*Gross domestic product (GDP) in Germany was expected to grow by 0.3% in the first quarter, while a contraction of -0.1% was recorded. A growth of 0.2% was recorded compared to the same quarter of the previous year, and the growth expectation of 0.8% was not met. There was no change in the unemployment data, which was published just before the economic growth data. Unemployment in Germany remained at the expected level of 5.6%.

*Eurozone economy grew by 0.1% in the first quarter of 2023, against the 0.2% growth expectation. There was no change with 0.0% in the previous data. Compared to the same quarter of the previous year, 1.3% growth was realized against the 1.4% growth expectation. The previous data on the indicator was at a growth rate of 1.8%. In Germany, consumer price index increased by 0.4% in April, as announced the previous month. Monthly expectations were for a 0.6% increase. Compared to April of the previous year, it was announced that it increased by 7.2%, just below the 7.3% expectation.

*In the USA, personal consumption expenditures increased by 0.1% monthly in March and increased by 4.2% compared to the same period of the previous year. Core personal consumption expenditures, on the other hand, increased by 0.3% on a monthly basis and increased by 4.6% compared to the same period of the previous year.

*The Canadian economy grew by 0.1% in February. While the expectations were for 0.2% growth, the previous data was 0.6%.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

EURJPY

EURJPY – Euro Stronger and Pair Rising Faster…

The Japanese Yen had depreciated rapidly as of this morning on the statements of the Bank of Japan that it could not give any tightening message in its monetary policy, as well as that it could “loose even more if necessary”. However, the Euro side continues to stand strong. As we can see from the EURUSD parity, the parity thinks twice while falling below 1.10 and gets a reaction every time these days. While the European Central Bank’s statement that it will continue to increase interest rates keeps the Euro strong, it makes it even stronger against the Japanese Yen, which is a victim of the opposite policy.

While the EURJPY was at 147.85 this morning, it reacted up to 149.55 after the decision. It surpassed the October 2022 high on the upside. The main support point is now at 148.35. If it holds on this region, the rises may take step by step. First of all, 151.38 and then 155.20 levels may be in our follow-up in the medium term.

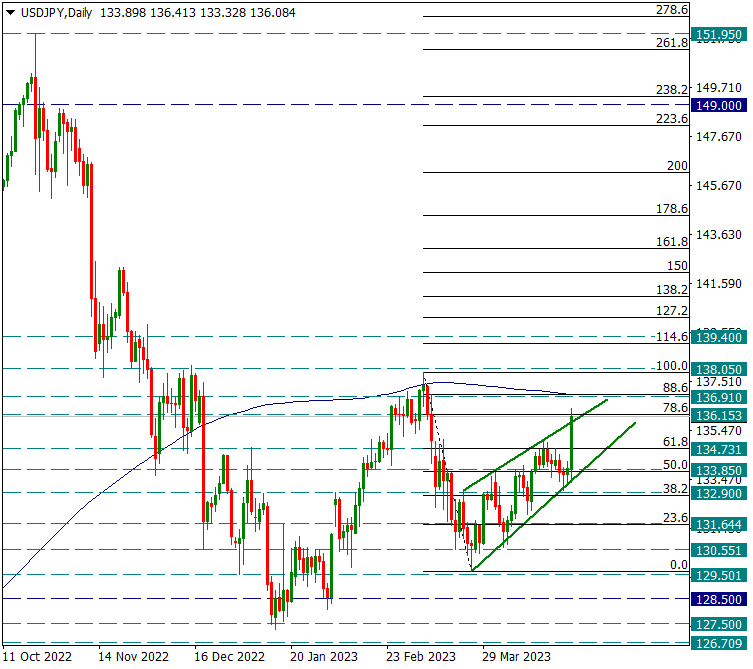

USDJPY

USDJPY – Rising Triggered by BOJ’s Extremely Loose Policy Continued During the Day…

The decisions of the Bank of Japan caused sudden depreciation on the Japanese Yen side today and pushed the USDJPY parity higher. The BOJ kept interest rates at -0.1%, while the 10-year Japanese government bond yield, anchored to 0.5%, remained unchanged. There was some expectation in the markets that the BOJ could raise the interest rate ceiling to 1%, but the bank did not give up its excessively loose monetary policy and did not tighten it. The bank also decided to change the forward guidance, where the main idea was the continuation of the extremely loose monetary policy.

With this easing move by the Bank of Japan, the USDJPY parity reacted from 133.85 to 136.40. 134.75 resistance was important in intraday movements. With this hard attack, as you can see on the chart, Fibo reacted up to the 78.6 correction zone. As long as it stays above 134.75, it is possible for the pair to continue its uptrend up to the 200-day average.

The 200-day average was tested on March 8, 2023 but could not be broken. If it is broken with daily candles this time, a dollar rally can start in the pair.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

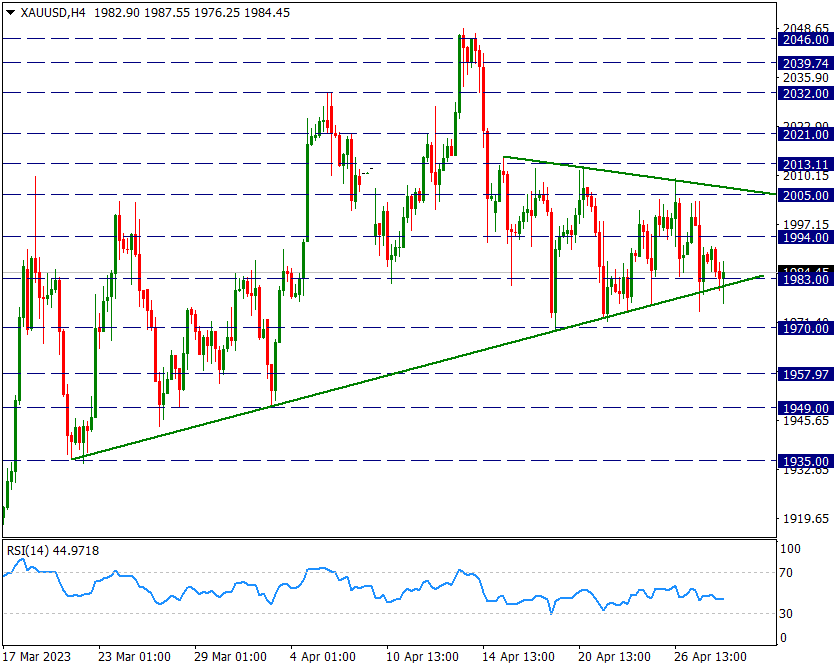

XAU/USD

Ounce Gold – Continuing to Push the Lower Band of the Narrowing Triangle…

While Ounce Gold continues its movements in the compression triangle, it has been compressing the lower band of this triangle for the last 1-2 days. This lower band now coincides with the 1983 support. The downward break of the narrowing triangle may suddenly draw the eyes to 1935. For this reason, it is useful to be careful about the movements around the 1983 support zone in the coming days, maybe even hours.

In possible attacks, intermediate resistance can be seen as 1994 and main resistance as 2005 level.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.