- ECB President Lagarde made statements as if to reaffirm his determination that the European Central Bank will continue its tightening policy. In today’s speech, Lagarde was asked why he was unable to persuade the market about the tightening policy, “asking market participants to reconsider their positions.” He recommended.

- In his statements in Davos, ECB President Lagarde stated that inflation remained very high. While saying that the route will be determined with interest rate hikes, he said that caution should be exercised against the possible rise in inflation expectations.

- According to the December 2022 minutes of the European Central Bank announced during the day, it was emphasized that almost all members supported the 50 basis point rate hike. However, it was stated that there were also members who supported the 75 basis point increase. In addition, the members expressed their opinions that the duration of the high interest rates will also be important. It was accepted that the upward trend in inflation risks continued.

- EURUSD parity continued to be priced at 1.0820 levels during the day. It was a day when the German 10 and 2-year bond yields rose slightly faster than the US bond yields today.

- Another central bank governor who made a statement was from the UK. Bailey argued that they will likely start to see inflation come down by the end of the spring. However, he was in a structure that did not want to give up his hawkish attitude despite the market pressure.

Open A Demo

CDO has wide range of tools, professional and friendly support for clients to achieve their financial markets trading goals. Open a live account now to enjoy this experience with virtual deposit.

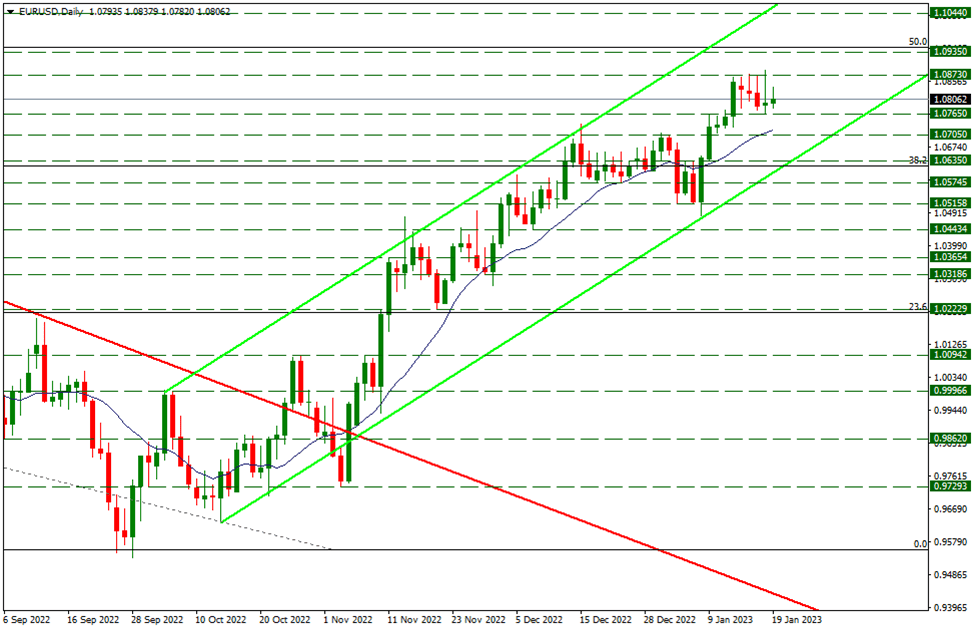

EUR/USD

EUR/USD – At the Center of the Upward Channel…

- Although it strongly tested the 1.0873 resistance with the strength it received from the 1.0765 support and reached the 1.0887 level, it was unable to break this resistance and retreated and closed slightly above the opening price. Today, pricing continues at the center of the bullish channel. If the movements in favor of the euro continue, the resistance of 1.0873, which has been tested strongly for a few days, can be reached. In an upside break from this level, 1.0935 level can be followed as new resistance.

XAU/USD

XAU/USD – 1896.55 Support Remains Strong…

- Although gold rose to the level of 1925.90 the other day, the sellers showed their strength again towards the end of the day and the closing was realized at the level of 1903.90. Today, the uptrend continues. If the positive movements continue, the 1928.95 level may appear as resistance. However, we can meet with the support of 1896.55, with the possible profit sales showing the strength. This support can be considered as an important level during the day as it was tested yesterday.

CDO TRADER

CDO TRADER, our cutting-edge trading platform, follows the technology from the forefront with new features added continuously. Moreover, CDO TRADER is now available for Android and iOS! So it allows you to trade on the go!

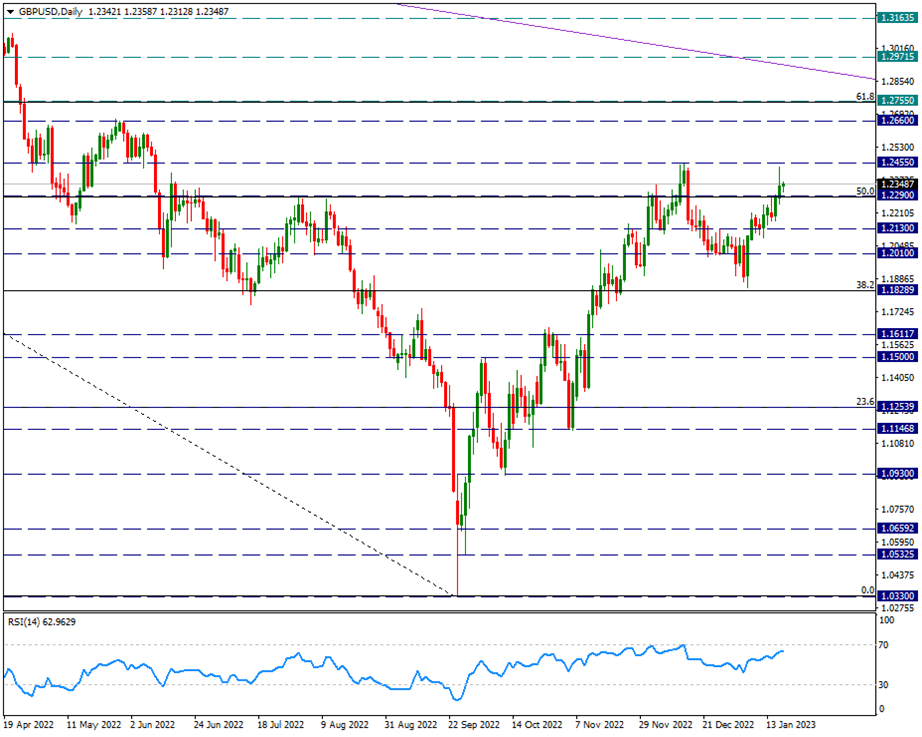

GBP/USD

GBPUSD – Tests 1.2455 Resistance Once Again…

- The sterling side rose again, step by step, with the recent weakness of the Dollar index. As a result of this rise, it tested the 1.2455 resistance that it tested on December 14. Tested yesterday, this resistance could not be broken, but profit sales remain rather weak for now. It held on the support of 1.2290 during the day. If the movements continue in favor of Sterling in the pair, our next focus will be 1.2660 resistance.

- Against this, we will follow the 1.1830 support as the main weekly support, while watching the supports on the step-by-step chart for possible power losses.

MetaTrader 4

MT4 has user friendly interface that is providing simplicity and efficiency. The traders can perform trading strategies for different products like Forex and CFD. MetaTrader 4 has over 50 built-in indicators, also it’s the tool that predicts trends and defines the appropriate entry and exit points.

Contact Us

Please, fill the form to get an assistance.