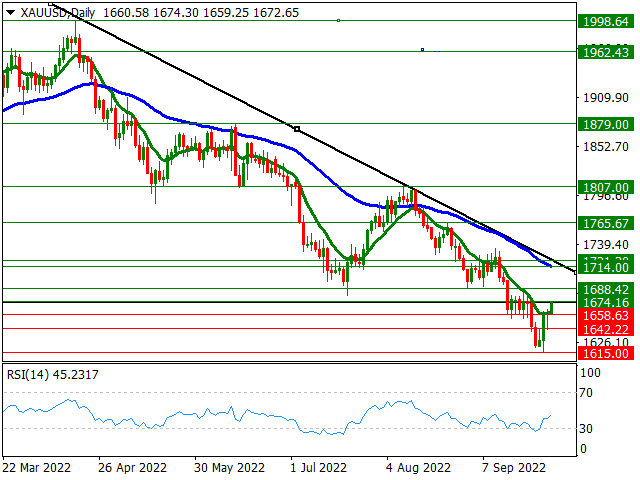

XAU/USD

XAUUSD – It Maintains Its Uptrend Above Its 10-Day Average…

On the last trading day of the week, the 1674 region, which maintains its upward trend above the 10-day average, can be followed as the first resistance band.

If it heads above this region, 1688, the highest level it saw last week, and the black descending trend line with the 50-day average can be followed as the next resistance zones. Below, the 1642 and 1615 bands stand out as the next support zones in possible retracements below the 10-day average.

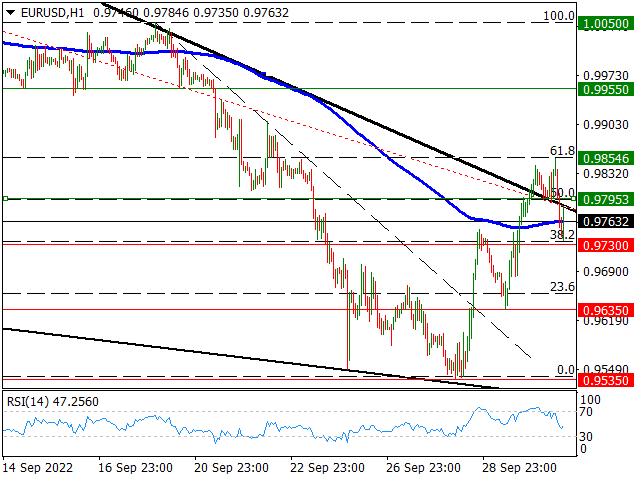

EUR/USD

EURUSD – Euro Zone Loses Its Rising Momentum After Inflation Figures…

The EURUSD parity, which rose to the highest levels of 6 days with 0.9853 in the first trading hours of the European session, gave back its gains after the Euro Zone inflation figures, which rose to double digits.

From a technical point of view, the pair, which regressed below the black descending trend line it broke yesterday, is trying to hold on to its 200 hour average and 0.9730 support band.

In possible decreases below this region, 0.9635 and 0.9535, which is the historical bottom region, can be followed as the next support regions. Above, the 0.9795 band, which is the 61.8% Fibonacci band of the 1.0050 -0.9535 decline and before the 0.9854 level, which is the region where sales are encountered today, can be viewed as the intermediate resistance zone.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

GBP/TRY

GBPTRY – In the 100-Day Average Region…

With the appreciation of the British Pound in the global market in the last trading days of the week, the GBPTRY parity rose to the highest level of the week with 20.81.

From a technical point of view, if the parity, which has risen above its 100-day average, succeeds in closing the weekly above this region, the recovery trend may continue next week. On the other hand, 20.11 and 19.47 levels can create support if the parity gives its direction down.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

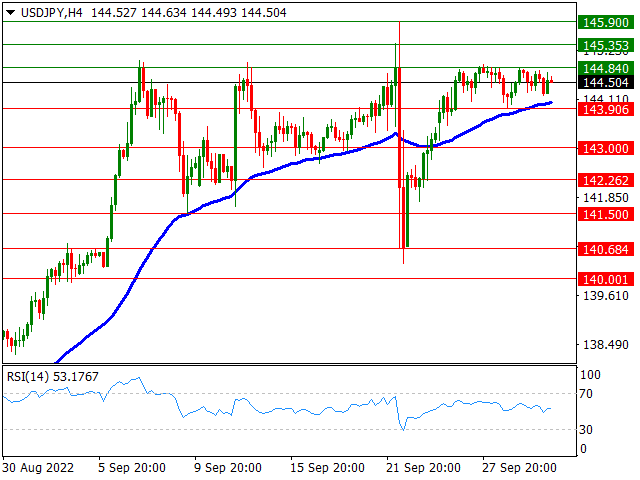

USD/JPY

USDJPY – Uptrend Loses Momentum Under 144.84 Resistance Band…

In the last trading days of the week, with the US Dollar losing ground in the global market, the USDJPY parity paused its upward trend under the 144.84 resistance band, although the pullbacks were not strong.

In the parity, which we will follow as the first support zone of the 50-unit exponential moving average on the 4-hour chart below, if the prices fall below this zone, 143.00 and 142.26 levels come to the fore as the next support zones. Above the 144.84 band, 145.35 and the 145.90 band, which is the highest level it has seen recently, can be viewed as the next resistance zones.

Contact Us

Please, fill the form to get an assistance.