*JOLT’s Job Opportunities data, announced at 17:00 in the USA, was announced as 8,827M against 9,465M expectations and came in at the lowest level since March 2021. According to this data, the labor market in the USA continues to loosen, which is one of the factors that reduces the pressures on inflation. For this reason, the Dollar Index quickly retreated from 104.20 to 103.76. The US slackened rapidly from 4.21% to 4.14% in 10 years.

These data may ease some of the pressures on the FED’s much tighter monetary policy implementation and the September decision may be questioned again. The US Non-Farm Payrolls Change, which will be released this Friday, will be crucial.

The USDJPY parity, which had risen as high as 147.36 during the day, fell to 146.18 as a very sensitive parity to this type of data. On the other hand, US futures markets continue the session with a positive effect.

*Australia Central Bank (RBA) chief Bullock said in a statement that interest rates may need to rise again to keep inflation under control, policy makers are watching the data very carefully and they will make a month-to-month decision for now.

Agenda of the day;

17:00 US Consumer Confidence Index

23:30 US OPI Crude Oil Stocks

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

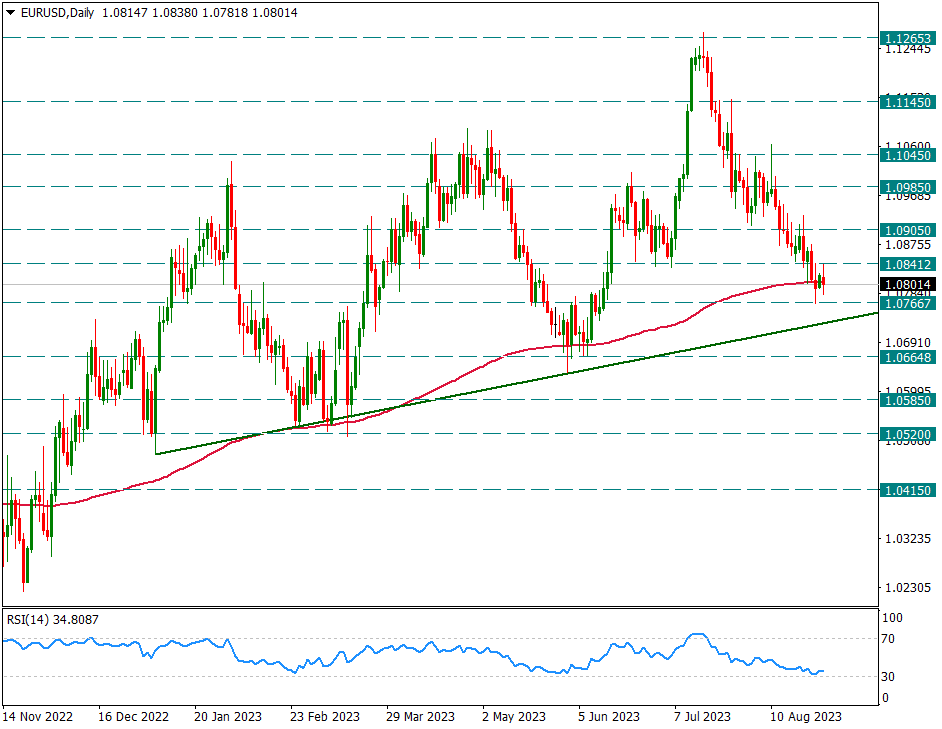

EURUSD

EURUSD – Preparing to Drop Below 200-Day After Nine Months…

The pair is gradually hanging below its 200-day average and is trying to prepare a daily candle close below this average. In this process, we will follow 1.0765 as an important support below. In the price movement below the 200-day average, the outlook in favor of the dollar may become stronger and there may be strong decreases in the parity. The pair had previously cleared below the 200-day average in mid-November 2022 and paved the way for the pair to move up to 1.1265 with upside zigzags.

If there are daily candle closes below the 200-day average, we will gradually follow the declines in the pair according to the support zone.

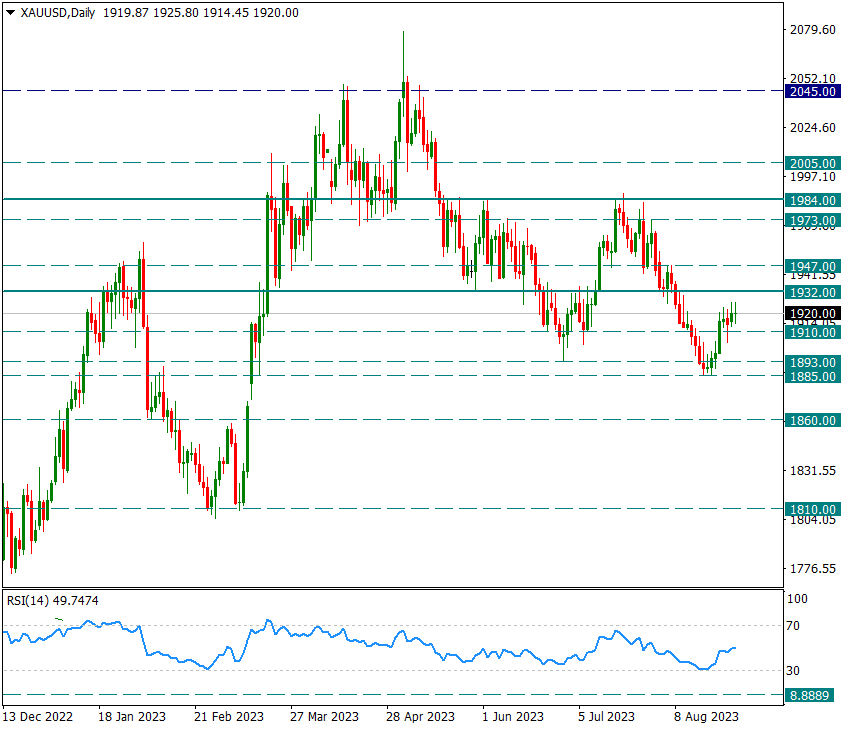

XAUUSD

Ounce Gold – Can Feel The Pressure As It Stays Below 1932…

The slowdown in the rise in the US 10-year bond yield and its progress in the horizontal region in recent days are among the effects that prevent the weakening of the yellow metal. However, the US 10-year bond yield is above 4.20% and the dollar index is preparing to rise to 105. Therefore, these two technical pressures on Ounce Gold are still in question.

We think that the current pressure can be triggered at any time as long as it does not exceed 1932 in the short term. This pressure may make itself felt even more under 1910.

The main support is the 1885 level.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

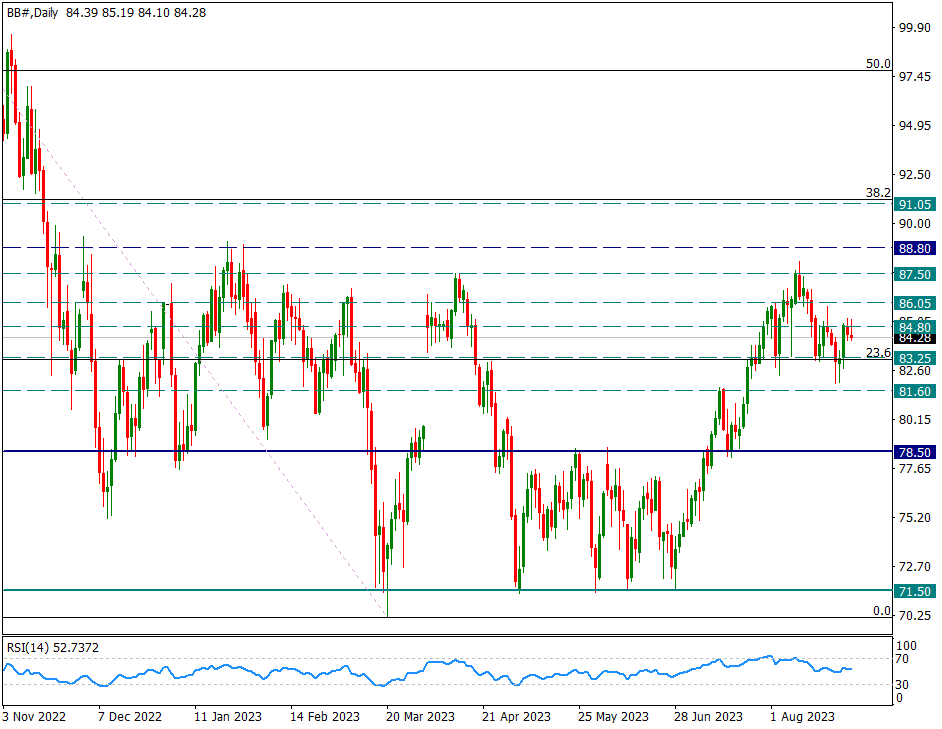

BRENT

BRENT – Attacks In Intraday Trading Stops 84.60 Resistance…

Brent oil side rose as high as 84.60 after receiving a reaction at 83.25. But the resistance here makes itself felt. A few possible four-hour or daily candle close formations above 84.60 in intraday movements may sustain the reactions.

In possible declines, the main intraday support is 83.25 and breaking 83.25 with daily candle may trigger strong selling pressure.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.