*We followed the panel discussion at the European Central Bank conference held in Sintra, Portugal, with the participation of the heads of four major central banks. ECB President Lagarde, Fed Chairman Powell, BOE Governor Bailey, and BOJ Governor Ueda made statements regarding monetary policy. ECB, Fed, and BOE conveyed clear messages in favor of further tightening. Fed Chairman Powell emphasized the need to continue with a tighter policy while highlighting that inflation and employment are strong simultaneously. ECB President Lagarde mentioned that there might be an interest rate increase in July. BOE Governor Bailey signaled the continuation of interest rate hikes by pointing to clear evidence of sustained inflation. As usual, Japan remained the only central bank that did not emphasize interest rate hikes. The Governor of the Bank of Japan stated that core inflation remains above 2%, and they also pay attention to movements in the yen. BOJ continued to diverge from the Fed, ECB, and BOE.

*The recently announced Australian inflation figure is quite positive, and this data could change the balance for the decision of the Reserve Bank of Australia in July. The CPI came in at the lowest level in 13 months, at 5.6%. However, the annual core CPI remaining at 6.4% may not be very encouraging for the RBA. Nevertheless, we can say that the uncertainty of the RBA meeting will increase.

*According to the report released by the National Australia Bank, intervention preparations for the yen, which has been steadily depreciating lately, are expected to be conducted around 145-150. With the anticipation of further speculative transactions in the yen above 145, there is a consideration that the Bank of Japan may intervene by buying yen as it approaches 150. However, it should be noted that central banks generally do not like to intervene in exchange rates. If this happens, it is usually a last resort.

*In the morning session of the European Central Bank conference in Sintra, Portugal:

-From the ECB’s Vasle: We need to continue with a tightening policy at our next meeting.

-From the ECB’s Vujčić: There is a good chance of an interest rate increase in September.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

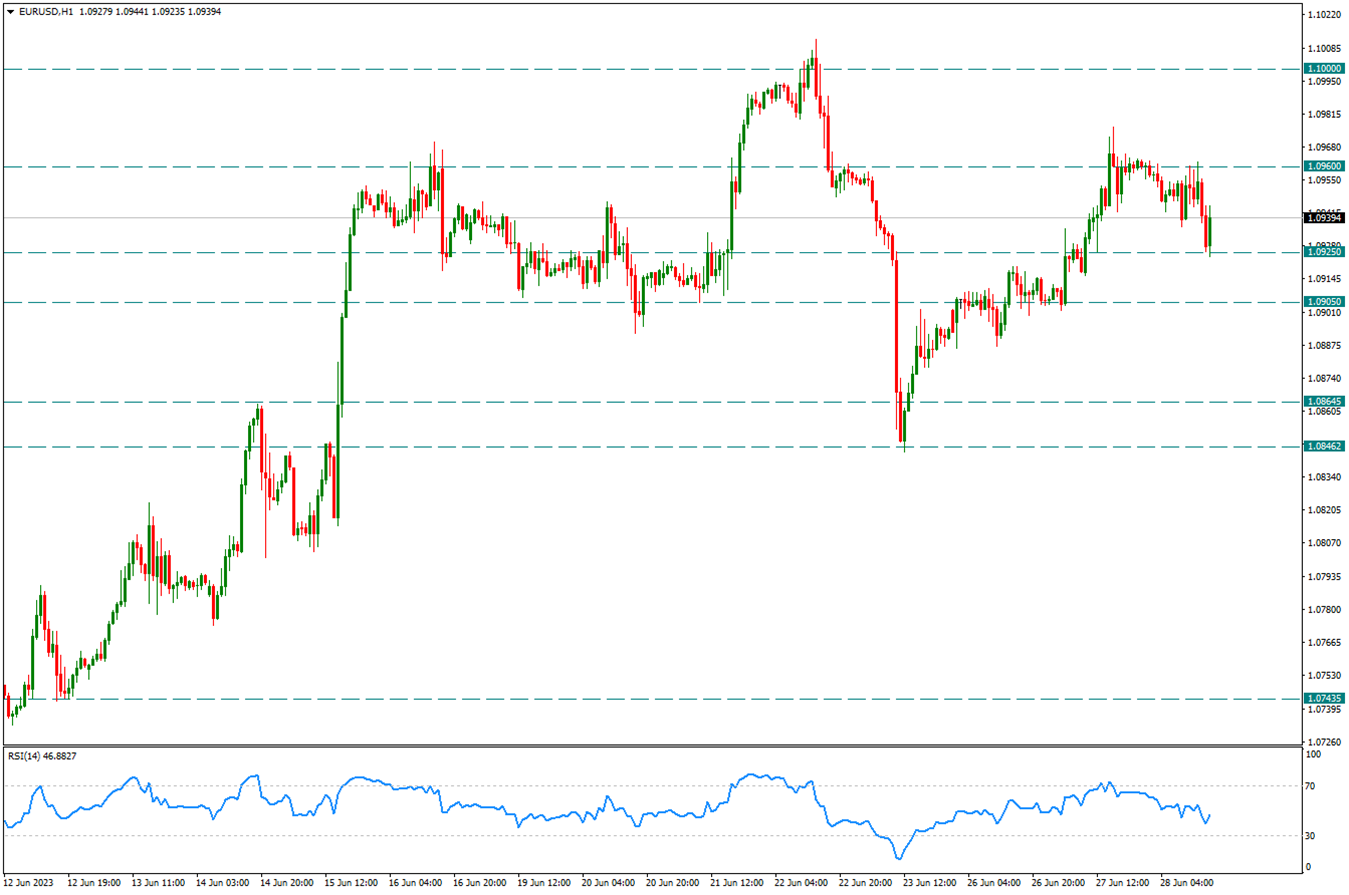

EURUSD

EURUSD – The pair remains above 1.09…

The exchange rate made attempts to rally in the short term but failed to surpass 1.0960 and pulled back towards the support level at 1.0925. While 1.0925 serves as the initial significant support, a break below 1.0905 could potentially lead us towards 1.0850. We will monitor this closely.

Today, the hawkish statements from both Powell and Lagarde have left the movements in the exchange rate uncertain. Therefore, it might be beneficial to pay attention to the support and resistance levels on the chart in the short term and remain cautious.

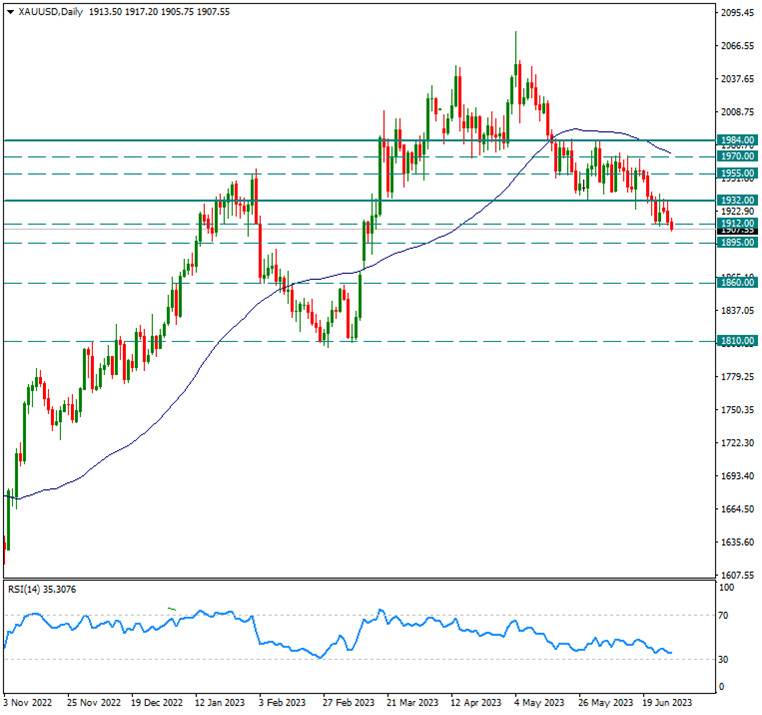

XAUUSD

Ounce Gold – After 1932, 1917 Support Has Been Broken Today…

Previously, gold prices were ranging between 1984 and 1932, with significant support/resistance levels. The yellow metal broke below this horizontal range, indicating a break of the 1932 support level and declining towards the next support at 1917. Subsequently, after a bounce from this support level and a confirmation of the broken 1932 level, today the price broke below the 1917 support. Prices dipped as low as 1907 intra-day. Now, our focus will shift to the 1895 level, and if it is broken, the decline could deepen towards 1860. In the short term, unless we see a bounce back above the 1932 level, any upward movements are likely to be temporary.

We are not seeing a clear recovery in the US dollar index, but from a fundamental analysis perspective, one of the factors putting pressure on gold is the clear message from the European Central Bank about continuing with interest rate hikes. Additionally, while we may not see a significant recovery in the US dollar index, the Federal Reserve is expected to raise interest rates at least twice more this year.

The ongoing global tightening is weighing on gold as well.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

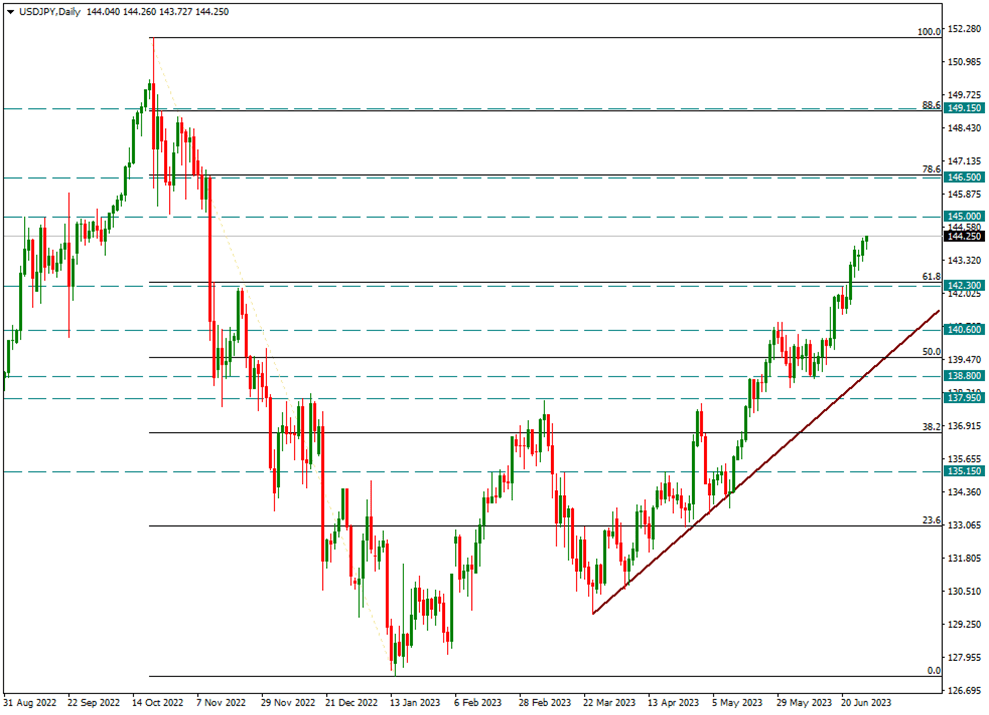

USDJPY

USDJPY – Pair Advances Step By Step Towards 145…

Today, the USDJPY pair sparked a lot of discussions. After lingering around the 142.30 resistance for a while, USDJPY broke above it and gained momentum, climbing up to 144.20 today.

According to international reports, the Bank of Japan, which intervened at certain points while reaching the 151 peak, is expected to signal intervention at 145 and above.

Technically, after breaking the 142.30 resistance, which is the Fibonacci 61.8 correction of the 151.93/127.21 decline, the dollar gained momentum. It is now heading towards 145, and the 146.50 level, which corresponds to the Fibonacci 78.6 correction, becomes significant.

While monitoring this upward trend step by step, our short-term support is at the 142.30 level.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.