- All assets were literally crushed under the strength of the US Dollar on the last trading day of the week. The mode of buy US dollars and sell other assets was dominant in the market. Stock Exchange Global Stock indices, important major units, commodities such as Gold and oil experienced hard sales. The US Dollar Index rose to a new 20-year high of 112.50.

- With the announcement of the biggest tax cuts since 1972 by the Finance Minister Kwasi Kwarteng in the UK, the UK 5-Year Bond yield hit 4.13% with a record 58 basis points daily increase. GBPUSD parity, on the other hand, dropped to 1.10, the lowest region it has seen since March 1985. The daily loss exceeded 2.50% in the pair.

- In the Euro Zone, where the leading Manufacturing and Services PMI figures for September are followed, the common currency fell to the bottom regions of the last 20 years with 0.9736 against the US Dollar. According to S&P Global/BME preliminary sectoral annual reports, the contraction in the manufacturing and service sectors in Germany deepened in September due to rising energy costs. Manufacturing PMI in Germany, the economic powerhouse of the Eurozone, came in at 48.3 this month, below both the expectations and the previous (49.1). Thus, the index fell to its lowest level in 27 months. Services PMI fell to 45.4 from 47.7 previously recorded. This is the lowest level in 28 months. Across the Eurozone, Manufacturing PMI fell sharply from 49.6 to 48.5 and Services PMI fell sharply from 49.8 to 48.9 in September.

- US futures stock indices hit their lowest level in two years. US 10-year bond yields rose to a 12-year high of 3.82%. The strengthening seen in the US Dollar index and bond interest pushed Gold Ounces to the lowest region since April 9, 2020 with 1641.

- On the energy front, the decline in oil prices was also at the forefront. Fears that major Central Banks’ interest rate hikes will push the global economy, especially the Euro, into recession feeds demand-side concerns and puts pressure on oil prices. In addition, the strengthening of the dollar index creates extra weight on oil prices. Crude Oil price regresses below the $80 band, while Brent oil price is priced in the $86 region. Natural gas futures prices, on the other hand, fell to the lowest region of the last 10 weeks at $6.73.

- Towards the last trading hours of the week, FED Chairman Powell’s speech at the FED Listens event at 21:00 CET may be important.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

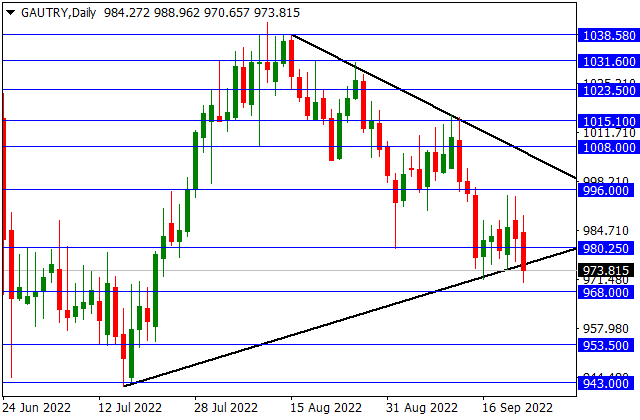

GAU/TRY

GAU/TRY – The Lower Band of the Formation is Tested…

In Gr Gold TL, the lower band of the symmetrical triangle formation that we watch daily is being tested. In case of a downward exit from the formation, 968 and 953.50 can be viewed as support. In case of staying in the formation, we can see rises again. In this case, 980.25 and 996 can be followed as resistance.

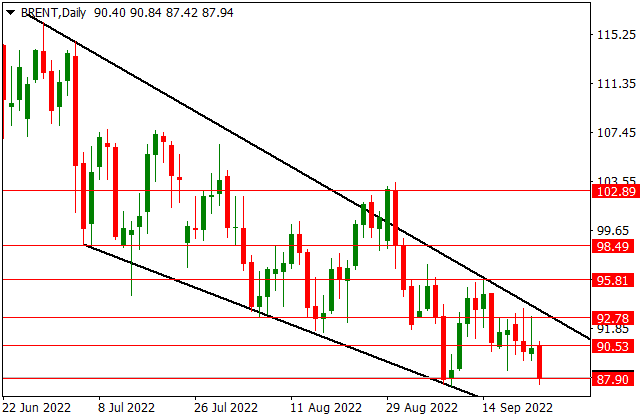

BRENT

BRENT – Retesting 87.90 Support…

The 87.90 support, which was previously tested and not broken in Brent Petrol, is being tested again. If this level is broken, 85.54 and 84.10 can be viewed as support. We can see recovery in case of holding above 87.90 support. In this case, 90.53 and 92.78 can create resistance.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

XAG/USD

XAG/USD 19.0925 Support Retested…

After the pullbacks that started with the resistance encountered in the falling price trend in silver, the support of 19.0925 was tested. This level was also tested on Tuesday and could not be broken. Breaking this level and pricing below may increase the downside momentum. In this case, 18.65 and 18.22 can be viewed as support. In case of holding above 19.0925 support, we can see rises. In this case, 19.46 and the falling price trend may form resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

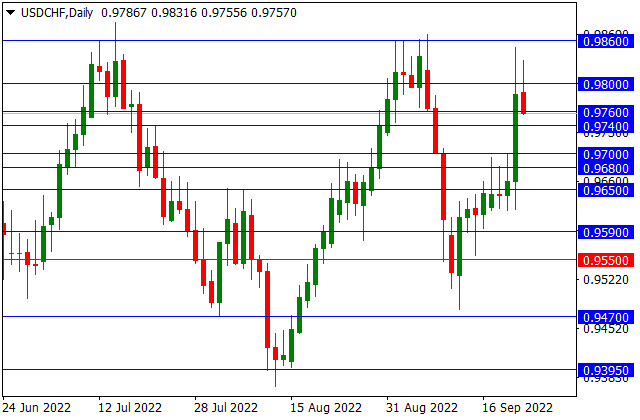

USD/CHF

USD/CHF – Withdrawn Up To 0.9760 Support…

After the interest rate hike by the FED and the Swiss National Bank (SNB), there were increases in the USDCHF parity to the resistance of 0.9860, which was previously tested and could not be passed. With the resistance encountered at this level, there were pullbacks again and 0.9760 support was tested. In case of holding above this level, 0.9800 and 0.9860 can be viewed as resistance. If the 0.9760 level is broken and below, 0.9740 and 0.9700 support can be formed in the pricing.

Contact Us

Please, fill the form to get an assistance.