- In Germany, the Manufacturing PMI for February, announced today, dropped to 46.5 from 47.3, while the Services PMI rose to 51.3 from 50.7. Likewise, in the Euro Area, Manufacturing PMI fell from 48.8 to 48.5, while Services PMI rose to 53.3 from 48.7. On the UK side, PMI data came in positive. Manufacturing PMI rose from 47.0 to 49.2 and Services PMI rose from 48.7 to 53.3. Sterling gained value against the US Dollar after positive data in the UK.

- The Zew Economic Index for Germany and the Euro Zone, announced today, came in above expectations. The index rose to 28.1 in Germany and 29.7 in the Eurozone. In the evaluation made by Zew, it was stated that most of the participants thought that the economy had improved in the 6-month period and that the expectations for long-term interest rates increased.

- In Canada, the Consumer Price Index announced for January fell below expectations, increasing 0.5% month on month and 5.9% year on year. The previous data came at the level of -0.6% and 6.3%, respectively. Core CPI, on the other hand, decreased by 0.6% monthly and increased by 5.0% annually. Apart from these data, Retail Sales, another important data, increased by 0.5%, while Core Retail Sales increased by 0.6%. The Canadian Dollar fell against the US Dollar after the data.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

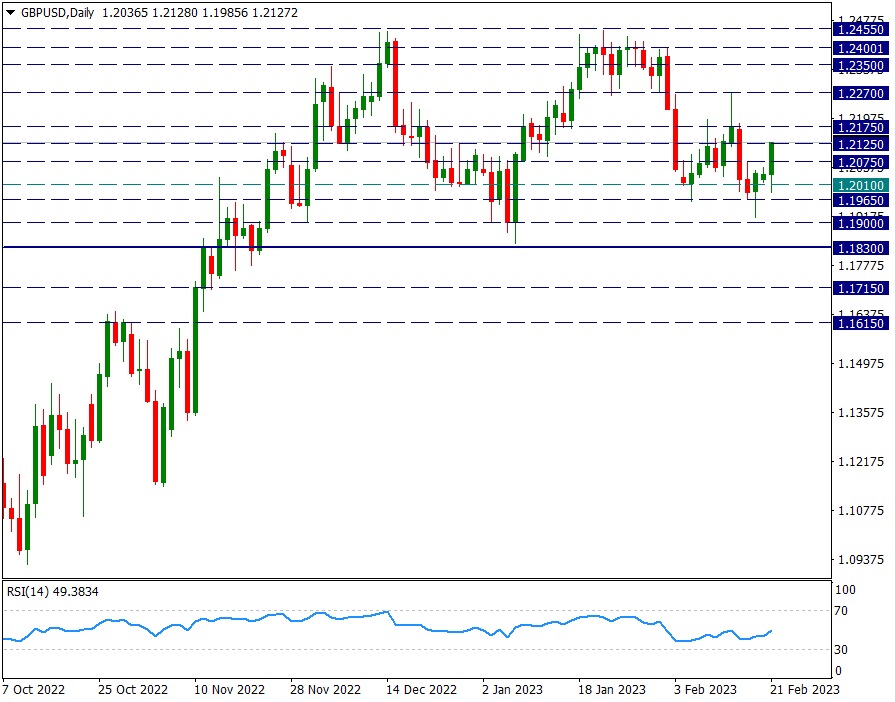

GBP/USD

GBP/USD – Rising After UK PMI Data Draws Attention…

During the day, the Dollar Index makes its weight felt a little more in the global markets. However, that didn’t hold true for the Sterling, and it appreciated against the US Dollar today.

The expectation that the Bank of England could increase interest rates more easily after the PMI data from the UK that came above the expectations during the day caused the Sterling to gain strength.

GBPUSD parity increased from 1.20 to 1.2115 levels. For the incoming reactions, 1.2175 resistance will be technically more important during the day. This region was tested in the attack last week, the rise that day jumped up to 1.2270, but the daily close remained at 1.2175. For this reason, it will be technically important to break this resistance with a daily candle in the continuation of possible attacks.

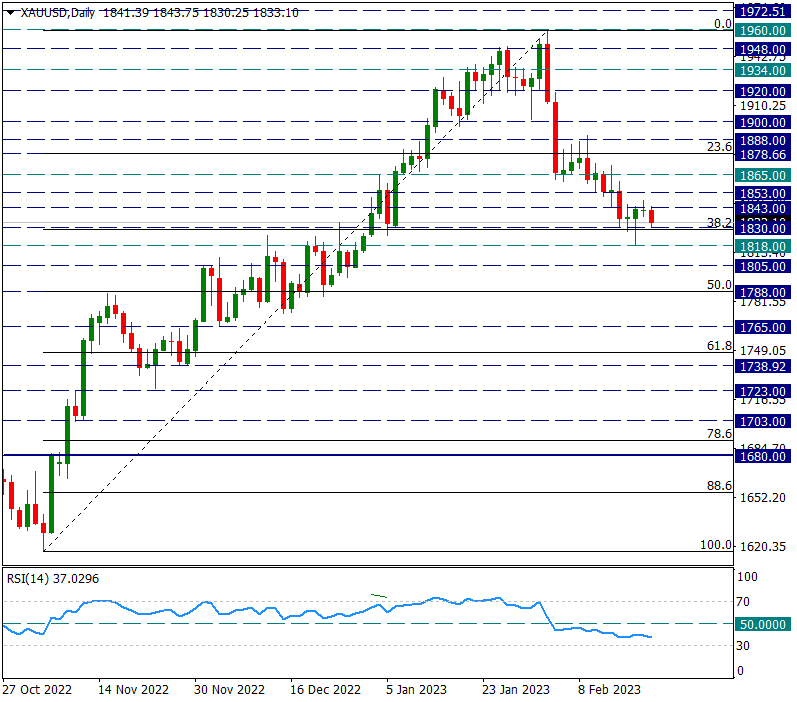

XAU/USD

XAU/USD – Under Pressure Due to The Dollar and Pushing the 1830s…

Markets were quiet yesterday due to the US holiday. As of today, we can think that the market has reopened and there is an image in favor of the US Dollar. While the US 10-year bond yield maintains its upward trend, this situation puts pressure on Ounce Gold. With this edition, 1830 support, which was tested for the last three days last week, is being tested again. This region is also important as it coincides with the Fibonacci 38.2 retracement of the 1615/1960 rise. If the 1830 support, which coincides with this important correction zone, is broken, the declines may turn towards the Fibo 50 correction.

In possible reactions, the first resistance will be 1843, as it was last week.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

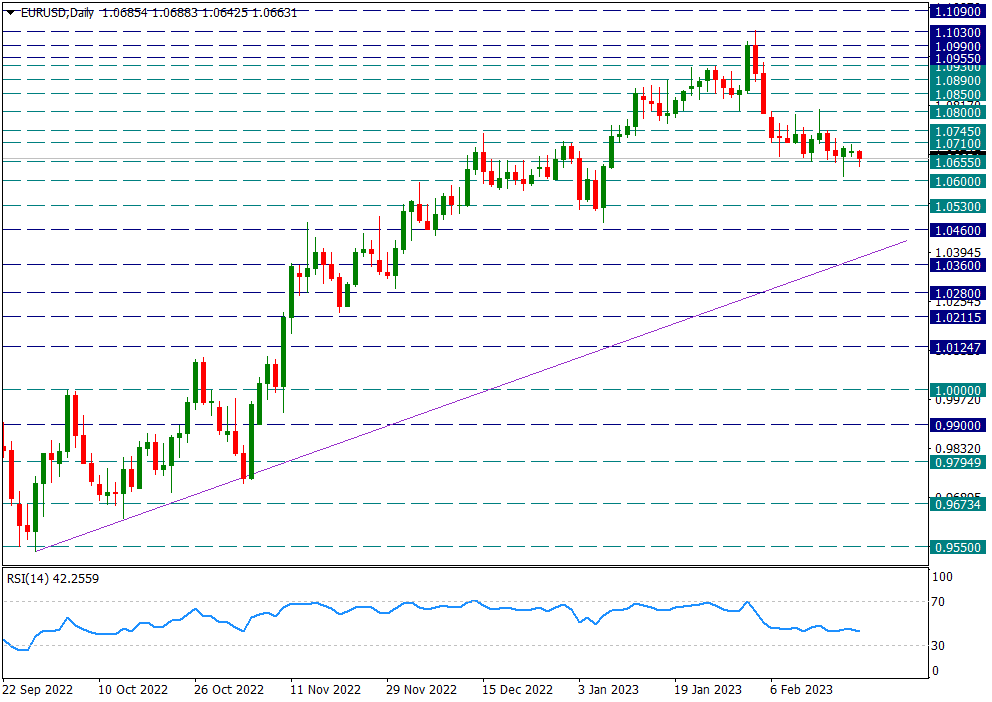

EUR/USD

EUR/USD – 1.0655 Support Persistently Retesting…

On the parity side, the movements in favor of the dollar continue to be weighted and the 1.0655 support is being tested again. This region was tested 7 days over 11 working days. It remains a strong support. If this region is broken with the daily candle, the downward trend in the parity can continue by gaining strength. In this case, the 1.0460 level will come to the fore.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.