- Fears about the global recession and geopolitical tensions affect the market on the first trading day of the critical week, when the interest rate decisions of major central banks, especially the Fed, the Bank of England and the Bank of Japan will be followed. Over the weekend, US President Joe Biden said the US military would defend Taiwan if it were invaded by China. In response to this statement, China’s Ministry of Foreign Affairs said in a statement that Beijing was “saddened by this and strongly opposed it”. U.S. stock index futures fell in the risk-averse market environment.

- On the other hand, US 10-year Treasury yields are on the rise before FOMC. The US benchmark 10-year Treasury yield hit 3.518% during the European session, its highest level since April 2011. The two-year yield rose to a 12-year high. The US dollar is on the rise against its rivals. The main expectation in global markets is that the Fed will raise interest rates by 75 basis pounds on Wednesday.

According to the CME Group Fed Watch Tool, the probability of the Fed raising the policy rate by 100 basis points is priced at 20%. - In the Euro area, the monthly report of the Vice-President of the European Central Bank and the German Central Bank was followed. European Central Bank (ECB) Vice President Luis de Guindos said that inflation expectations should be well anchored and that the slowdown in growth may not be enough to reduce inflation. The German Central Bank (Bundesbank), on the other hand, said in its monthly report published today that the economy is most likely to decline slightly in the current quarter and severely in the winter as a result of Russia’s war against Ukraine.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

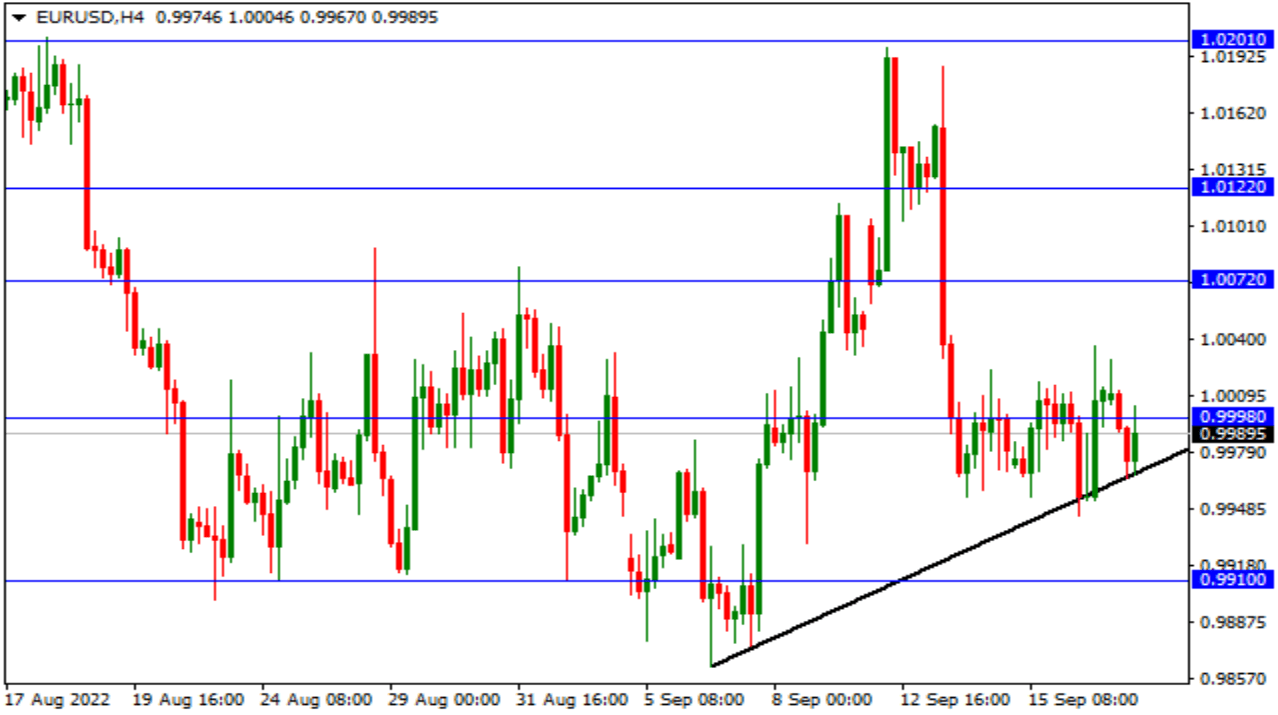

EUR/USD

EURUSD – Recovering with Support from Rising Trend…

- With the expectation that the FED will continue to increase interest rates by 75 basis points at the meeting on September 21, there has been a decrease in the EURUSD parity until the rising price trend that we watch in a 4- hour period.

- With the support received from here, recovery is seen. In the continuation of the recovery, 0.9998 and 1.0072 resistance can be observed. In pullbacks and pricing below the rising trend, the downward momentum can accelerate. In this case, 0.9910 and 0.9850 can create support.

XAG/USD

XAGUSD – Continuing its Falling Course…

- In silver, the transactions are carried out within the falling price channel that we watch on a daily basis. It can be watched as 19.0925 and 18.65 support in the channel. In upward transactions, 19.46 and the upper band of the falling price channel can form resistance. In case of an upward exit from the channel, the rises can gain momentum.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

CRUDE

CRUDE – Continues its Decline…

- Crude Oil is declining due to the strengthening Dollar Index, expectations that global economic growth will slow down, and expectations that an agreement with Iran will be reached and oil supply will increase. In the continuation of the decline, 81.77 and 80.78 can be viewed as support. On the upside, 82.93 and 84.86 may form resistance.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

USD/TRY

USDTRY – Continues Its Course in Formation…

- In the USDTRY parity, the transactions are carried out within the rising wedge formation that we watch in the daily period. It can be viewed as 18.33 and 18.50 resistance within the formation. In pullbacks, 18.21 and 18.15 can create support. Let us remind you that this week, the Fed’s interest rate decision was made on Wednesday and the CBRT’s interest rate decision on Thursday.

Contact Us

Please, fill the form to get an assistance.