As we close the week, our eyes were on the US 10-year bond yield, Ounce Gold and Dollar Index. The US 10-year bond yield, which declined to 3.32% during the week, has been reacting since yesterday and has reached 3.5% again today. The US Dollar Index reacted slightly to this, albeit slightly, and US stock markets have been under pressure since Wednesday.

We followed the statements of the Governor of the Bank of Japan in the market today. BOJ President Kuroda stated that they will continue the current easing policies in order to reach the 2% inflation target in the long term, and that the bond interest ceiling adjustment made at the last meeting is necessary and they do not regret it. He said that loose monetary policy will continue. The USDJPY pair moved up to 130.50 levels by moving about 200 pips during the day after the BOJ statements.

FED members will enter the blackout period before the February 1 meeting. Speaking before this period, Harker reiterated in his statements that a 25 basis point rate hike process should be started.

In addition, Harker added that inflation will determine how much interest rates will rise. He said that interest rates are currently at the highest level of 5%. Besides, many members make statements stating that the level of interest rates will be as important as how long they stay at those levels.

China will enter the new lunar year and will be closed next week.

During the day, data from the UK and Germany were announced. UK retail data overall fell short of expectations and the previous month.

The German Producer Price Index, on the other hand, came back negative on a monthly basis.

- UK – Core Retail Sales (YoY): -6.1% (Previous: -5.6%)

- UK – Core Retail Sales (MoM): -1.1% (Previous: -0.3%)

- UK – Retail Sales (YoY): -5.8% (Previous: -5.7%)

- UK – Retail Sales (MoM) : -1.0% (Previous: -0.5%)

- Germany – Producer Price Index (YoY): 21.6% (Previous: 28.2%)

- Germany – Producer Price Index (MoM) : -0.4% (Previous: -3.9%)

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

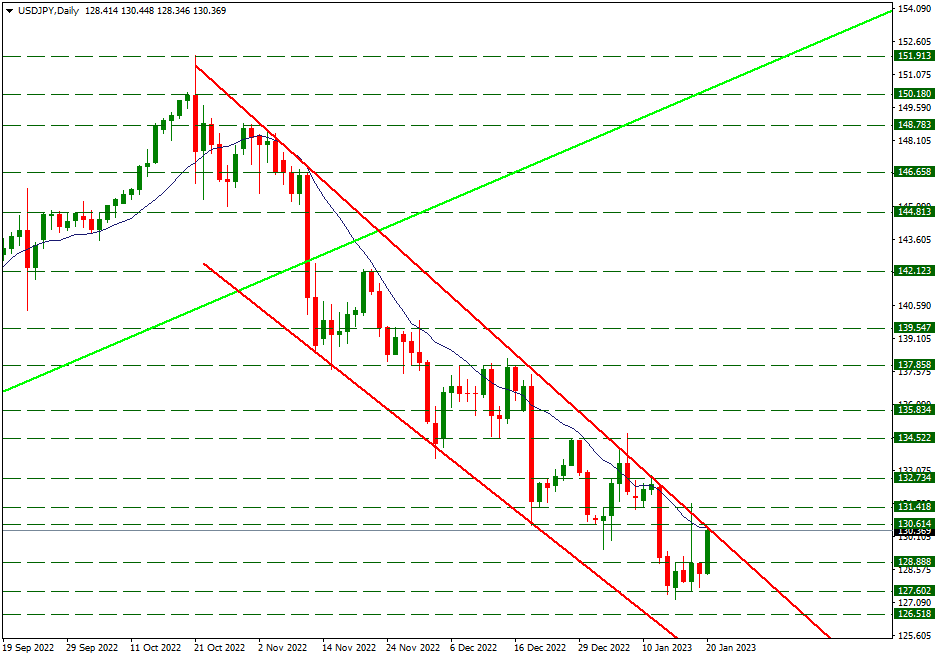

USD/JPY

USD/JPY – Above 130 Level After BOJ Chairman Kuroda Statement…

After the Bank of Japan (BOJ) Governor Kuroda’s statement on the grounds that the 2% inflation target could not be reached, the USDJPY parity rose above the 130 level. If the rise continues, 130.61 resistance can be tested. In an upward pricing from this resistance, we can consider the 131.41 resistance that it tested during the Bank of Japan (BOJ) statement two days ago. On the downside pricing, it can retest 128.88 support. If pricing is below this support, we can consider the 127.60 support.

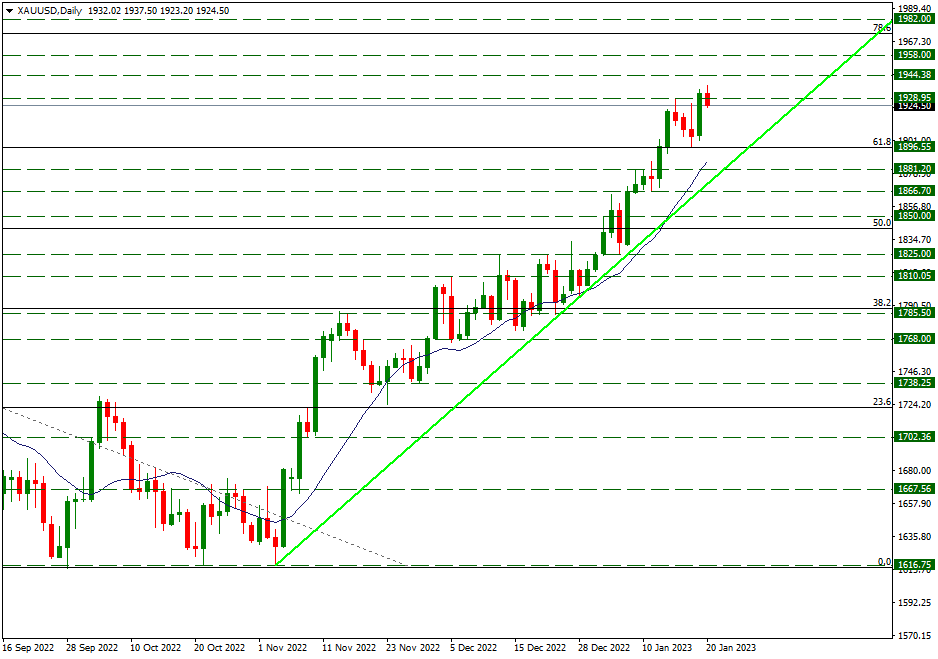

XAU/USD

XAU/USD – 1928.95 Resistance May Be New Support…

Closing of gold (Ounce) parity was realized above 1928.95 resistance. Today, it has risen to the level of 1937.50. With the profit sales coming from this level, pricing continues around the 1928.95 resistance. If the uptrend continues, the 1944.38 level can be determined as resistance. On the downside pricing, 1896.55 can form support.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

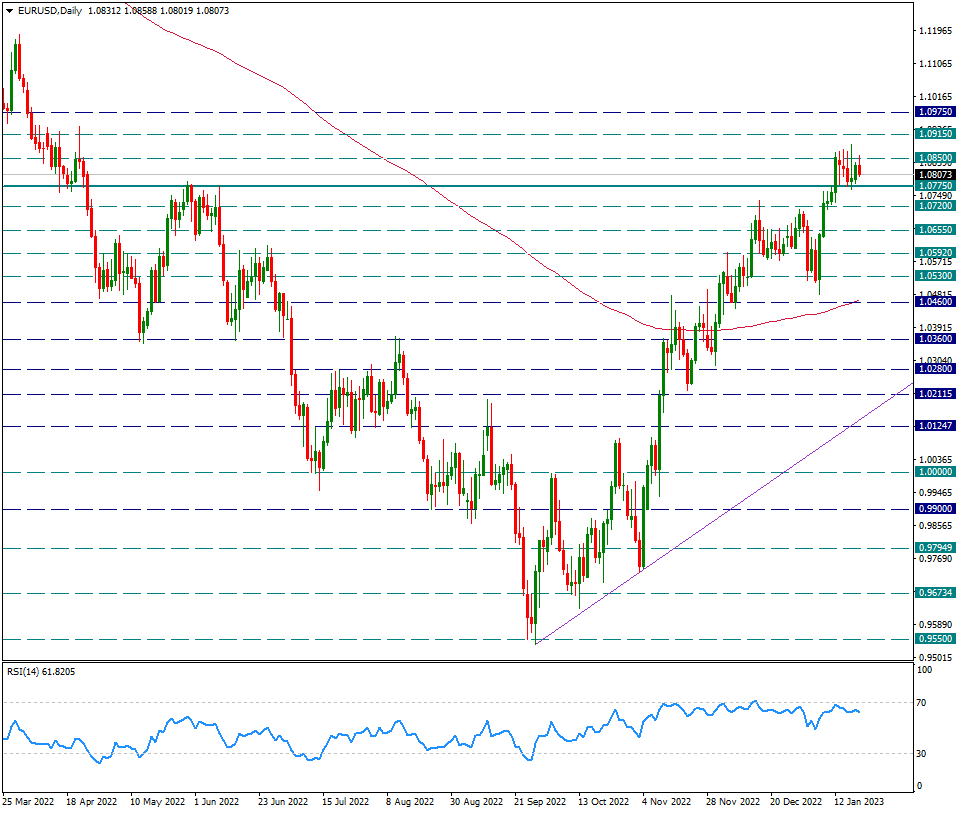

EUR/USD

EUR/USD – It Remained In The Range Of 1.0850/1.0775 During The Week…

The EURUSD parity continues to be priced between 1.0850 and 1.0775. The ceilings and floors of this region were tested many times during the week. The hawkish statements of Lagarde, the head of the European Central Bank, the other day, brought the parity closer to 1.0850. However, this resistance continues to operate and prices remain in the band range.

When we look at the daily chart, we see a slight negative dissonance in the RSI indicator. For this reason, as long as 1.0850 cannot be exceeded with daily candles, the pair can be prepared for profit sales step by step. Breaking the 1.077 support with daily candles may trigger possible profit sales and cause a strong movement in favor of the dollar.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

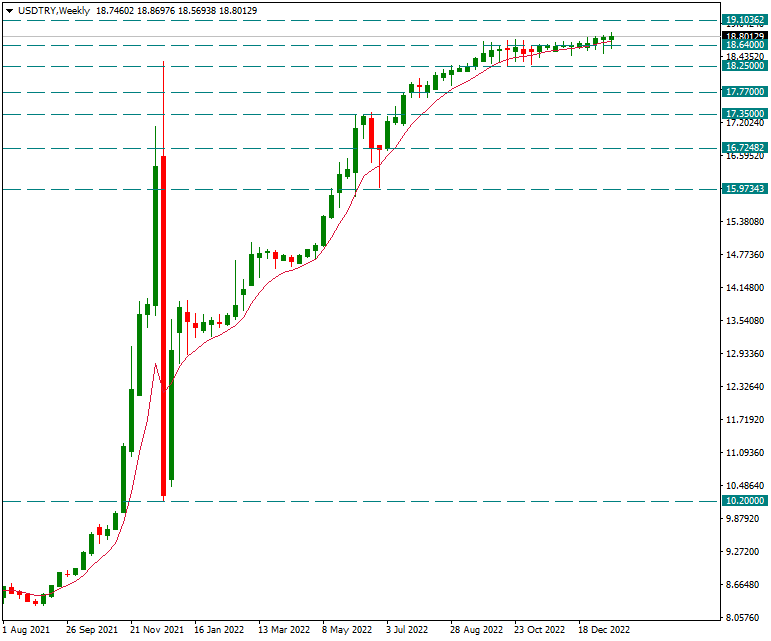

USD/TRY

USD/TRY – It mostly held above 18.80 during the day…

While closing the week on the dollar side, we see that an upward trend continues, albeit slowly. In today’s pricing, mostly quotes above 18.80 were formed. We can expect the current trend to continue as long as the 8-week average is closed on the Dollar Rate chart, which you follow with the weekly chart.

Contact Us

Please, fill the form to get an assistance.